Crypto Today: Metaplanet raises $10M to buy BTC, ETH price moves below $1,600 as Tron gains signals panic

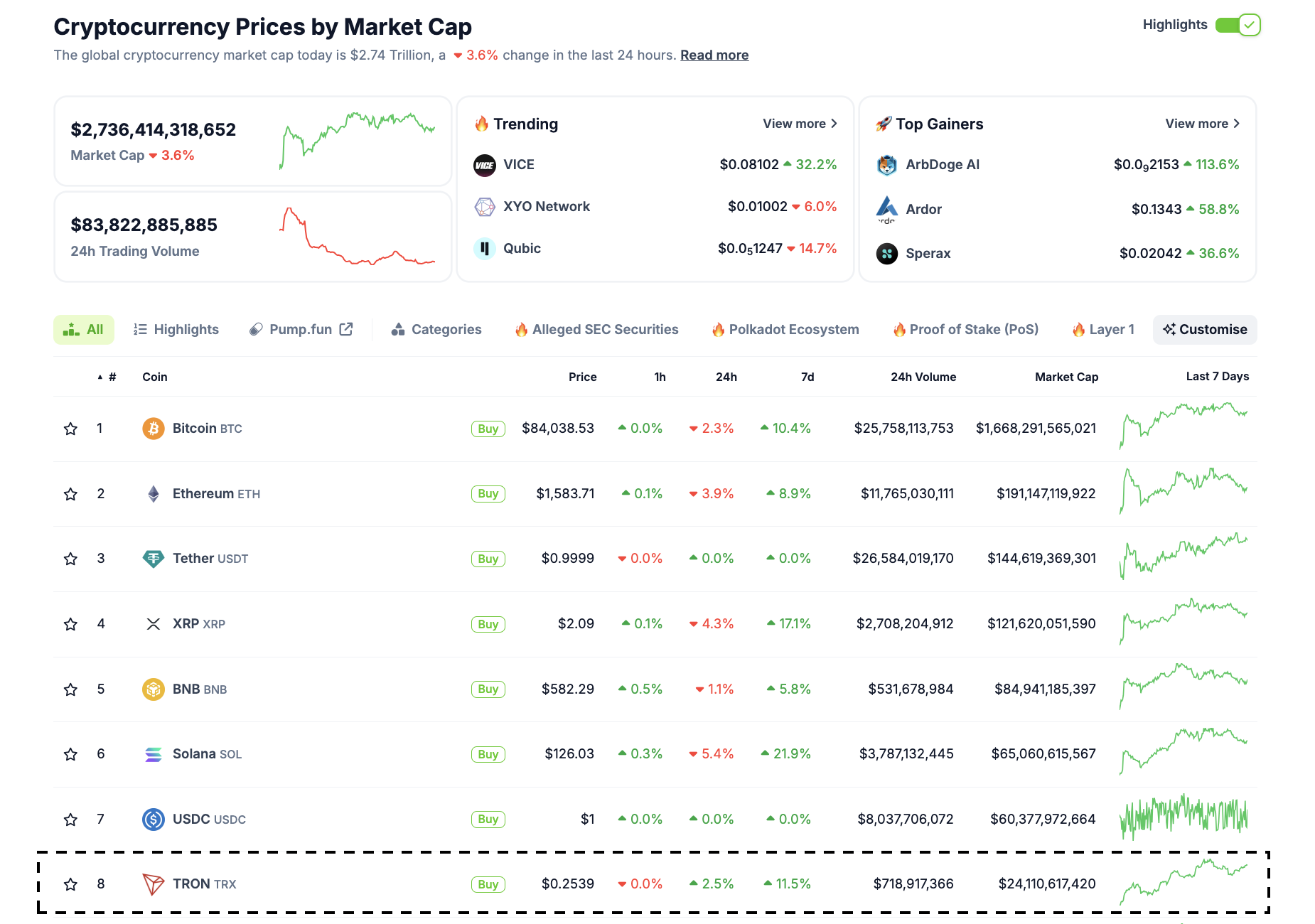

- Cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

- Japanese firm Metaplanet has issued $10 million in zero-interest bonds to fund another round of Bitcoin purchases.

- As cautious traders rotate into stablecoins for safety, Tron price surges 2% to emerge as the only top-10 ranked asset in profit over the last 24 hours.

The cryptocurrency aggregate market capitalization stabilized around $2.7 trillion on Wednesday, with Bitcoin’s $84,000 support momentarily anchoring the market against external bearish discourses.

Bitcoin market updates:

- Bitcoin price held firm above $84,000 on Wednesday, while altcoins experienced minor sell-offs.

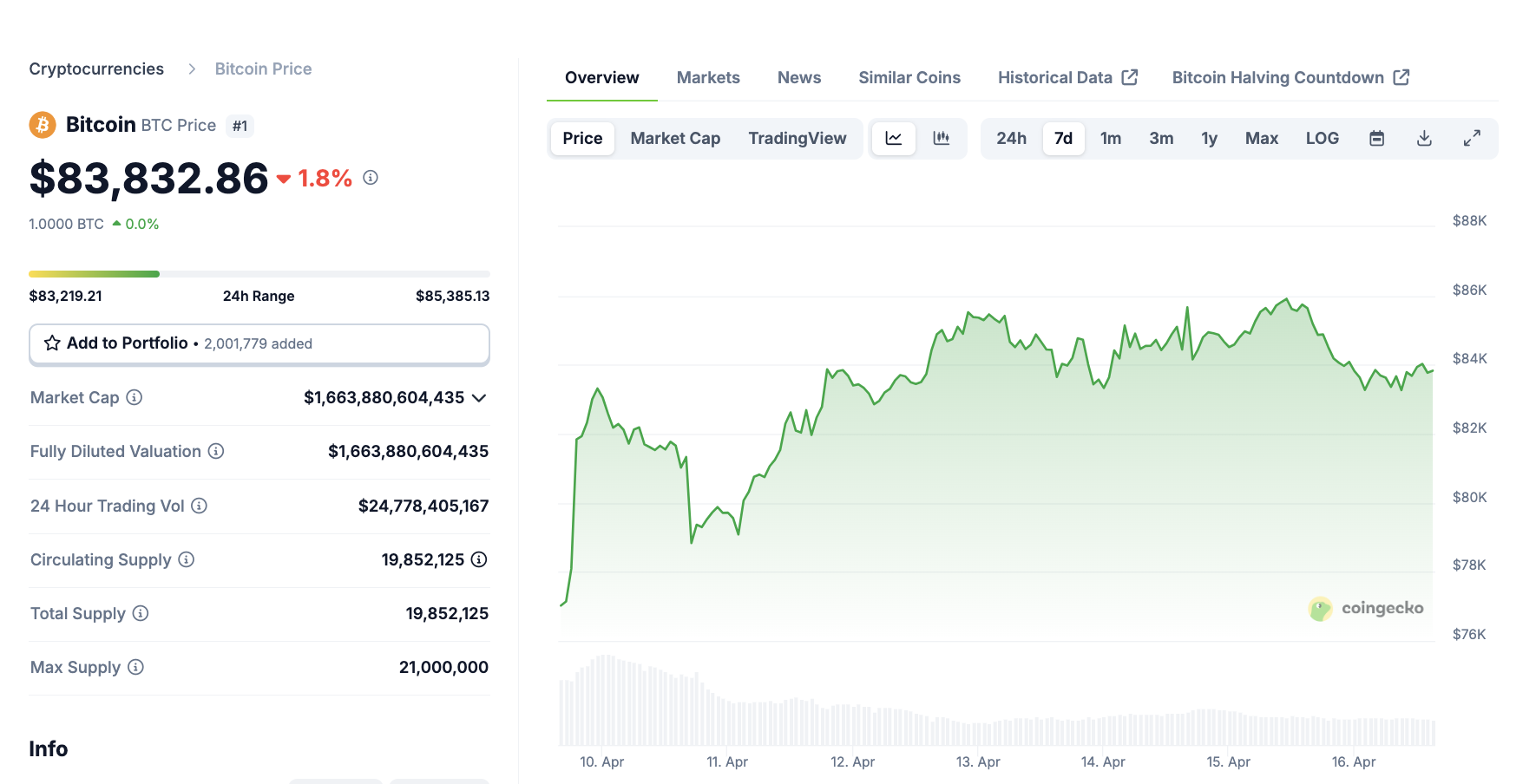

Chart of the Day: BTC tops $84,000 as NVIDIA stock gets caught in US trade war crosshairs

Nvidia stock price dipped 5% on Wednesday, experiencing major sell-offs on Wednesday following a $5.5 billion charge resulting from a US government ban on its H20 chip sales to China.

Initial market reactions suggest BTC appears to benefit from displaced capital as traders exit NVDA and adjacent US tech stocks to mitigate the impact of trade war.

Bitcoin price action, April 16 | Coingecko

With Bitcoin viewed as resistant to global trade and supply chain risks, BTC could potentially approach $85,000 as the day unfolds if traders continue to rotate funds from stocks into crypto.

On the flipside, considering Nvidia’s systemic importance to crypto mining equipment, if the NVDA sell-off intensifies, it could eventually spread bearish headwinds toward BTC markets, potentially knocking prices closer to $80,000.

Altcoin market update: Ethereum losing market share as Tron gains signals market panic

The altcoin market reflects growing risk aversion, with traders gravitating toward assets linked to stability and high utility.

Despite its dominant smart contract presence, Ethereum price has plunged below the $1,600 support, dropping 3.1% over the past 24 hours, amid broader fears of declining DeFi activity.

Meanwhile, Tron has surged by 2.3%, becoming the only top-10 crypto to post a daily gain, signaling a different kind of market response.

Tron's price gains stand out not just for its price action but for what it represents: heightened on-chain activity driven by stablecoin transactions. As a dominant player in the stablecoin sector, especially for USDT on-chain volume, Tron's rise signals increased demand for low-cost, high-throughput transfers.

This often correlates with rising trading volume and capital flight, as investors and exchanges use Tron’s cheap fees to park funds in stablecoins during volatile market periods.

Hence, the mild uptick in Tron also reflects a defensive stance by the market, favoring networks that enable the efficient movement of capital. Meanwhile, Ethereum’s decline suggests some traders are rotating out of high-fee Layer 1 protocols, opting instead for practical utility and transaction efficiency, especially during trade war-driven volatility

Crypto news updates:

Metaplanet raises $10 million through zero-interest bonds to expand Bitcoin holdings

Metaplanet has issued its 11th series of ordinary bonds, totaling $10 million, to EVO FUND. The bonds carry no interest and are part of the company’s ongoing strategy to increase its Bitcoin reserves. The funds from this bond issuance will be used exclusively to acquire additional Bitcoin, aligning with plans previously disclosed by Metaplanet in January 2025.

The zero-interest bonds are set to mature on October 14, 2025. Metaplanet confirmed that redemption of these bonds will be financed through proceeds from its 14th to 17th Series of Stock Acquisition Rights.

Coinbase Institutional warns of possible crypto winter as market indicators turn bearish

Coinbase Institutional has released a report citing several bearish signals pointing to a potential onset of a new crypto winter. The firm noted a significant decline in total crypto market capitalization, excluding Bitcoin, alongside a slowdown in venture capital funding in Q1 2025.

The report also emphasized that both Bitcoin and the COIN50 index have dipped below their 200-day moving averages.

DWF Labs invests $25 million in World Liberty Financial, opens New York office

DWF Labs has announced a $25 million investment in governance tokens of World Liberty Financial, a digital finance platform backed by Donald Trump. The investment aligns with the firm’s broader strategy to support emerging DeFi projects, including the USD1 stablecoin initiative, which is part of the expanding digital asset ecosystem.

As part of its US expansion, DWF Labs is opening a new office in New York City. The firm stated that the move will help foster regulatory engagement, attract local talent, and strengthen partnerships within the American crypto market.