Solana price hits $200 ahead of SBF's sentencing

- Solana continues its positive momentum as its market capitalization exceeds that of Binance Coin.

- Sam Bankman-Fried's imminent sentencing may be behind SOL's growth.

- SBF should face 40 to 50 years in prison sentence, says federal prosecutors.

Solana (SOL) has flipped the Sam Bankman-Fried curse into a boon, which has resulted in an explosive uptrend. With the interest for SOL hitting new all-time highs and the recent uptick to $200, this Ethereum-competitor is likely to remain a popular token going forward.

Solana interest peaks

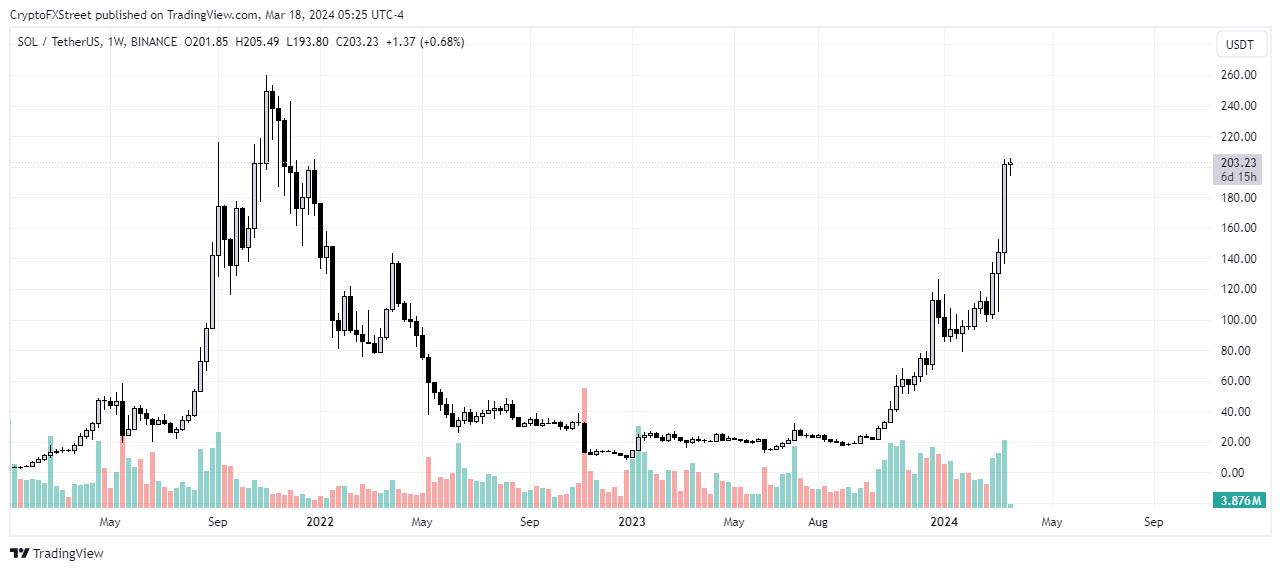

Solana has registered 2,468% in gains since forming a bottom at $8 in December 2022. This massive growth slowed a bit coming into the new year, but March saw the Layer 1 token recording new highs. Currently, SOL trades at $200 and looks like it could climb higher.

SOL/USDT 1-week chart

Beyond price, almost everything connected to Solana has been growing; the ecosystem, the total value locked, trading volume, user activity and so on. Notably, its meme coin sector has received a lot of attention which has given rise to the likes of dogwifhat (WIF), Myro (MYRO), Book of Meme (BOME) and so on.

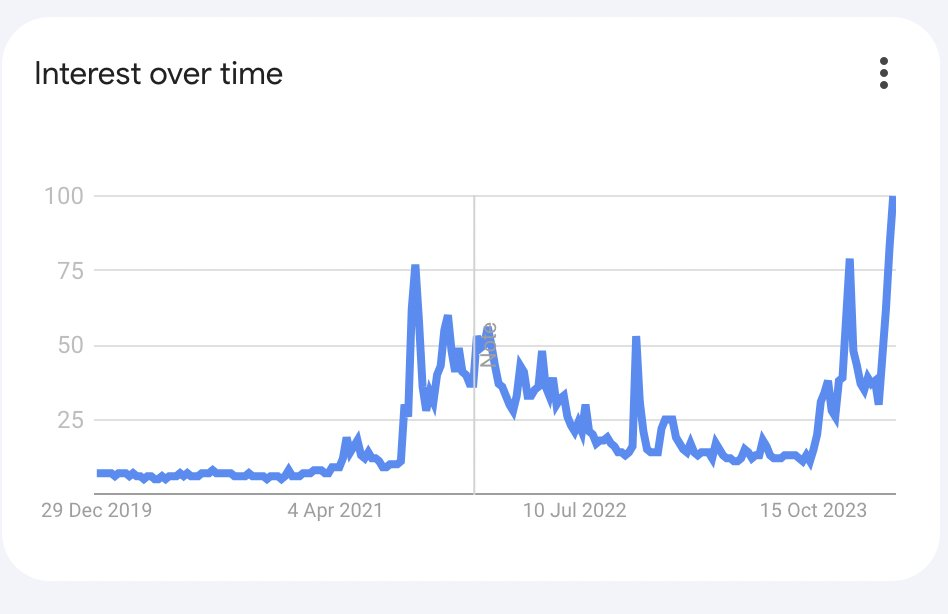

Additionally, the Google trends data also shows that interest in Solana overtook the previous all-time high formed in late 2021 and hit a record high of 100. This development goes to show the popularity surrounding the Ethereum-competitor.

Read more: Solana Price Prediction: Is SOL the altcoin to buy this bull cycle?

Solana Google Trends

SBF’s 50-year sentencing and impact on SOL

While the recent uprise in altcoins has been largely attributed to the increasing Bitcoin (BTC) price, Solana's situation has another major factor layered in its surge – Sam Bankman-Fried (SBF). Before his conviction SBF and the companies associated with him had a major stake in SOL. As a result, when the FTX saga went down, its ripple effect caused Solana and the connected ecosystem to nosedive.

While SBF's involvement seemed like a curse for SOL's ecosystem, it may have been responsible for its recent surge. But, with the SBF sentencing set to take place on March 28, things could get a bit dicey for Solana again.

Also read: FTX and Alameda wallets deposit over $24 million in Ether to Coinbase, ETH price at risk of decline

Recap of FTX before SBF sentencing

- Barely two years ago, SBF was the celebrated young leader of the FTX cryptocurrency exchange. However, after the exchange collapsed in November 2022, his activities were brought under the radar of law enforcement agencies.

- A year later, in November 2023, he was convicted of seven fraud and conspiracy charges, carrying a combined sentence of 110 years in prison.

- The federal probation department had separately recommended a 100-year sentence. But prosecutors have stated that a 40 to 50-year sentence would be more appropriate considering the severity of the crime – stealing at least $10 billion – and his relative youth.

- This comes off the back of a filing by SBF's lawyers in February, requesting a sentence of at most 6.5 years.