Cardano Holders’ Selling Reverses Momentum, Price Falls Back to $0.6

Cardano’s price has experienced a notable decline recently, falling to $0.60 after failing to recover.

This downtrend came as long-term holders (LTHs) decided to sell their holdings, likely to prevent further losses. This shift in investor sentiment triggered a reversal in Cardano’s momentum.

Cardano Investors Selling Triggers Bearishness

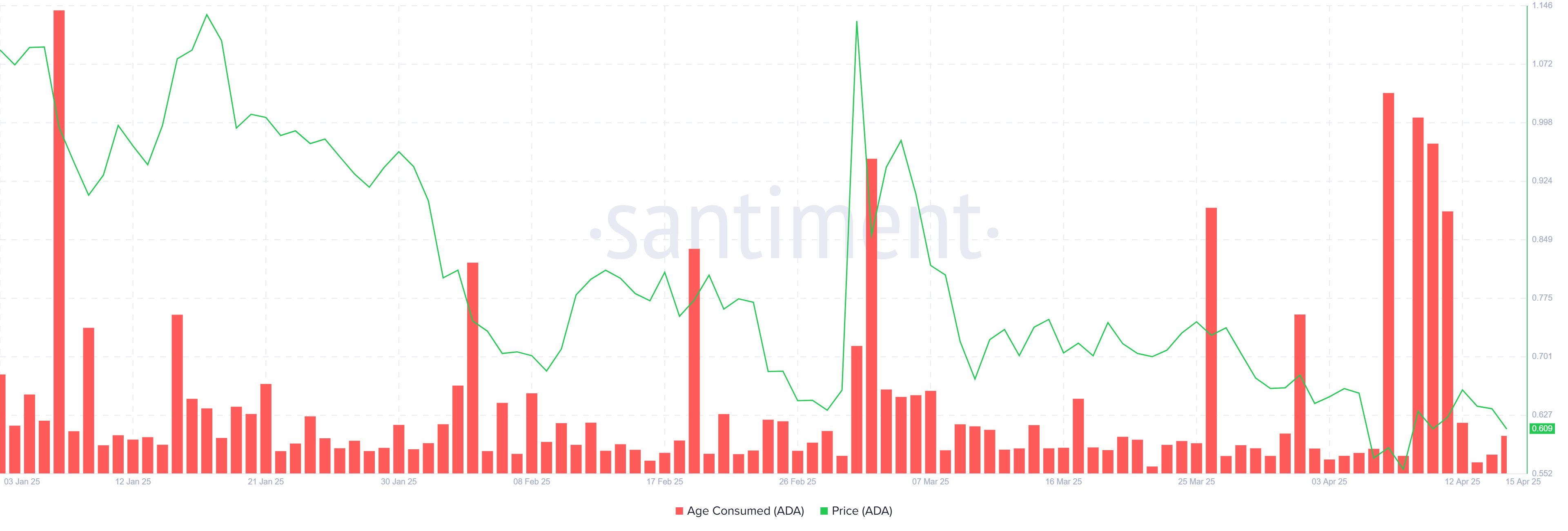

The Age Consumed metric has spiked over the past week, signaling a significant uptick in selling activity from long-term holders. As the price of Cardano rose slightly earlier in the week, LTHs likely seized the opportunity to cash out, capitalizing on the short burst of gains. This selling activity has intensified the downward pressure on the coin, causing a sharp decline in price.

In addition, this trend of selling suggests that LTHs may be more cautious and unwilling to hold further amidst the ongoing market uncertainty. With increased selling volume, Cardano’s market sentiment has shifted from optimism to caution.

Cardano Age Consumed. Source: Santiment

Cardano Age Consumed. Source: Santiment

Technical indicators such as the Relative Strength Index (RSI) reflect the negative sentiment surrounding Cardano. Despite briefly approaching the bullish zone, the RSI failed to cross the critical 50 line, signaling that momentum has not shifted in favor of a recovery. This failure indicates that the selling from LTHs continues to weigh on the price action, contributing to the broader bearish outlook.

The persistence of this selling pressure has kept the RSI below 50, signaling that Cardano remains in a bearish phase. As long as the bearish momentum persists, ADA remains vulnerable to further corrections and potential losses, making any price rebound a challenging prospect for the immediate future.

Cardano RSI. Source: TradingView

Cardano RSI. Source: TradingView

Can ADA Price Make It Back Up?

At $0.60, Cardano has failed to secure $0.63 as a critical support level, which it had the chance to do earlier. The selling activity from LTHs has been a key driver in this decline, exacerbated by the ongoing bearish sentiment in the market. The recent price action suggests that Cardano is at risk of further price erosion.

If the price continues to decline, it may test the next support level at $0.57. A drop below this level could significantly extend the losses for investors, potentially delaying any meaningful recovery.

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingView

However, if Cardano manages to reverse its current momentum and reclaim $0.63 as support, it could invalidate the bearish outlook. This recovery would open the door for a potential rise toward $0.70 as the market sentiment improves, and LTHs may become more confident in holding the asset once again.