Bitcoin Dominance Slides, Japan Election Reform and More

Welcome to the Asia Pacific Morning Brief—your essential digest of overnight crypto developments shaping regional markets and global sentiment.

Grab a green tea and watch this space. Bitcoin dominance briefly dipped below 60% amid altcoin momentum. Japan’s electoral shift has accelerated discussions on crypto tax reform, potentially reducing the rate from 55% to 20%. Meanwhile, Jack Dorsey’s Block Inc. has joined the S&P 500, validating the viability of Bitcoin-integrated business models.

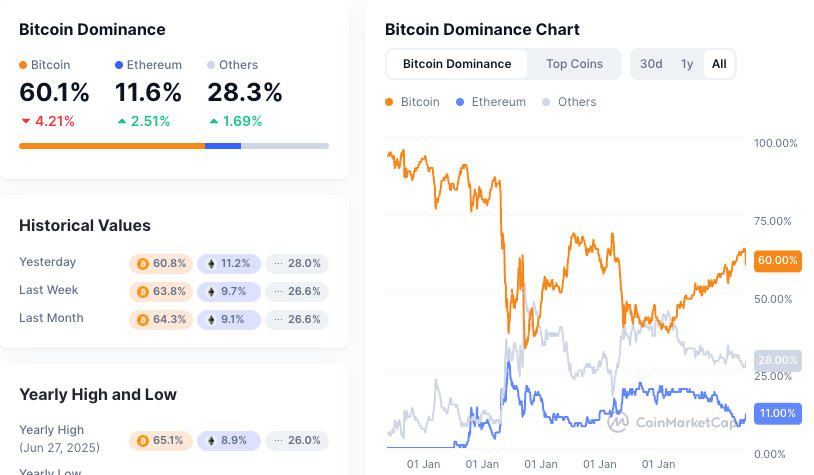

Bitcoin Dominance Dips Below 60% Threshold

Bitcoin dominance briefly fell below 60% this morning for the first time since March. The metric, measuring Bitcoin’s share of total cryptocurrency market capitalization, dropped to 59.8% early Monday.

Bitcoin dominance briefly fell below 60% this morning. Source: Coinmarketcap

Bitcoin dominance briefly fell below 60% this morning. Source: Coinmarketcap

This decline reflects strengthening altcoin performance across major digital assets. Ethereum gained 4% while XRP and Solana advanced 2% and 3% respectively. Bitcoin itself retreated 1% during the same period.

Market dynamics suggest portfolio rebalancing toward alternative cryptocurrencies is accelerating. Theme-based tokens experienced notable surges alongside broader altcoin momentum. The dominance ratio has since recovered to 60.1% as of 01:00 UTC.

Japan Election Triggers Crypto Tax Reform Momentum

Japan’s Liberal Democratic Party suffered its most significant electoral defeat in decades. The LDP lost its parliamentary majority in both houses for the first time since 1955. Coalition partner Komeito fell at least two seats short of maintaining control in Sunday’s upper house election.

This historic shift creates unprecedented political instability amid rising living costs and stagnant wages. Prime Minister Shigeru Ishiba faces internal calls for resignation as populist opposition parties gain leverage. Markets anticipate volatility as the weakened government negotiates from a diminished position.

Digital Asset Policy Transformation

The electoral outcome accelerates cryptocurrency taxation reform discussions significantly. Opposition parties campaigned extensively on tax reduction platforms, particularly targeting crypto assets. Japan Blockchain Association submitted proposals for separated taxation, replacing the current 55% maximum rates with 20.315% unified levies.

Current heavy taxation hasn’t prevented Japan from ranking fifth globally in cryptocurrency trading volume. Bitcoin-JPY pairs represent the world’s third-largest market despite regulatory constraints. Corporate Bitcoin adoption accelerates domestically with MetaPlanet becoming the fifth-largest institutional holder globally.

Web3 advocate Takahiro Yasuno (in the right) secured his first parliamentary seat. Source: BeInCrypto

Web3 advocate Takahiro Yasuno (in the right) secured his first parliamentary seat. Source: BeInCrypto

Japan’s $20 trillion household savings pool represents massive untapped investment potential. Significant tax reductions could unleash domestic demand, potentially amplifying Bitcoin’s ongoing price momentum. Web3 advocate Takahiro Yasuno secured his first parliamentary seat, signaling technological policy prioritization in the new political landscape.

Block Inc Achieves S&P 500 Milestone

Jack Dorsey‘s Block Inc will join the S&P 500 index on Wednesday, marking institutional recognition of Bitcoin-centric business models. The former Square company surged 10% in aftermarket trading following the announcement. Block replaces Hess Corporation in the benchmark index.

This milestone follows Coinbase’s inclusion two months prior, establishing crypto-focused enterprises within traditional equity indices. Block operates a comprehensive digital asset infrastructure, including Bitkey self-custody wallets and Proto mining services alongside payment platforms.

The company demonstrates strategic Bitcoin commitment through systematic treasury allocation. Block invests 10% of monthly Bitcoin profits back into BTC, accumulating 8,584 coins worth approximately $1 billion. Management open-sourced their treasury blueprint, enabling corporate adoption and replication.

Block’s S&P inclusion validates institutional acceptance of Bitcoin-integrated business models. The achievement represents broader market maturation as traditional indices accommodate blockchain-native companies.

Shigeki Mori and Paul Kim contributed.