Avalanche Price Prediction: AVAX targets $50 as BTC rally lifts Ethereum rivals

- Avalanche (AVAX) price broke above $43 on Monday as Bitcoin’s rally to $100,000 lifted altcoin markets.

- AVAX whale wallets recorded positive net inflows for 21 trading days since December 15, making acquisitions worth $600 million.

- The RSI technical indicator shows AVAX is approaching market saturation, as the latest price surge coincides with declining trading volumes.

AVAX price breached the $40 resistance on Monday, driven by the crypto market's positive start to 2025. While on-chain data shows rising demand from large investors on the Avalanche network, technical indicators flash cautionary signals.

AVAX price surges 25% as Bitcoin rally enters day 6

AVAX has emerged as one of the standout performers amid the crypto markets’s ongoing bullish start to 2025.

Against the backdrop of positive speculations on United States (US) President-elect Donald Trump’s inauguration and dovish macroeconomic tweaks, the Avalanche’ teams recent $250 million fundraising has also attracted investor attention.

Consequently, AVAX price action has mirrored BTC in the past week, delivering more than threefold gains.

Avalanche Price Action vs. Bitcoin (BTC)

Avalanche Price Action vs. Bitcoin (BTC)

The chart above shows the AVAX price climbed 27.8% since the start of 2025, tracking Bitcoin’s 8% gains between December 31 and January 6.

This shows that while Ethereum’s rally has been subdued below the $3,700 mark, investors have increasingly leaned towards rival layer-1 coins.

This has seen the likes of AVAX and Cardano (ADA) above the $40 and $1 levels respectively on Monday.

With AVAX price having breached the $45 resistanceon Monday, bulls could potentially set sights on another leg-up towards $50.

AVAX whales spotted moving $600M in 21-day buying streak

When a mega-cap asset like AVAX closely aligns with Bitcoin’s price, as observed in the past week, it signals strong positive sentiment among existing investors.

On-chain data trends reveal that whale wallets have been acquiring large amounts of AVAX coins since mid-December after the Avalanche team announced a $250 million fundraise for network updates.

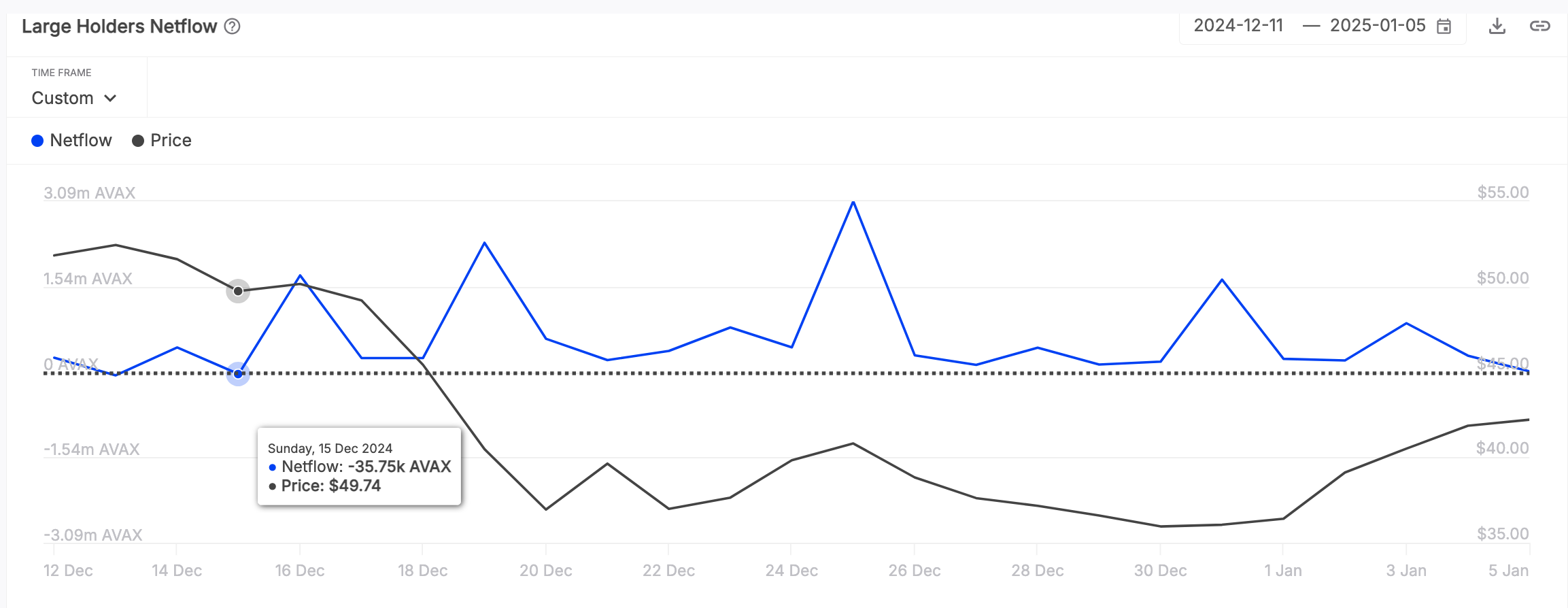

Confirming this narrative, IntoTheBlock’s Large Holder Netflow chart tracks the daily changes in balances of whale wallets holding at least 0.1% of total AVAX supply in circulation.

Avalanche Large Holders’ Netflow | Source: IntoTheBlock

Avalanche Large Holders’ Netflow | Source: IntoTheBlock

The chart above shows that AVAX whales have recorded positive netflow in the last 21 trading days between December 16 and January 5.

During that period, the whale wallets acquired 14.6 million AVAX worth approximately $595.6 million.

Market reports suggest the whales entered a buying spree in reaction to the Avalanche team’s announcement of a $250 million fundraise on December 12, defying the year-end market downturn.

Evidently, the persistent buying pressure from Avalanche whales has been pivotal to AVAX price tracking the BTC rally as market sentiment recovered at the turn of the year.

Avalanche Price Forecast: $50 sell-wall calls for caution

Backed by strong whale demand, Avalanche price extended its year-to-date gains to 28%, breaking past the $45 resistance on Monday.

However, after five consecutive green candles, technical indicators on the AVAX/USD daily chart suggest caution as the broader crypto market rally nears potential exhaustion.

Despite the bullish momentum, AVAX trading volumes on Binance have declined over the past three days.

This divergence between rising prices and falling volume often signals weakening buyer enthusiasm, indicating the market could be approaching a local top.

Adding to this, the RSI is approaching the 60 level, a zone where previous rallies have stalled, further hinting at potential reversal risks ahead.

AVAX Price Forecsast | AVAXUSD

AVAX Price Forecsast | AVAXUSD

The Keltner Channel upper band at $47 marks the next major resistance level.

Failure to attract higher volumes and liquidity could result in AVAX facing rejection from $47, triggering a pullback toward the midline Keltner level at $41.

Conversely, a daily close above $47 would invalidate the cautious outlook, potentially paving the way for a breakout above $50.