VENOM leads $235 million token unlocks this week

Over $235 million worth of tokens are set to hit the crypto market between April 21 and April 28.

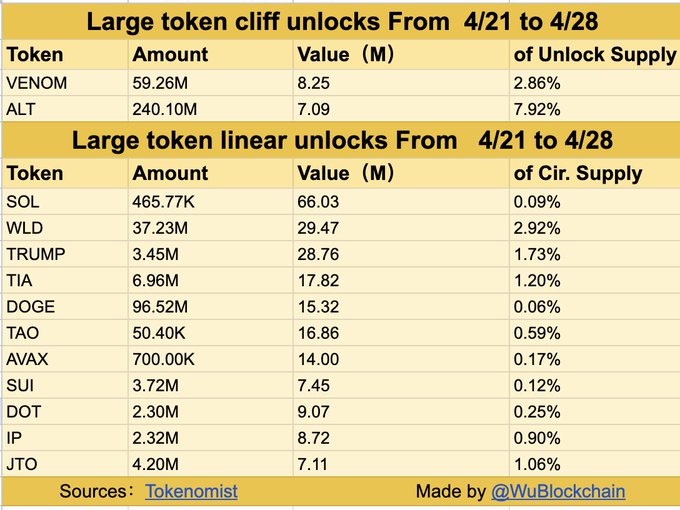

According to data by Tokenomist, the upcoming unlocks include both cliff-style and linear events. VENOM and ALT will lead the cliff-style unlocks with combined values exceeding $15 million, while Solana tops the linear unlocks with 465,770 SOL worth $66.03 million entering circulation.

VENOM leads large token cliff unlocks

Two major tokens are scheduled for cliff-style unlocks between April 21 and April 28. VENOM leads these unlocks with 59.26 million tokens set to be released, valued at approximately $8.25 million. This release represents 2.86% of VENOM’s total unlock supply.

Following VENOM is ALT, with an even larger volume of tokens being unlocked. The data shows that 240.10 million ALT tokens, valued at $7.09 million, will be released during this period. This unlock is particularly substantial as it represents 7.92% of ALT’s unlock supply. This makes it the larger percentage-wise of the two cliff unlocks.

Together, these two cliff-style unlocks will release tokens valued at approximately $15.34 million into the market. Cliff unlocks typically create more immediate market impact than linear unlocks. This is because all tokens become available for sale at once rather than being distributed gradually over time.

Solana leads large linear unlocks

Most of the upcoming token unlocks are going to happen sequentially and Solana (SOL) is leading presently in terms of value. According to data provided by Tokenomist, 465,770 SOL tokens valued at $66.03 million will unlock during the week between April 21 and April 28.

Even though the dollar value is notable, the unlock is only 0.09% of Solana’s circulating supply. Worldcoin (WLD) is the second-largest linear unlock. It will release 37.23 million tokens worth $29.47 million. That represents 2.92% of WLD’s circulating supply.

TRUMP token ranks third with 3.45 million tokens valued at $28.76 million scheduled for unlock. This release will add 1.73% to TRUMP’s circulating supply. TIA comes in fourth place with 6.96 million tokens worth $17.82 million and is 1.20% of its circulating supply.

Other notable linear unlocks include TAO (50.40K tokens, $16.86 million, 0.58% of supply), Dogecoin (DOGE) with 96.52 million tokens worth $15.32 million (0.06% of supply), and Avalanche (AVAX) with 700,000 tokens valued at $14 million (0.17% of supply).

The remaining tokens with linear unlocks exceeding the $5 million threshold include SUI (3.72 million tokens, $7.45 million, 0.12% of supply), Polkadot (DOT) with 2.30 million tokens worth $9.07 million (0.25% of supply), IP (2.32 million tokens, $8.72 million, 0.90% of supply), and JTO (4.20 million tokens, $7.11 million, 1.06% of supply).

Combined, these linear unlocks account for approximately $220 million of the total $235 million in token unlocks scheduled for the week.

Less popular unlocks

Beyond the major token unlocks, several smaller projects are also scheduled to release tokens during the April 21-28 period. These less prominent unlocks may not generate as much market attention but could still impact their respective token prices.

According to data from CoinMarketCap, Fjord Foundry (FJO) has an unlock progress of 51.87%. As per the data, the next unlock will release 3.85 million FJO tokens worth around $737,701. This is 3.85% of all the locked tokens. Scroll (SCR) is 19.00% into its unlock schedule and will unlock 40 million SCR tokens worth approximately $10.41 million shortly.

This is 4.00% of all the locked SCR tokens. TonUP (UP) has 38.28% of unlocked tokens, out of which 2.93 million UP tokens are available for release, worth approximately $21,752. That is 2.93% of locked supply. Amazy (AZY) has achieved 71.84% unlocks, and 11.9 million AZY tokens worth $3,011 (1.19% of total locked) will be released in the next one.

Sociapol (SPOL) has 34.05% of its tokens unlocked. There are 3.37 billion SPOL tokens valued at $26,091 and set to be released.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot