PEPE Price Prediction: $0.000015 support at risk as bears deploy $15M leverage

- PEPE price fell to $0.000018 on Wednesday, declining over 10% in the last 24 hours.

- Leveraged short positions on PEPE crossed $15.1 million, exceeding active long contracts by more than 85%.

- Technical charts suggest heightened risks of a breakdown below the $0.000015 support.

PEPE price plunged 10% to hit $0.000018 on Wednesday as traders rapidly cut back on high-risk memecoin exposure amid intense market turbulence. Derivative markets data show bear traders deploying high volumes of leverage to amplify profits amid macroeconomic uncertainty.

PEPE price losses $0.000020 support as bears gain foothold

PEPE price, along with other high-risk memecoins, experienced significant downward pressure on Wednesday. The market-wide sell-off was fueled by heightened macroeconomic uncertainty amid the United States (US) Federal Reserve’s (Fed) hawkish stance.

PEPE Price Action (PEPEUSD)

PEPE Price Action (PEPEUSD)

PEPE’s price dropped 10% over the past 24 hours, sliding from $0.000020 to a weekly low of $0.000018 by Wednesday.

The decline comes as broader crypto markets face downward pressure amid intensifying macroeconomic uncertainty.

Bear traders deploy $15 million leverage in hopes of further downside

The bearish momentum in PEPE has been driven by lingering market volatility following the Fed's hawkish signals in late December.

Concerns over reduced liquidity and tightened financial conditions have prompted traders to reduce exposure to high-risk speculative assets, such as memecoins.

Interestingly, PEPE bear traders have made strategic moves to earn amplified profits amid the latest crypto market upheaval.

PEPE Liquidation Map

PEPE Liquidation Map

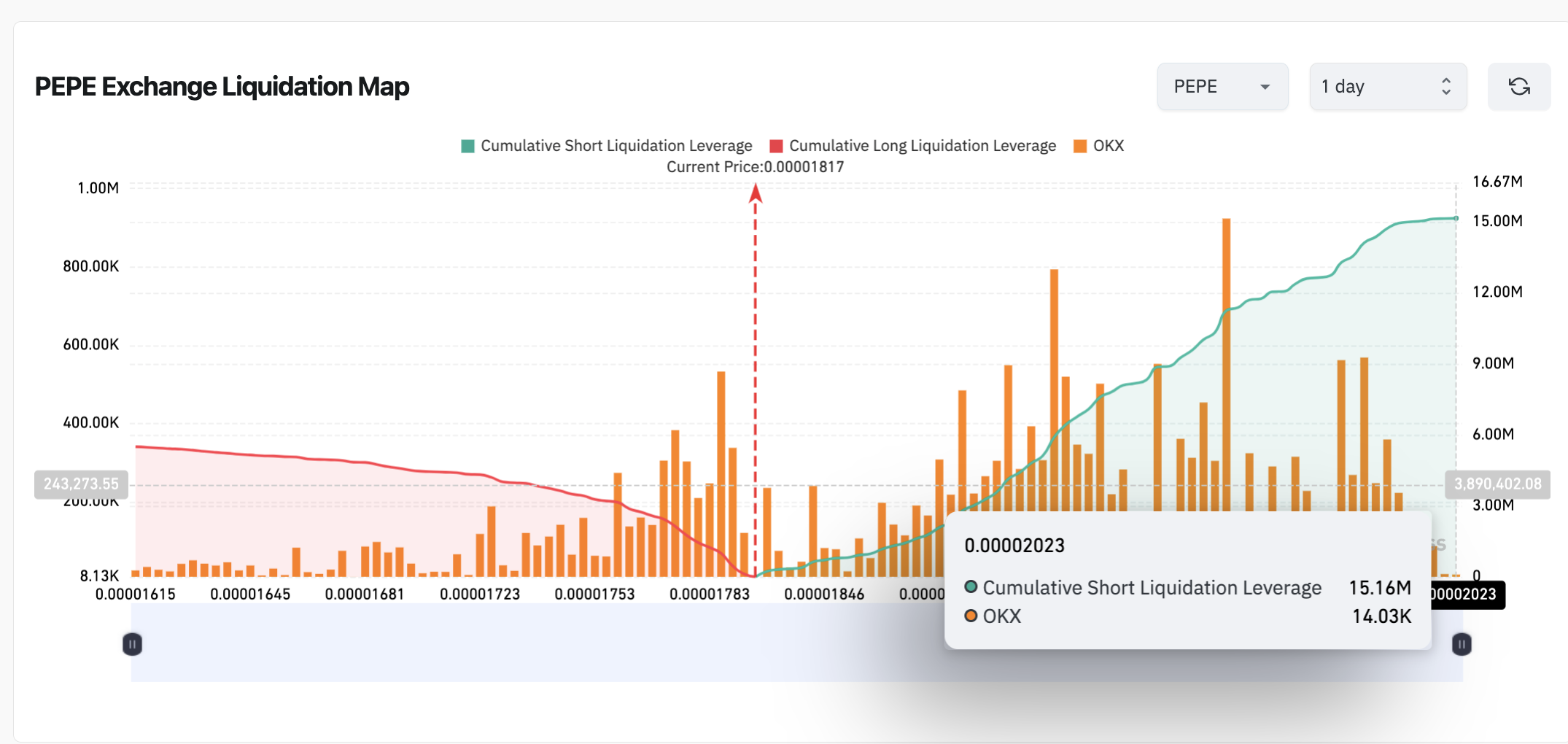

The PEPE Exchange Liquidation Map reveals that cumulative short leverage positions have surged to $15.1 million, dwarfing active long positions of just $5.5 million by over 85%.

This imbalance indicates that the majority of traders are anticipating continued downside for PEPE, as bearish sentiment dominates the market.

Such a significant tilt toward short positions suggests that traders are aggressively leveraging their bets, hoping to amplify gains if the price drops further.

This strategy also aligns with the narrative that hawkish fed bets could see traders scaled down their exposure to memecoins like PEPE within the current macroeconomic landscape.

In summary, concentrated short positions signal expectations of increased selling pressure, a key catalyst that could trigger a further breakdown in PEPE prices in the coming days.

PEPE Price Forecast: Bears could force $0.000010 reversal

PEPE price is under mounting bearish pressure, currently trading at $0.000018 after losing 13.19% in a single trading session.

The chart shows a critical technical development as the 30-day Simple Moving Average (SMA) crosses below the 50-day SMA, signaling a bearish crossover and potential for continued downside momentum.

The steep increase in sell volume further reinforces bearish sentiment, with traders actively capitalizing on price weakness.

PEPE Price Forecast | PEPEUSD

PEPE Price Forecast | PEPEUSD

In the bearish scenario, a breakdown below the $0.000017 support level could trigger further declines toward the psychological $0.000015 threshold.

A failure to hold this level may open the door to a deeper correction, with bears eyeing $0.000010 as a long-term target.

Conversely, a bullish rebound hinges on the price reclaiming the $0.000020 resistance level, marked by the current 30-day SMA.

If PEPE regains this level, it could attract sidelined buyers and spark a recovery rally toward $0.000022.

However, for this scenario to materialize, a significant uptick in trading volume and a reversal of the SMA crossover signal are critical.