Dow Jones Industrial Average tests new record high on Wednesday

- The Dow Jones tapped the 45,000 level for the first time ever.

- Despite an early upshot into a new record bid, the major index is trading softer.

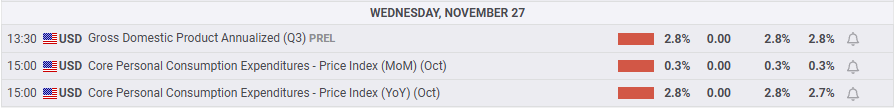

- US inflation and growth data met expectations, causing little stir.

The Dow Jones Industrial Average (DJIA) rose to another all-time high on Wednesday, tapping the 45,000 major price handle before settling back below the day’s opening bids near 44,800. Equities are turning tepid quickly as the US market space pivots into the upcoming Thanksgiving holiday on Thursday. Shorter hours on Friday further squeeze out the potential for momentum in the back half of the trading week.

Annualized US Gross Domestic Product (GDP) grew by the expected 2.8% through the third quarter, to no one's surprise and barely moving the needle on investor pulses. Core Personal Consumption Expenditure Price Index (PCEPI) accelerated to 2.8% for the year ended in October, also meeting expectations. While upticks in inflation metrics generally bode poorly for market expectations of future rate cuts, the move upward was widely expected, and a hold in monthly figures at 0.3% MoM helped to frame the bump in the data as being in the rear-view mirror.

Dow Jones news

After an early bump to test record highs, the Dow Jones is softening slightly, down around 75 points as of writing. Most of the major equity board’s listed securities are finding higher ground on the day, but concentrated losses in familiar tech stocks are dragging the averages lower.

Salesforce (CRM) fell over 3.5% to $330 per share as investors ease back on data management company that has been at the forefront of the AI integration space. CRM is slated to deliver its latest quarterly financials on December 3. Despite still being light on details about how a larger AI segment within the company will generate excess revenue, the generative data wave has propelled Salesforce to a $315 billion market cap, doubling its share price over the past five years.

Dow Jones price forecast

Despite pivoting into the red through the Wednesday trading session, the Dow Jones still set another record high, briefly piercing the 45,000 level for the first time ever. Despite all technical signals suggesting DJIA is overbought, bearish momentum has proven to be a trap rather than a successful entry point through most of 2024.

The Dow Jones is up around 20% YTD, and has outrun its own 200-day Exponential Moving Average (EMA), currently rising into 40,460, for over a year straight. A near-term floor is priced in at the 50-day EMA near 42,900, with the last swing low all the way down at the 42,000 handle.

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.