MOODENG surges more than 40% as Upbit Korea announces trading support

- Solana-based meme coin Moo Deng rallies over 40% in the last 24 hours.

- The surge follows Upbit Korea’s announcement of trading support for the hippo-themed token.

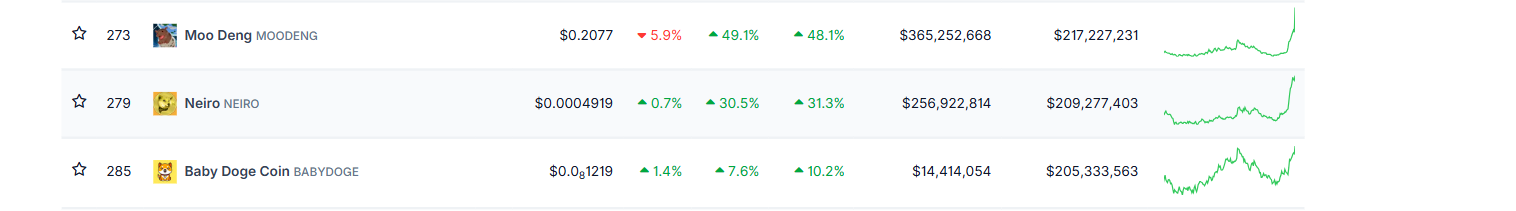

- MOODENG’s market cap hits $217 million, overtaking meme coins like Neiro and Baby Doge Coin.

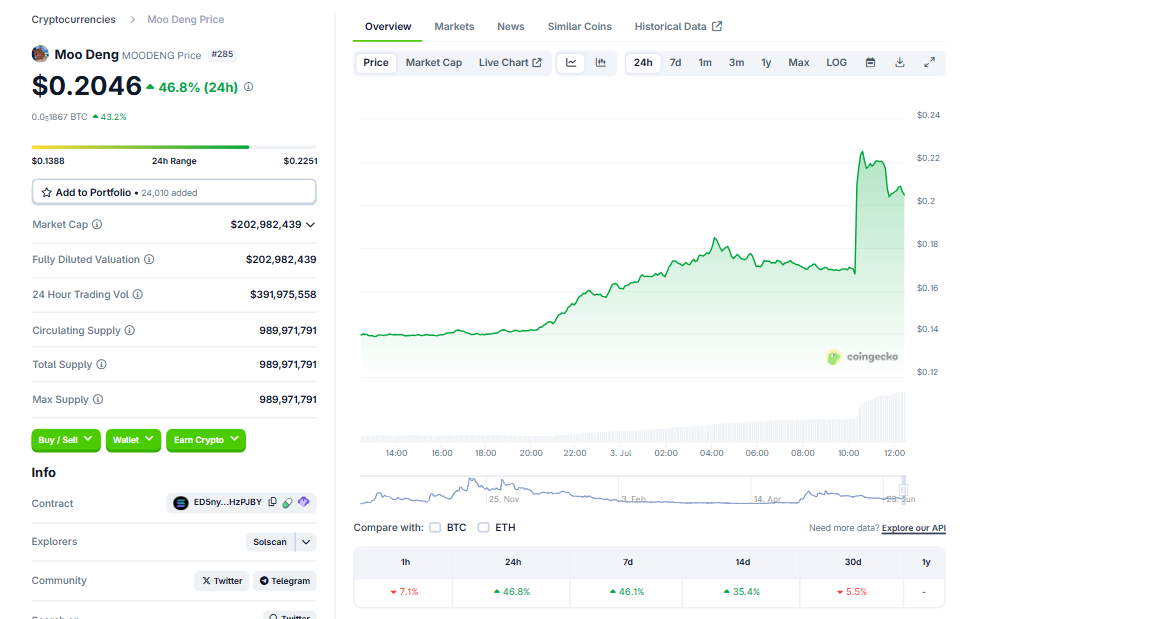

Moo Deng (MOODENG), a Solana-based meme coin, has surged more than 40% in the last 24 hours and trades around $0.204 at the time of writing on Thursday. The main reason for this ongoing rally is the announcement by the Upbit Korea exchange to provide trading support for the hippo-themed token. The meme coin quickly gained traction, pushing its market capitalization over $217 million and surpassing other popular meme coins, such as Neiro (NEIRO) and Baby Doge Coin (BABYDOGE).

Why is MOODENG rallying today?

MOODENG’s price has rallied more than 40% in the last 24 hours, as shown in the CoinGecko chart below.

The main reason for this price surge is the announcement by Upbit Korean exchange on Thursday that it will provide trading support for MOODENG. According to Upbit Korea’s X post, the trading support is scheduled for Thursday at 17:00 KST.

This news has sparked excitement among investors, with many speculating that the hippo-based meme coin could potentially reach its all-time high of $0.705 set on November 15.

Looking at the meme coin market capitalization chart below, it is evident that MOODENG’s ongoing rally has pushed its market capitalization over $217 million and has surpassed other popular meme coins, such as Neiro (NEIRO) and Baby Doge Coin (BABYDOGE).

Meme coin market capitalization chart. Source: CoinGecko

How high can MOODENG go?

MOODENG’s daily chart shows that it broke above the descending trendline (drawn by counting multiple highs since May 26) on Wednesday, rallying 28% that day. At the time of writing on Thursday, it is breaking above its daily resistance level of $0.186.

If MOODENG closes above the daily resistance at $0.186 on a daily basis, it could extend the rally to retest the 61.8% Fibonacci retracement level at $0.258 (drawn from the May high of $0.344 to the June low of $0.12).

The Relative Strength Index (RSI) on the daily chart supports the bullish thesis as it reads 60, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) indicator displayed a bullish crossover on Sunday. It also shows rising green histogram bars above its neutral value, indicating bullish momentum and an upward trend.

MOODENG/USDT daily chart

However, if MOODENG faces a correction, it could decline and find support near the descending trendline at around $0.16.