Solana Price Forecast: Traders hold open interest at $4B as FTX and Alameda send $450M SOL to Binance

- Solana price stagnated below $150 on Wednesday, despite a positive uptick in market sentiment.

- SOL price has been tempered by another 3 million SOL coins unlocked by FTX’s parent company Alameda Research this week.

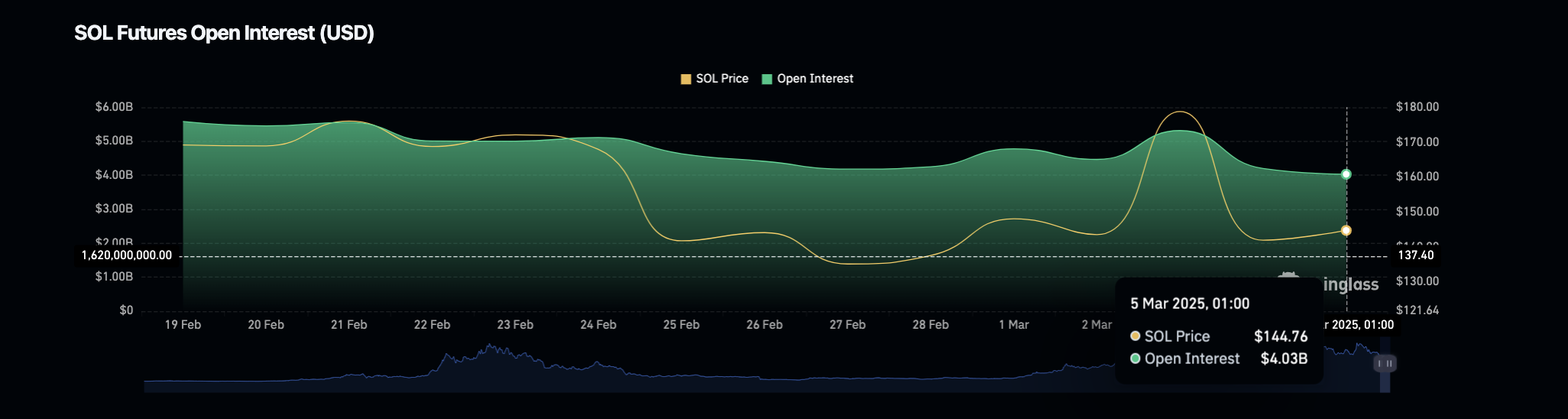

- SOL open interest has hovered around $4 billion since Monday, as speculative traders remain hesitant about entering new positions.

Solana price stagnated below $150 on Wednesday, despite a positive uptick in market sentiment. With derivatives market trends signaling widespread hesitation among speculative traders, how will SOL prices react in the coming sessions?

Solana (SOL) struggles despite rival altcoins rallying on Trump tariff rollback plan

Solana (SOL) has struggled to gain directional momentum this week as opposing market catalysts counteract each other.

On the positive side, speculation that President Donald Trump could ease tariffs imposed on Canada and Mexico lifted investor sentiment on Wednesday. This came just days after SOL was included in a newly proposed crypto strategic reserve.

Solana price action | SOLUSDT

In response, Bitcoin (BTC), Ethereum (ETH) and XRP posted gains exceeding 5% on Wednesday, with Cardano (ADA) surging 24% during the day.

However, SOL’s price remained stagnant within a narrow $140–$150 range over the past 24 hours, underperforming its peers.

Three million SOL unlocked from FTX and Alameda wallets dampens price momentum

As seen above, Solana’s price action over the past week has been subdued compared to other major altcoins included in Trump’s crypto strategic reserve plan.

Recent market reports indicate that SOL price gains have been tempered by the three million SOL tokens unlocked by the defunct FTX exchange and its parent company Alameda Research.

FTX and Alameda wallets deposit SOL to Binance. Source: Solscan, March 4

Validating this stance, Coinglass Open Interest charts track the daily balances of capital invested in Solana futures contracts, offering insights into capital flows around key market events.

Solana Open Interest | Coinglass

Solana Open Interest | Coinglass

The data reveals that while SOL’s stagnation in spot markets reflects cautious sentiment among speculative traders, open interest has consolidated around $4 billion since Monday.

When open interest remains flat, it signals that traders are hesitant to enter new positions.

At the current price of approximately $148 per coin, the 3 million SOL unlocked by FTX and Alameda effectively flood Solana’s short-term market supply by more than $450 million.

Short-term outlook: Solana traders take on a sit-and-watch approach

Recent media reports surrounding Solana have resulted in a standoff between bulls and bears.

Bears are hesitant to enter short positions as Trump is expected to roll back tariffs, potentially benefiting the broader crypto market.

Meanwhile, bulls remain reluctant to initiate fresh long positions due to the $450 million supply shock from FTX and Alameda, expected to flood the market in the coming days.

This dynamic explains why SOL’s price is expected to trend sideways in the near term as traders assess the interplay between bullish macro catalysts and the overhanging supply pressure from the FTX unlocks.

Solana Price Forecast: $145 support remains shaky as SOL tests key resistance

Solana price hovers around $145, attempting to stabilize after a recent rebound from local lows.

The Keltner Channel (KC) suggests that SOL remains in a downtrend, with the midline at $161.88 acting as an immediate resistance.

A breakout above this level could open the door for a rally toward the upper KC boundary at $198.29, a crucial bullish threshold.

However, failure to reclaim this midline may result in consolidation or further downside.

Solana Price Forecast

Parabolic SAR (Stop and Reverse) dots continue to print above the price action, signaling bearish momentum.

Until this flips, traders may remain cautious about initiating aggressive long positions.

Meanwhile, the Bull-Bear Power (BBP) indicator at -19.02 reflects lingering bearish pressure despite the recent price uptick. If BBP turns positive, it could validate a stronger recovery attempt.

A bullish breakout scenario could see SOL reclaim the $160 level, setting the stage for a potential rally toward $198.

Conversely, rejection from resistance could push prices back to test support at $130.66, with a break lower exposing $125.47. The coming sessions will be critical as SOL navigates between these pivotal levels.