Top 3 Bittensor Ecosystem Tokens to Watch For The First Week Of May

Three Bittensor subnet tokens — Chutes, Proprietary Trading Network, and Targon — are among the top projects to watch this week.

Chutes remains the largest subnet token by market cap despite recent price pressure, while Proprietary Trading Network is gaining attention through the DeFAI narrative. Targon, meanwhile, is trading at deeply oversold levels and could be setting up for a potential rebound. Here’s a closer look at each of these Bittensor-based tokens heading into the first week of May.

Chutes

Chutes is a serverless AI compute platform built by Rayon Labs. It is designed to deploy, run, and scale any artificial intelligence model within seconds.

Users can interact directly with the Chutes platform or integrate it easily through a simple API, offering fast and flexible AI infrastructure without the complexity of traditional server management.

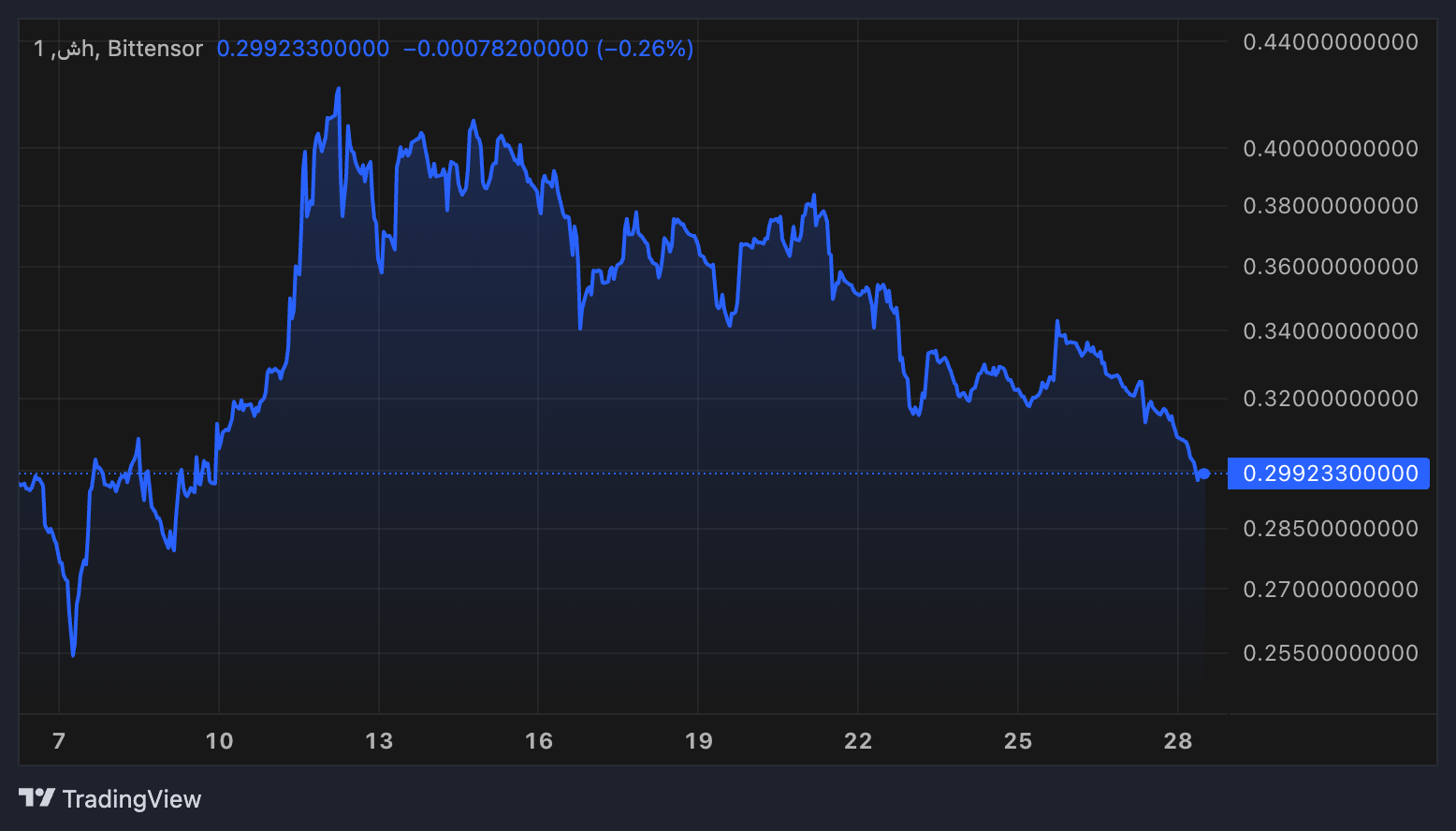

Chutes is currently the largest Bittensor Subnet token by market cap, but it has faced pressure recently, falling nearly 18% over the past seven days.

Chutes Token Performance. Source: Tao Stats.

Chutes Token Performance. Source: Tao Stats.

After rallying 67% between April 7 and April 12, the token has since dropped about 30% from its peak. Its Relative Strength Index (RSI) is now at 23.78, signaling deeply oversold conditions.

This setup could mean that Chutes is nearing a potential reversal zone.

If the project manages to recover its earlier momentum, being the biggest Subnet on Bittensor could amplify its gains through network effects, potentially triggering a strong uptrend that could drive the price back toward the $0.40 range.

Proprietary Trading Network

Proprietary Trading Network, or Taoshi, is a decentralized finance platform operating within the Bittensor ecosystem. It builds dynamic subnetworks where decentralized AI and machine learning models analyze data across multiple asset classes.

Its mission is democratizing access to sophisticated trading strategies, combining AI, blockchain, and finance to deliver advanced data that helps users make more informed financial decisions.

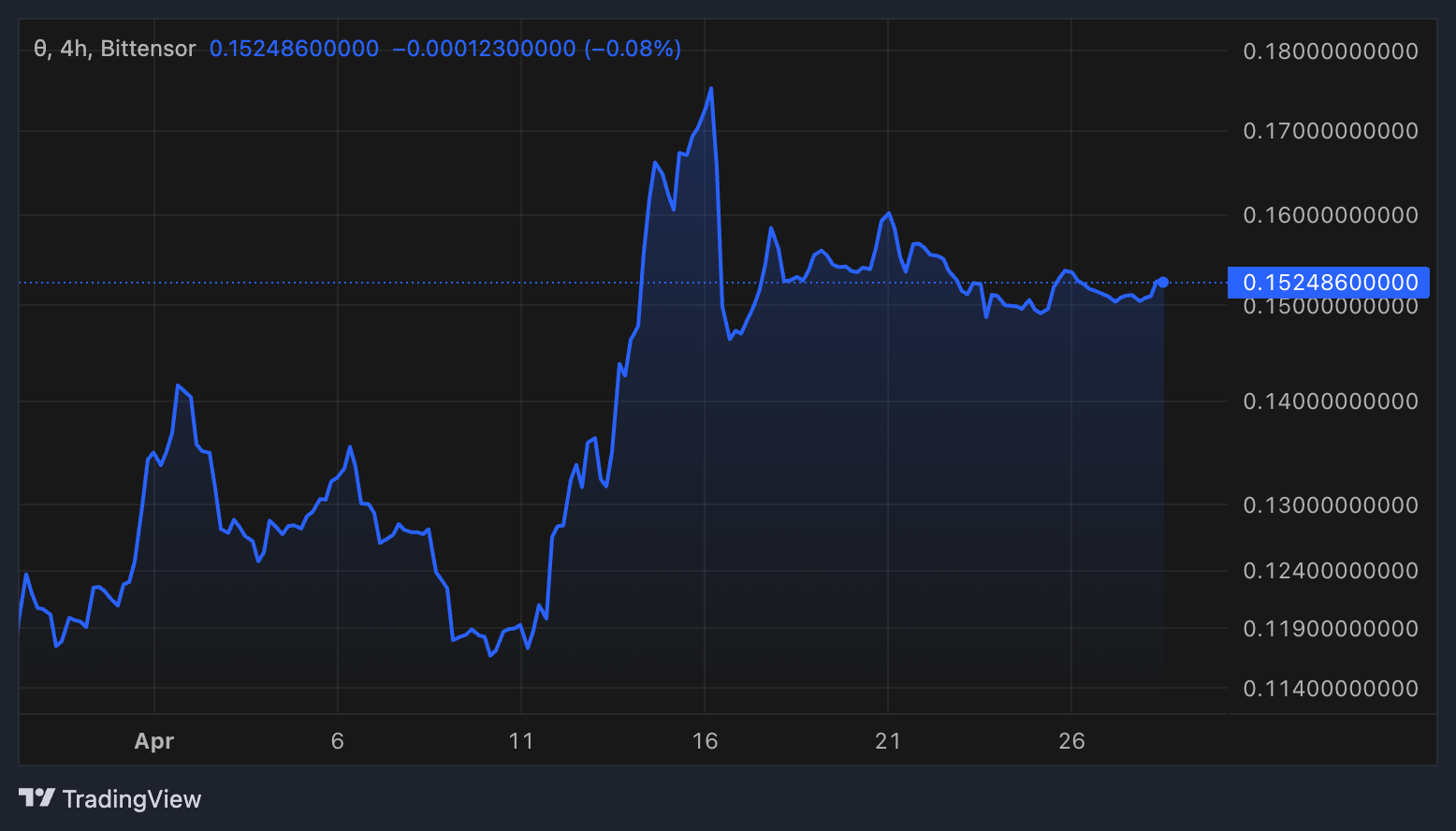

Proprietary Trading Network’s market cap is close to $50 million, with its trading volume jumping nearly 160% in the last 24 hours to reach $3 million.

Proprietary Trading Network Token Performance. Source: Tao Stats.

Proprietary Trading Network Token Performance. Source: Tao Stats.

With DeFAI emerging as one of the hottest narratives for 2025, Proprietary Trading Network is well-positioned to leverage its exposure to trending sectors like AI, Bittensor subnets, and trading.

If the current momentum strengthens, the token could soon rise to retest the $0.20 and $0.25 resistance levels, supported by growing attention across these sectors.

Targon

Manifold Labs developed Targon, which is a Bittensor Subnet token that is building an AI cloud platform that enables users to run inferences on AI models at high speed and low cost.

Through its Playground and API, Targon offers many models optimized for completion and chat tasks.

The platform emphasizes fast performance, high scalability, and cost-efficiency, allowing developers and companies to deploy and scale AI models while minimizing infrastructure complexity easily.

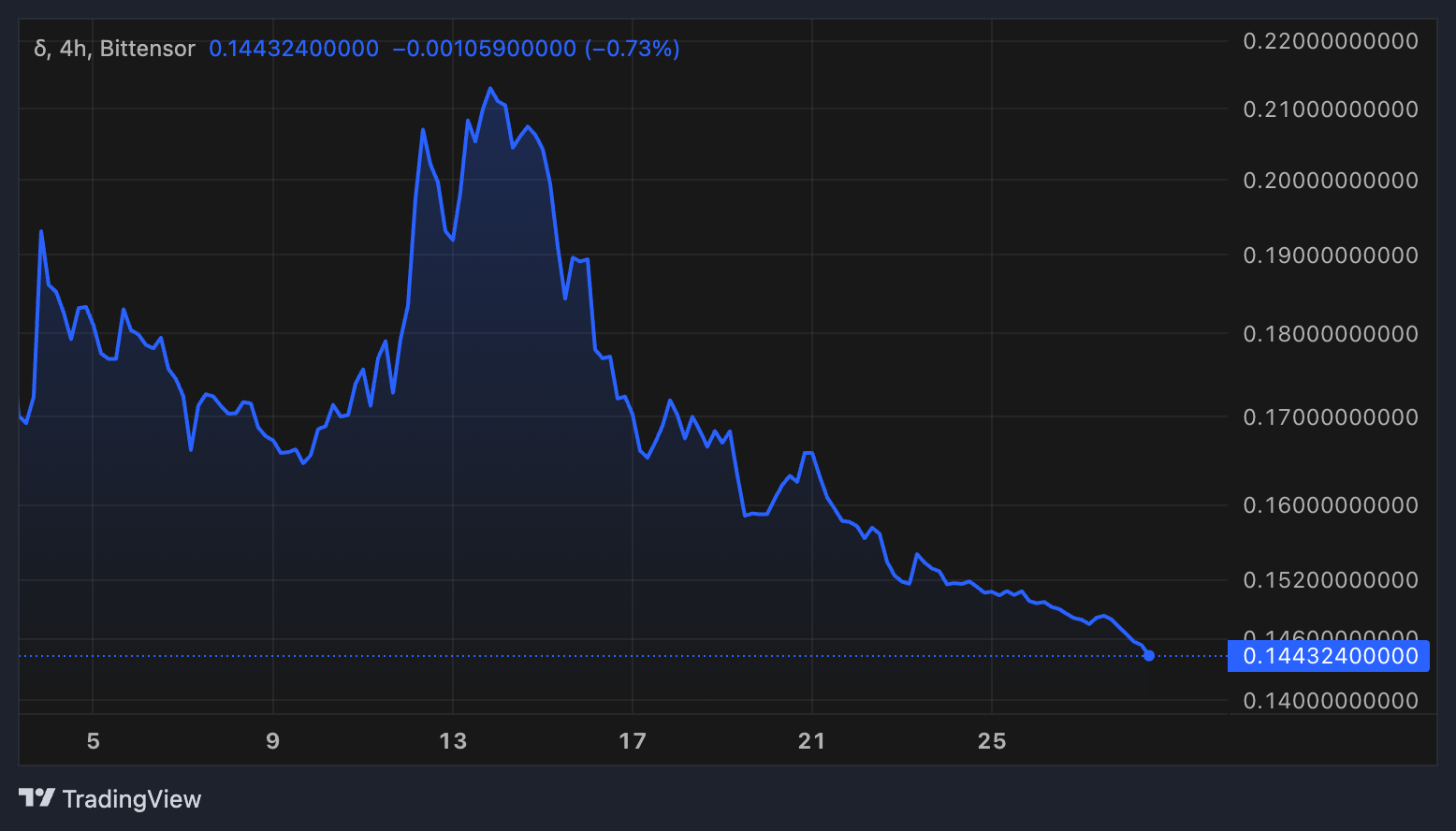

Targon Token Performance. Source: Tao Stats.

Targon Token Performance. Source: Tao Stats.

Targon’s market cap currently sits around $47 million, with daily trading volume reaching $1.33 million.

Targon’s price has fallen more than 9% over the past 24 hours. Its RSI is at 19.23, signaling deeply oversold conditions that often precede a rebound.

Targon could gain up to 48% if new momentum builds and retests price levels from 15 days ago.