Tether latest partnership with Fizen could unlock $8.9 trillion payment market for USDT

- Tether invests in fintech firm Fizen to scale real-world stablecoin payments and adoption of self-custody wallets.

- Fizen currently offers on-ramping, fiat settlement and critical crypto payments solutions that bridge the gap between blockchain and traditional merchants.

- The partnership aims to boost financial inclusion by removing access barriers to digital assets, especially for the unbanked.

Tether's investment in Fizen signals a new chapter in the race to mainstream stablecoin payments, with an eye on the unbanked.

Tether taps Fizen for global stablecoin adoption and financial inclusion

Tether, the world’s largest stablecoin issuer by market capitalization, announced a strategic investment in Fizen Limited, a fintech startup focused on self-custody crypto wallets and blockchain-based payment solutions.

The deal is central to Tether’s bid to expand the practical use of stablecoins in daily transactions, especially in emerging markets where access to traditional financial services remains out of reach for millions.

Currently, Fizen’s infrastructure offers users the ability to transact in stablecoins like USD₮ via familiar methods such as QR codes and card readers, while merchants receive instant fiat settlements—bypassing the typical friction associated with blockchain-based payments.

Integrating intuitive user interfaces with self-custody wallets aims to bridge a long-standing gap between crypto utility and mainstream adoption, making it easier for consumers and businesses to engage with digital assets without deep technical knowledge.

"Tether’s investment in Fizen underscores our commitment to expanding global access to efficient and reliable digital financial solutions that promote the informed, responsible use of digital assets in everyday life,” said Paolo Ardoino, CEO of Tether.

By enabling smartphone-based wallets and eliminating onboarding complexities, Fizen provides a framework that could significantly expand stablecoin penetration among underbanked populations.

Tether’s expansion could open up $8.9 trillion market for USDT

Tether’s move is also reflective of a broader shift in crypto strategy. Converging with TradFi giants like BlackRock venturing into the tokenization of real-world assets, stablecoin issuers like Tether are doubling down on real-world utility.

Fizen’s current operational model addresses these gaps. The company’s platform allows users to pay using stablecoins without realizing they transact on-chain. Meanwhile, merchants receive funds in local fiat via familiar infrastructure, removing the need for additional blockchain integrations or volatility risk.

“The technology infrastructure is already in place, but we lack consumer-friendly applications with intuitive UI/UX,” said Leo Vu, CEO of Fizen. “Fizen is solving this by making crypto payments an intuitive part of daily transactions.”

The potential market impact is significant. For context, QR code payments have reached $5.4 trillion globally for 2025, forecast to surpass $8 trillion globally by the end of 2029, with 2.2 billion users expected by 2025, according to Juniper Research.

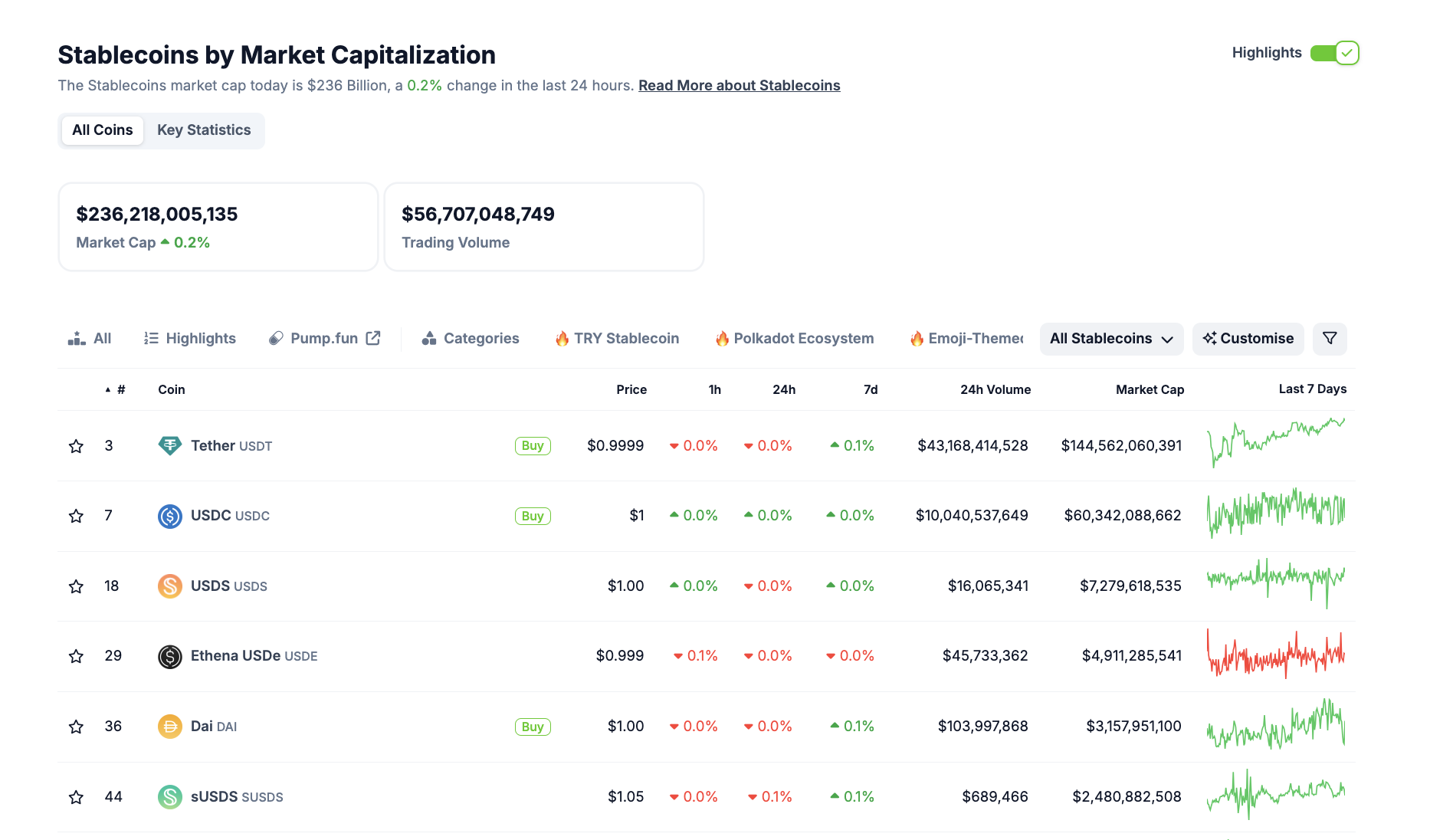

In comparison, the global stablecoin supply is trending at $236 billion at the time of writing. Tether ranks first with $144.5 billion, while Circle’s USDC and USDS rank make up the top three stablecoins list with circulating supplies worth $60 billion and $7.3 billion, respectively.

With the partnership with Fizen, USDT could be integrated into daily QR code transactions, unlocking a potential $8.9 trillion utility market. If Tether captures a fraction of the market, it could unlock billions in utility value through USDT issuance and adoption.

Currently, Asia leads the trend for daily digital crypto transactions. Still, adoption is also accelerating in Latin America and sub-Saharan Africa, where mobile-first economies are more prevalent for daily microtransactions than traditional banking infrastructure.

Regulatory clarity could speed up stablecoin adoption

The partnership comes at a time when regulatory scrutiny on stablecoins is intensifying. In March 2025, the US Congress began the legislative process on a new crypto stablecoin bill aimed at establishing a regulatory framework for USD-denominated stablecoins and issuers operating within the US jurisdiction.

In terms of global trends, the Financial Stability Board (FSB) and the International Monetary Fund (IMF) have repeatedly emphasized the need for clarity around stablecoin usage, governance and risk frameworks.

By integrating Fizen’s product features, Tether signals its intent to position itself as an industry leader in the next wave of blockchain-based solutions for financial inclusion and off-chain transactions.

It remains to be seen if this will spread real-world usage of cryptocurrencies as the rest of the year unfolds.