Binance Chain completes $914M BNB token burn, hinting at a potential rally

- Binance Chain finalizes its 31st quarterly token burn, removing 1,579,207 BNB from circulation.

- Binance’s automatic token burn mechanism aims to reduce the BNB token supply to 100 million.

- BNB price could rally as total supply shrinks while demand increases.

- BNB sits below the 50-day, 100-day and 200-day EMAs, bringing perspective to anticipated challenges to the recovery targeting $635.

Binance Chain has finalized its programmed 31st quarterly BNB token burn, potentially setting the stage for the world’s fifth-largest cryptocurrency, with a market capitalization of $81.45 billion, to rally in the coming weeks.

Binance removes 1.6 million BNB tokens from circulation

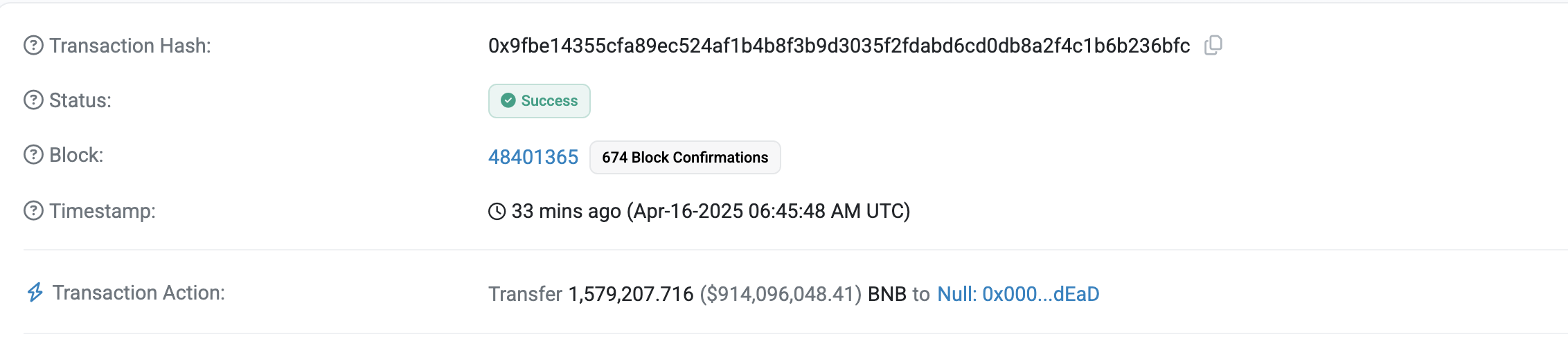

According to data from BscScan, the removal of 1,579,207 BNB tokens (approximately $916 million) from circulation was completed on Wednesday. This event brings the Binance Chain ecosystem closer to its goal of reducing BNB’s total supply of 100 million tokens – a move that could position the token for long-term growth if demand increases.

BNB Chain adopted an automatic token burn mechanism strategically set to reduce the circulating supply periodically. The system was introduced through the BEP95 proposal, which calculates the number of tokens to be burned each quarter based on BNB price and the blocks produced on the Binance Smart Chain (BSC) during the period.

BNB token burn data | Source: BscScan

According to CoinGecko data, BNB’s total supply was 200,000 million tokens, which is currently slightly below 146 million.

Key levels shaping BNB price action

BNB price sustains a downtrend to trade at $580 at the time of writing on Wednesday. Last week’s bullish momentum from United States (US) President Donald Trump’s 90-day tariff pause suddenly stopped at $600, leaving the 50-day Exponential Moving Average (EMA) untested.

The bulls seem determined to prevent further downside correction. They aim to reclaim resistance at $600 and seek support above the 50-day EMA in the coming days.

Despite bearish momentum building in the last few days, the Moving Average Convergence (MACD) indicator is resilient. Traders should watch out for a confirmed buy signal if the MACD line (blue) separates from the signal line (red), closing in on the center line.

If BNB rises and breaches the descending trendline resistance, the probability of tagging the next key supply area around $635 (red in the chart) would increase significantly.

BNB/USD daily chart

However, the Relative Strength Index (RSI) indicator reminds traders to be cautious because downside risks remain apparent. The RSI holds at 45 after reversing from the midline at 50, signaling a slight bearish momentum.

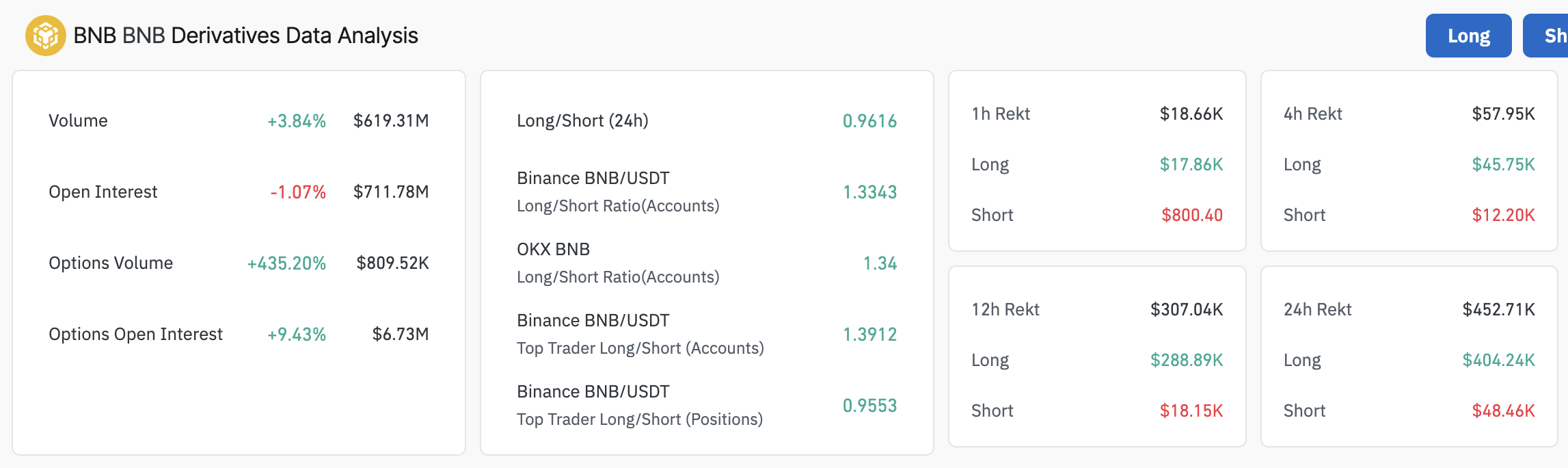

Furthermore, derivatives data from Coinglass emphasize the increasing sell-side risks as the long-to-short ratio stands at 0.9616, which suggests a more bearish or negative market sentiment as more traders are betting on a price decline rather than an increase. Additionally, more than $400,000 in long positions was liquidated in the last 24 hours, compared to only $48,460 in short positions.

BNB derivatives data | Source: Coinglass

The larger cryptocurrency market continues to trade on the edge despite the tariff war cooling in the US. China and the United States have been expanding trade tensions beyond tariffs, with targets set on computing chips and rare earth metals.