Bitcoin Price Surges Past $95,000 — Analyst Discusses The Real Drivers

The Bitcoin price has been in impressive form over the past few weeks, breaking above the psychological $90,000 level in the past week. The premier cryptocurrency seems to be approaching the weekend with the same — if not greater — momentum after crossing $95,000 on Friday, April 25th.

Who Is Really Behind The BTC Rally?

In a new post on the X platform, on-chain analyst IT Tech took a deep dive into the recent Bitcoin price rally, identifying the catalysts for the run from around $74,000 to $95,000. According to a crypto pundit, recent blockchain data shows there has been a clear rotation of capital in the past month.

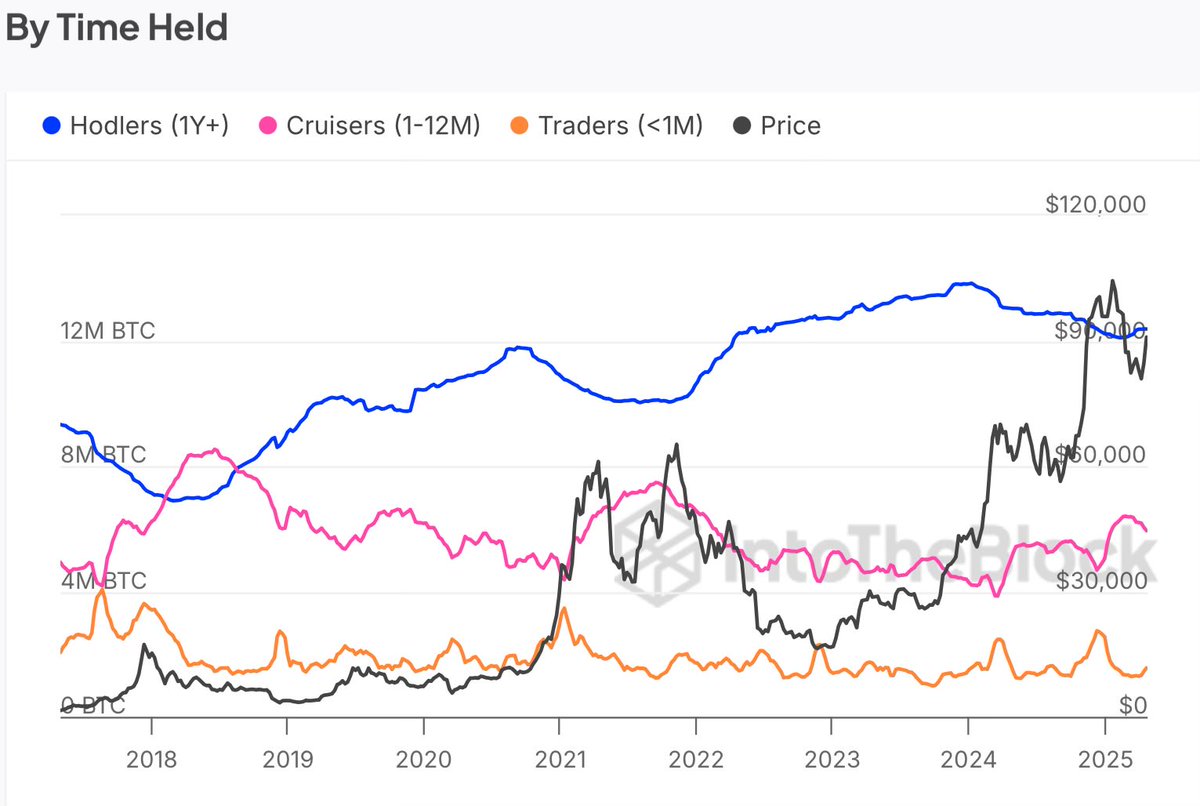

This analysis revolves around the activity of various classes of Bitcoin investors (based on the time spent holding their coins). According to data from IntoTheBlock, most activity has unsurprisingly come from the traders (or short-term holders), who have increased their balance by nearly 19% in the past 30 days.

IT Tech noted that these traders, true to their reactive nature and driven by FOMO (fear of missing out), have been aggressively buying BTC since its price fell to around $74,000. At the same time, the short-term traders have not taken their foot off the gas with the Bitcoin price now dancing above $95,000.

Furthermore, long-term holders seem to have stopped shaving off their holdings in recent weeks, removing the “major overhead pressure” on the Bitcoin price. According to data from IntoTheBlock, the balance of BTC long-term holders has grown by at least 0.3% in the last 30 days.

Finally, IT Tech highlighted an investor cohort dubbed “Cruisers,” with Bitcoin holdings aged between 1 to 12 months. Considering that their balance declined by 4.4% in the past month, the on-chain analyst mentioned these investors are either maturing into “Hodlers” or taking profit.

IT Tech concluded that the Bitcoin price could be entering a speculative bullish phase characterized by substantial short-term capital inflows and long-term stability. However, the analyst warned about the dominance of the short-term hands.

Given their reactive nature, highly volatile periods are historically correlated with the dominance of short-term holders. This means that there might be high volatility in the future of the Bitcoin market. In any case, IT Tech believes the Bitcoin price is yet to reach the local top.

Bitcoin Price At A Glance

As of this writing, Bitcoin is valued at around $95,210, reflecting a 2% increase in the past 24 hours.