El Salvador Increases Bitcoin Holdings Despite IMF Focus on Fiscal Reforms

The International Monetary Fund (IMF) had previously confirmed that El Salvador is upholding its commitment to halt Bitcoin accumulation within its public sector.

Yet, on-chain data reveals a different reality that the Central American nation is continuing to grow its Bitcoin reserves quietly.

Bitcoin Accumulation Continues in El Salvador Despite IMF’s Policy Claims

In an April 26 press briefing, Rodrigo Valdes, Director of the IMF’s Western Hemisphere Department, stated that El Salvador is complying with the agreed non-BTC accumulation policy.

“In terms of El Salvador, let me say that I can confirm that they continue to comply with their commitment of non-accumulation of bitcoin by the overall fiscal sector, which is the performance criteria that we have,” Valdes stated.

Valdes also highlighted El Salvador’s ongoing governance and transparency reform efforts, describing them as strong and encouraging steps forward.

“The program of El Salvador is not about bitcoin. It’s much more, much deeper in structural reforms, in terms of governance, in terms of transparency. There is a lot of progress there. And also, on fiscal. And authorities have been making a lot of progress implementing the reform,” he continued.

Beyond BTC, Valdes stressed that fiscal reforms are another priority for El Salvador. These measures could unlock access to as much as $3.5 billion in financial assistance, potentially boosting private sector investments and supporting sustainable economic growth.

El Salvador’s efforts are tied to its December 2024 agreement with the IMF for a $1.4 billion loan. As part of the deal, the financial regulator required the government to revise its Bitcoin policies.

These changes included removing mandatory BTC acceptance for merchants, ending Bitcoin-based tax payments, and scaling back the Chivo wallet project.

However, despite the IMF claims, blockchain data shows El Salvador has not paused its Bitcoin activities.

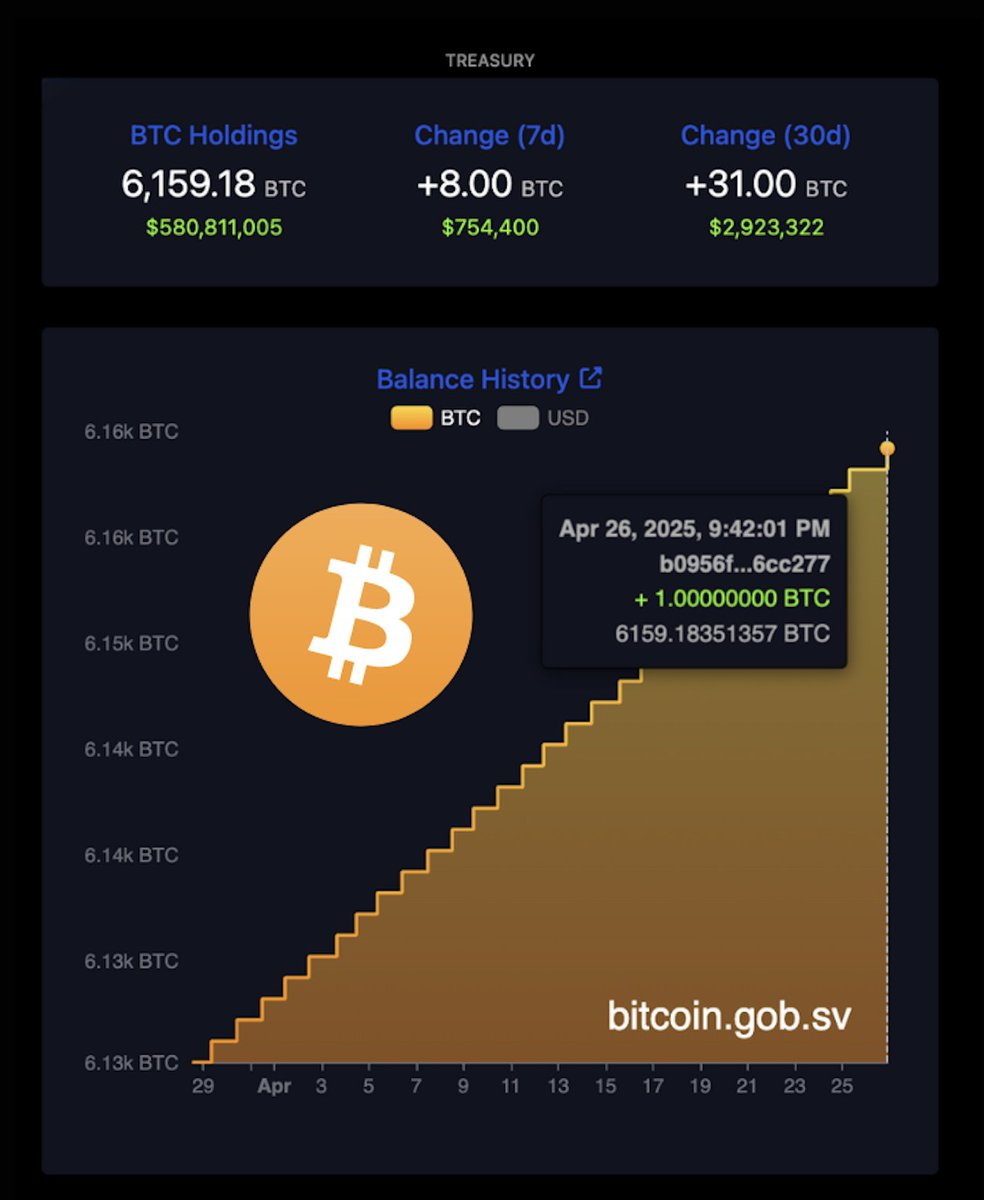

On April 26, the country’s National Bitcoin Office reported that El Salvador has purchased 8 BTC during the past week and 31 BTC over the past month.

These acquisitions have pushed El Salvador’s total BTC holdings to 6,159 BTC, valued at over $580 million at the time of writing.

This represents a staggering 99.93% profit on the approximately $155 million acquisition cost of the country, according to NayibTracker data.

El Salvador’s Bitcoin Holdings. Source: Bitcoin Office

El Salvador’s Bitcoin Holdings. Source: Bitcoin Office

Stacy Herbert, Director of the National Bitcoin Office, emphasized that El Salvador will continue to expand its strategic Bitcoin reserve.

She explained that this move helps the country maintain its first-mover advantage in the crypto space.

“El Salvador continues front-running the rest of the world by adding to its Strategic Bitcoin Reserve. First mover advantage intensifies,” Herbert said.

Meanwhile, the country’s embrace of emerging technologies continues to attract international attention. Stablecoin issuer Tether recently relocated its headquarters to El Salvador, praising the nation’s favorable regulatory environment.

In addition, El Salvador recently signed a letter of intent with AI leader NVIDIA to develop sovereign artificial intelligence infrastructure. This move will strengthen its position as a rising innovation hub in Latin America.