Bittensor faces volatility surge as AI token market cap drops 13% in a week

- Bittensor offers multiple sell signals as altcoins extend losses amid a spike in volatility.

- AI tokens trim July gains as the market cap drops 13% in one week, led by Bittensor, Virtuals Protocol and AIOZ Network.

- TAO drops below the 50-day, 100-day and 200-day EMAs amid volatility concerns and multiple bearish signals.

Bittensor (TAO) is declining alongside other Artificial Intelligence (AI) tokens on Wednesday amid a surge in volatility as the market awaits the Federal Reserve (Fed) interest rate decision on Wednesday.

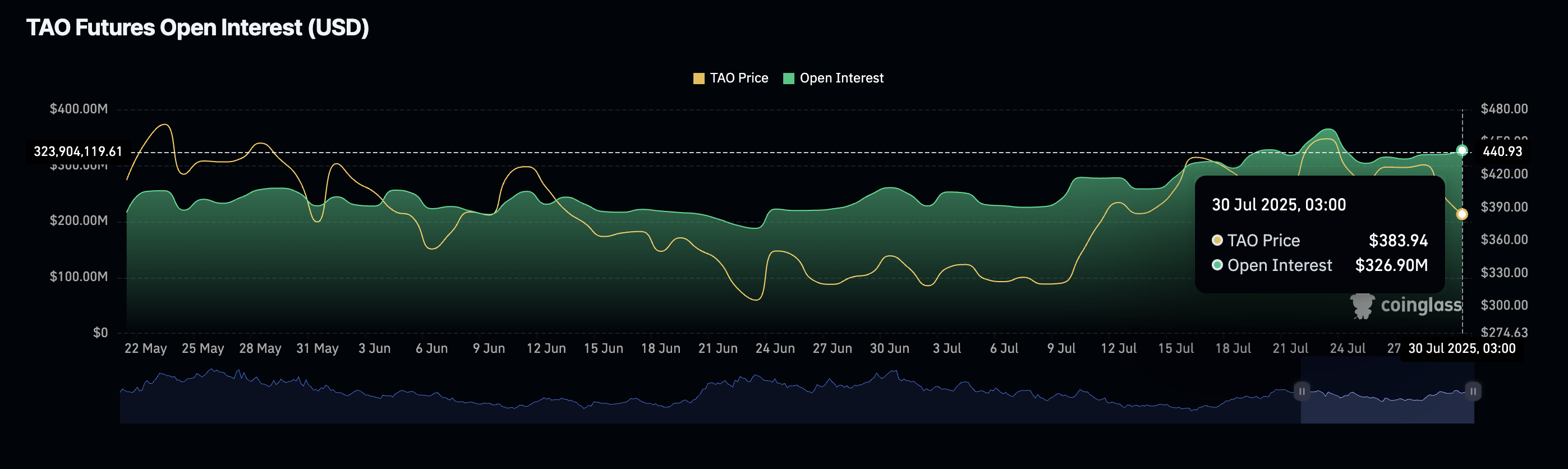

TAO is down over 4% on the day, trading at $368 at the time of writing as bulls search for a robust support toward $350. Despite the correction from July peak levels of $499, the futures Open Interest (OI) remains relatively high at $384 million, up slightly from $365 million.

Bittensor futures Open Interest | Source: CoinGlass

The steady OI, which represents the notional value of outstanding futures or options contracts, indicates that leverage bets are mostly bullish, thus increasing the probability of a trend reversal.

Bittensor leads AI token decline

Tokens in the AI sector are facing increasing volatility ahead of the Fed interest rate decision, with Bittensor headlining the decline. TAO is down 7% over the past 24 hours and 17% in the past week.

Virtuals Protocol (VIRTUAL), the blockchain platform for AI agents, has declined 6.4% in the last 24 hours, bringing the total drop in a week to 27%. AIOZ Network also trimmed gains by 17% in seven days, reflecting the surge in volatility among AI tokens.

Interest in AI tokens has generally slowed in the past week, evidenced by the market capitalisation shrinking by over 13% to $28 billion. The next few days provide insight into the direction the market could take, considering the rally in July and emerging macroeconomic risks such as the reciprocal tariffs taking effect in the United States (US) on Friday.

Technical outlook: Bittensor’s downtrend could persist

TAO bears show no signs of exhaustion, extending the decline for three consecutive days. Key technical indicators, including the Moving Average Convergence Divergence (MACD) that triggered a sell signal on Monday and the Relative Strength Index’s (RSI) drop to 41 after peaking near overbought territory in July, reinforced the bearish grip.

Traders may continue reducing exposure amid the surge in volatility, especially with Bittensor sitting below the 50-day Moving Average (EMA) currently at $387 and the 200-day EMA in confluence with the 100-day EMA at around $377.

TAO/USDT daily chart

Key areas of interest for traders include the horizontal support at $347, which was tested as resistance in late June, and the ascending trend line on the daily chart. If sentiment improves following the Fed interest rate decision on Wednesday, a quick reversal could ensue from the current price level or support at $347 toward the initial resistance at $400.

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.