Forex Today: Year-end markets spin a tight circle ahead of midweek holiday

Markets are struggling to find a reason to move too much in either direction ahead of the New Year’s market closures, which will see most global exchanges shuttered during the middle of the trading week.

Here’s what you need to know heading into Tuesday, December 31

The US Dollar Index (DXY) churned in place on Monday, cycling near the 108.00 handle as investors take the year-end sessions off. Market momentum has evaporated with global markets taking the holiday season off. Except for some last-minute position adjustments and a smattering of over-eager market participants, market volumes are horrifically constrained as the calendar grinds toward the New Year’s Eve midweek market closure. Following the death of former President Jimmy Carter this week, US officials have flagged January 9 as an additional holiday in observance of Jimmy Carter’s contributions to the US and the world.

EUR/USD saw some rough chop on Monday, testing 1.0450 before settling back into the 1.0400 handle. Market flows have cooled significantly during the holiday season, keeping Fiber constrained and on a tight leash near recent lows.

GBP/USD caught a similar downside move to kick off the new trading week, falling back into 1.2550 as Cable traders wait for a reason to bid the Pound Sterling. Some rough chop is expected in the near-term as market flows remain tight, and a lack of meaningful economic data from the UK side of things is doing little to provide directional bias for Cable traders.

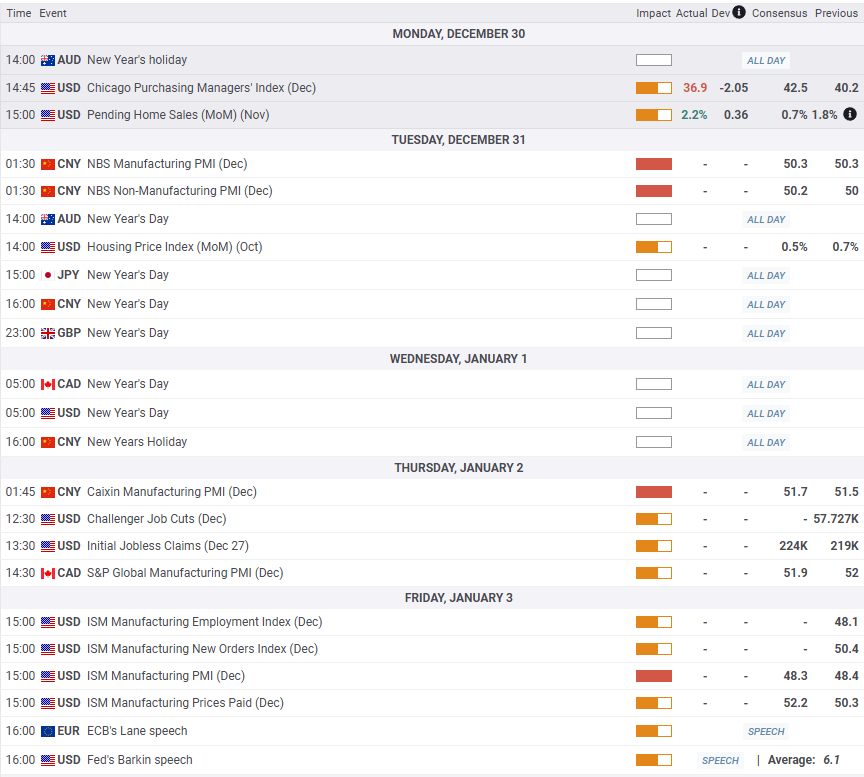

AUD/USD is poised for a thunderously quiet week with Australian markets dark for the entire front half of the trading week, however some key Chinese activity figures due this week could have a knock-on effect on the Aussie. Chinese NBS Manufacturing and Non-Manufacturing Purchasing Managers Index (PMI) figures are due early Tuesday, followed by the Caixin Manufacturing PMI on Thursday.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.