Bitcoin Spot Volume Nearly Triples As BTC Breaks $91,000

On-chain data shows the Bitcoin spot market hasn’t been left behind during the latest price rally as its volume has registered a large increase.

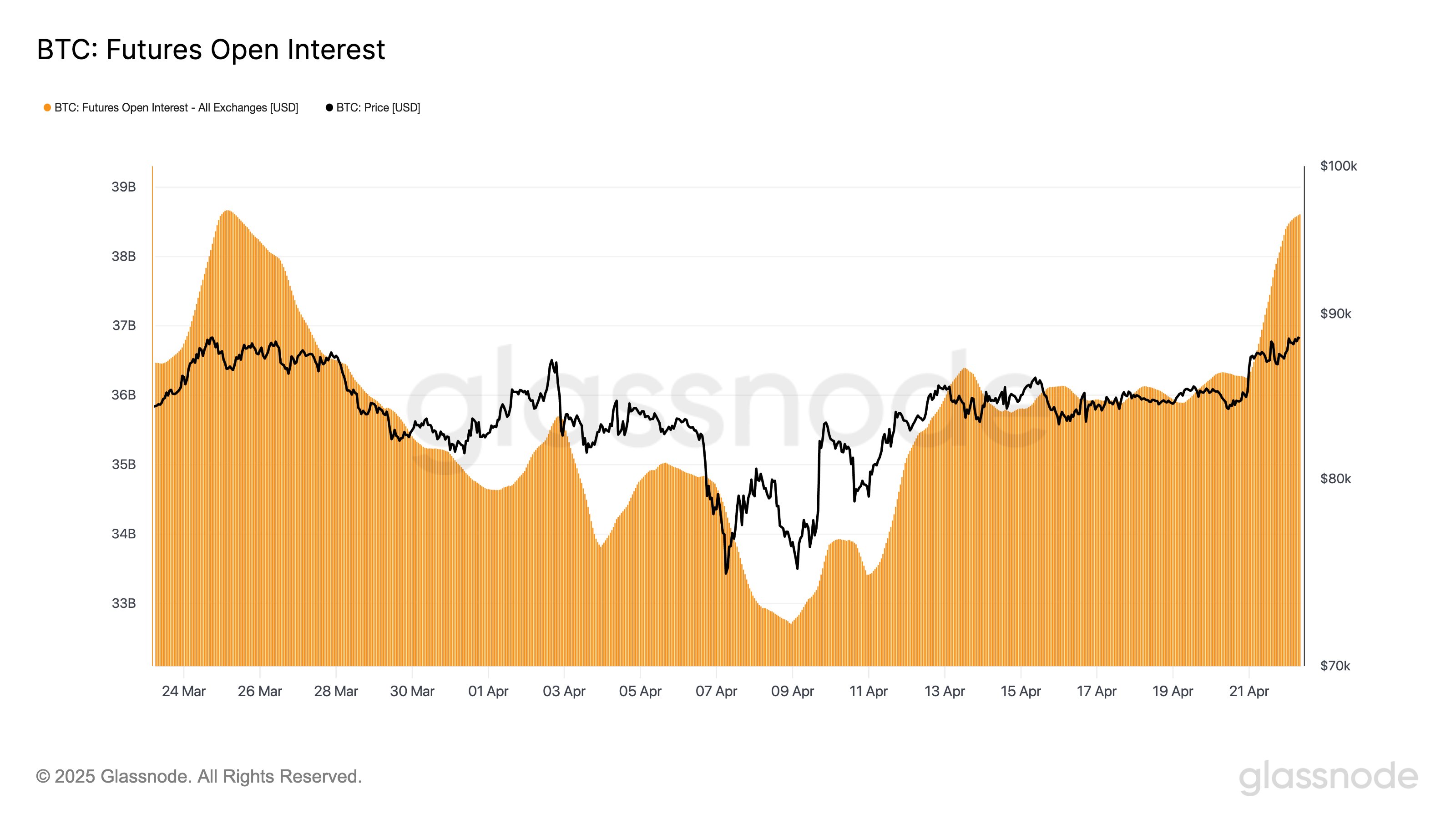

Both Bitcoin Open Interest & Spot Volume Have Shot Up

In a new post on X, the on-chain analytics firm Glassnode has discussed about the latest trend in the Bitcoin Open Interest. The “Open Interest” refers to an indicator that keeps track of the total amount of derivatives positions related to BTC that are currently open on all exchanges.

It would appear that the recent push toward recovery has led to a surge in speculative interest around the cryptocurrency, as the Open Interest has witnessed a notable increase.

“BTC Futures Open Interest rose from $36.2B on Monday to $38.6B today, a +$2.4B increase in less than 36 hours,” notes the analytics firm. This significant rise in the metric has garnered attention from the community, but something that’s being talked about less is that the other side of the market has also seen a boost in activity.

More specifically, the Trading Volume associated with the spot market has observed a sharp increase recently.

The “Trading Volume” is an indicator that measures the total amount of the cryptocurrency that’s becoming involved in trading activities on the centralized exchanges. In the current case, only the Trading Volume associated with the spot platforms is of interest.

This part of the Trading Volume has gone up from $2.9 billion to $8 billion, which suggests spot activity has almost tripled within less than 36 hours. “This shows a simultaneous influx of capital into the spot market alongside the OI spike,” says Glassnode.

Generally, rallies that are built on high speculative interest tend to be unstable, because the underlying leveraged positions can be susceptible to easy liquidation.

While the rise in the Open Interest could be bad for the current recovery run for this reason, the fact that the spot Trading Volume has also shot up at the same time could be a more optimistic sign.

Rallies require constant fuel to be sustainable, which comes in the form of an increase in the Trading Volume. Runs that fail to gather attention from the spot market tend not to last. With both the Open Interest and spot Trading Volume up right now, it remains to be seen how Bitcoin would turn out in the coming days.

BTC Price

Bitcoin has continued to add to its recovery during the past day as the asset’s price has now managed to touch the $91,000 level.