Dogecoin price rebounds 10% as Elon Musk’s Tesla loses $160B to US trade war: Is DOGE decoupling?

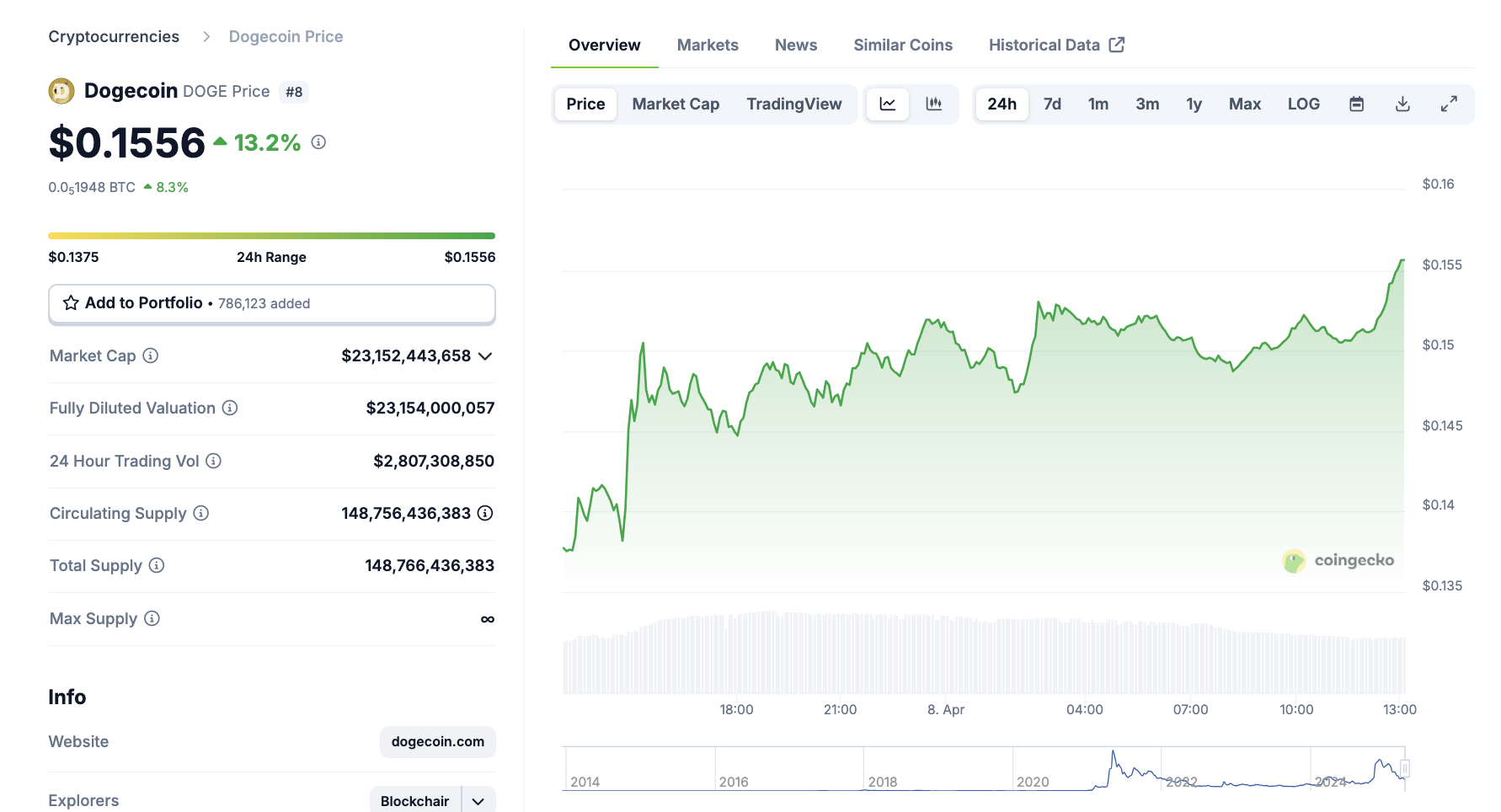

- Dogecoin price reclaims the $0.15 level on Tuesday, posting a rapid 10% rebound in the last 24 hours.

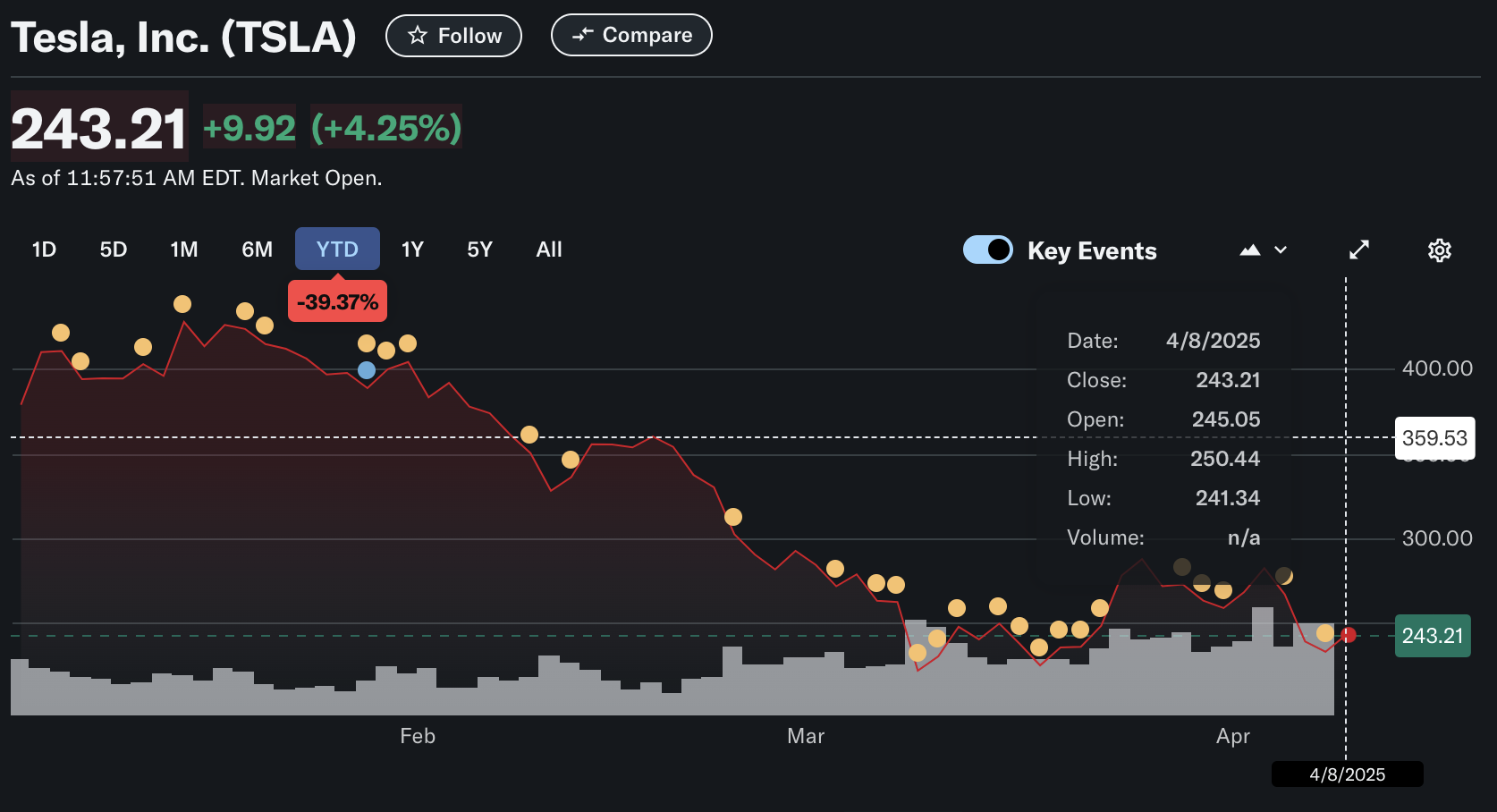

- Elon Musk’s Tesla stock price consolidates, extending its post Liberation Day losses to 17.5%.

- Key market indicators suggest DOGE price could be decoupling from Elon Musk’s influence.

Dogecoin’s (DOGE) price soared 10% within 24 hours, reclaiming the $0.15 level on Tuesday as the global financials market staged a mild rebound after a week of persistent sell-side pressure.

In contrast, Tesla (TSLA) stock shed over $160 billion in market capitalization since last week’s tariffs announcement by the Trump administration.

The directional divergence between Dogecoin and Tesla prices raises a critical question for investors: Is Dogecoin beginning to decouple from Elon Musk’s long-standing influence?

Is Dogecoin price finally decoupling from Elon Musk’s influence in 2025?

Historically, Elon Musk has exerted significant influence on Dogecoin price movements. The billionaire’s tweets, public endorsements, and corporate integrations—ranging from Dogecoin payments for Tesla merchandise to references during SpaceX events—have all triggered substantial DOGE price swings in recent years.

However, major news events and recent price trends observed in DOGE and TSLA markets this week suggest that Elon Musk’s influence on the memecoin could be subsiding. Here are two major reasons:

- Trump administration’s crypto strategy leaves DOGE behind

One catalyst behind this potential decoupling lies in Washington’s latest crypto strategy.

In March, the Trump administration unveiled the “Crypto Strategic Reserve,” a government-backed initiative to acquire cryptocurrencies.

This notably excluded Dogecoin as many had anticipated that Elon Musk's high position within the administration could yield a different outcome.

Instead, Trump had launched his own memecoins —TRUMP and MELANIA- at the inauguration, reducing the chances of promoting a rival memecoin within the administrations’ initiatives.

Dogecoin (DOGE) Price Action, April 8, 2025 | Source: Coingecko

Last week, Musk clarified there were “no current plans” to incorporate Dogecoin into any official government digital infrastructure. Yet DOGE price has quickly recovered, climbing above the $0.15 resistance level on Tuesday.

This resilience signals a maturing investor base more attuned to macro conditions as hopes of government adoption through Elon Musk’s influence fade.

Dogecoin price remains insulated from Tesla’s trade war exposure

Dogecoin’s resilience and divergence from Elon Musk-linked assets like Tesla also further emphasize the crypto market’s relative insulation from geopolitical risks.

Since President Trump announced a sweeping round of import tariffs last week, US equities have faced immense pressure, with Tesla emerging as one of the hardest-hit names.

Elon Musk's Tesla (TSLA) Price Performance, April 8, 2025 | Source: YahooFinance

Tesla stock opened trading at $245 on Tuesday, having tumbled 17.5% and erased nearly $160 billion in market value in the trading sessions that followed Trump’s tariff announcement on April 2 to this Monday.

Notably, after the initial $160 billion losses on Tesla stock, Elon Musk shared a video of Milton Friedman criticising trade tariffs on Monday. This sparked speculation that Trump’s close advisors could be pushing for a compromise.

TSLA price saw gains on the 24-hour chart after this cryptic post on X. However, the White House’s stance currently remains unyielding at press time. With the global market sentiment remaining largely bearish, the downtrend could continue in the coming trading sessions.

The company’s global supply chains—particularly with China and Canada—leaves it exposed to retaliatory tariffs, dampening hopes of meeting quarterly earnings targets as confirmed by Elon Musk in March.

Dogecoin, by contrast, is a decentralized asset with no physical operations or supply chain vulnerabilities. Its price is influenced by crypto market flows, community activity, and investor sentiment—not by commodity prices or geopolitical risk. This detachment from traditional economic variables gives DOGE a degree of insulation that Tesla, as a multinational corporation, simply does not enjoy.

Investors are watching closely as Dogecoin holds firm around $0.16 amid Tesla's $160 billion slump. It remains to be seen if this trend will hold for the foreseeable future. However, DOGE price has evidently exhibited early signals of decoupling from Elon Musk’s X feed since the turn of the year.

Dogecoin price forecast: Rally pauses below $0.16 as market weighs momentum shift

Dogecoin price has reclaimed the $0.15 level, currently trading at $0.1511 after rebounding from a recent low of $0.14. While this move marks a 10% recovery in 24 hours, indicators suggest caution in projecting a sustained breakout above $0.16.

The Relative Strength Index (RSI) remains subdued at 36.95, well below the 50-neutral zone, reflecting lingering bearish momentum despite the uptick.

The RSI’s failure to cross its moving average (yellow line at 42.16) implies weakening buying strength, which undermines confidence in the rally’s longevity. This divergence highlights a potential exhaustion in bullish pressure unless volume confirms further upside.

Dogecoin Price Forecast (DOGEUSD)

Volume spiked to 877.38 million DOGE, signaling renewed interest, but the price remains below the 50-day moving average near $0.17, capping bullish upside in the near term. More so, the Bollinger Bands are tightening, with resistance at $0.19 and support at $0.15, suggesting a volatility squeeze.

This suggests the recent bounce could be a correction of oversold conditions rather than the start of a new uptrend.

A daily close above $0.16 could shift the short-term bias bullish, targeting $0.17.

Conversely, a close below $0.15 would reaffirm the downtrend, risking a retreat to $0.13. Based on the current trading signal, Dogecoin price forecast now hinges on volume follow-through and RSI crossover confirmation.