Pi Network (PI) Rises More Than 4% Amid Mixed Roadmap Sentiment

Pi Network (PI) has climbed over 4% in the past 24 hours after the launch of its Migration Roadmap. The token is showing early signs of recovery across several indicators, but confirmation of a sustained uptrend remains uncertain.

While technical setups like the Ichimoku Cloud and RSI suggest a possible shift in sentiment, resistance levels continue to hold strong. At the same time, frustration among the community persists due to the lack of clarity in the Migration Roadmap, adding another layer of pressure to PI’s next move.

PI Tests Cloud Resistance With Weak Trend Structure Ahead

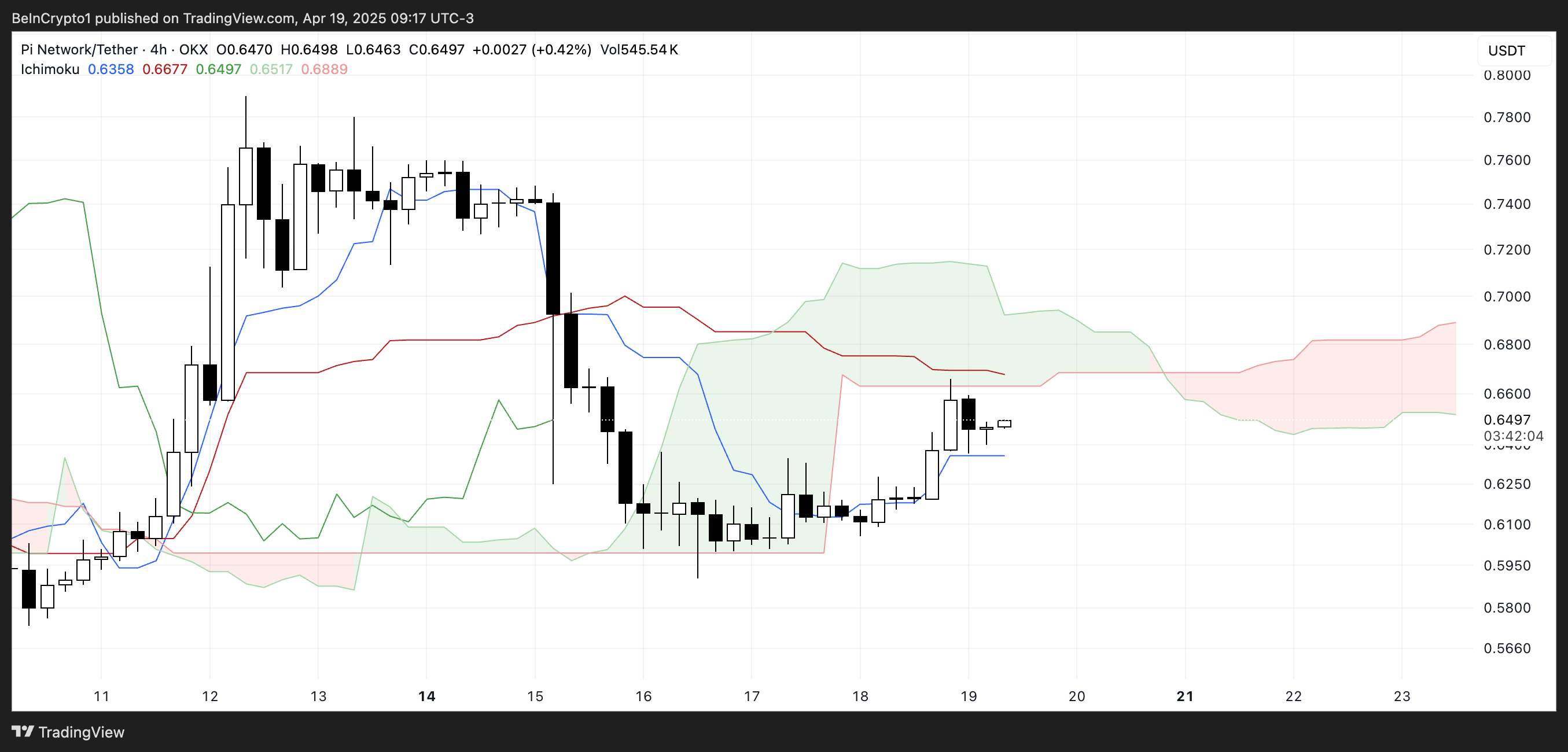

Pi Network is currently trading just below the Ichimoku Cloud, signaling hesitation as buyers attempt to regain control. While recent candles show higher lows and some bullish intent, the price remains under the cloud’s resistance zone.

The Tenkan-sen (blue line) is still below the Kijun-sen (red line), meaning short-term momentum hasn’t overtaken the medium-term trend yet.

Until a bullish crossover forms and the price breaks through the cloud, the structure favors caution over confirmation.

PI Ichimoku Cloud. Source: TradingView

PI Ichimoku Cloud. Source: TradingView

Looking forward, the cloud becomes thicker and increasingly sloped, suggesting that volatility may return and a stronger trend—bullish or bearish—could soon develop.

This widening Kumo indicates that the market may be preparing for a more decisive move, and a successful breakout above the cloud would be a significant signal.

However, as long as PI remains beneath this zone, it stays in a vulnerable position, with rejection and continued sideways movement still on the table.

Pi Network RSI Rises, But Fails to Hold Above 57

The Pi Network’s RSI is currently at 53.77, reflecting a significant recovery from its deeply oversold reading of 32.34 two days ago.

However, after peaking at 57.25 yesterday, the RSI has slightly cooled, suggesting that bullish momentum has weakened somewhat.

This shift indicates that while buying pressure recently returned, it has not yet been strong or consistent enough to sustain a full breakout. The market appears to be stabilizing, but not aggressively trending in either direction.

PI RSI. Source: TradingView

PI RSI. Source: TradingView

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and magnitude of recent price changes on a scale from 0 to 100.

Values above 70 typically suggest an asset is overbought and might be due for a correction, while readings below 30 indicate oversold conditions and possible upward reversals. With PI’s RSI sitting at 53.77, the token is in neutral-bullish territory, showing moderate strength but still far from overbought levels.

This leaves room for further upside if momentum picks back up, but also signals that caution is warranted as the trend hasn’t yet solidified.

PI Eyes Breakout Despite Roadmap Frustrations

PI price is currently hovering just below a key resistance level, suggesting that a decisive move could be approaching. If this resistance is tested and broken, PI may resume its upward trajectory, with potential targets around $0.789 and $0.858.

A sustained breakout could even reignite the strong momentum seen a few months ago, paving the way for a push toward $1.23 or even $1.79.

Despite the recent 4% price increase in the past 24 hours, sentiment remains mixed due to growing frustration over the Migration Roadmap, which still lacks a clear timeline.

PI Price Analysis. Source: TradingView

PI Price Analysis. Source: TradingView

On the downside, if PI fails to break through the $0.66 resistance, the token could face a pullback toward $0.54. A loss of that support level would open the door for a deeper correction, potentially dragging the price down to $0.40.

This makes the current zone a crucial battleground between buyers and sellers, as the next few sessions may determine whether PI enters a new bullish phase or slips back into decline.

Until there’s a clear breakout or breakdown, the price remains in a sensitive position, heavily influenced by both technical levels and community sentiment.