Bitcoin Set For Challenge With Two Major Resistance Zones – Analyst

The Bitcoin (BTC) market proved rather turbulent in the past week after a price decline below $75,000 was followed by a rebound to above $83,000. With the premier cryptocurrency showing indications of a sustained uptrend, blockchain analytics firm CryptoQuant has identified two potential key resistance zones lying in wait.

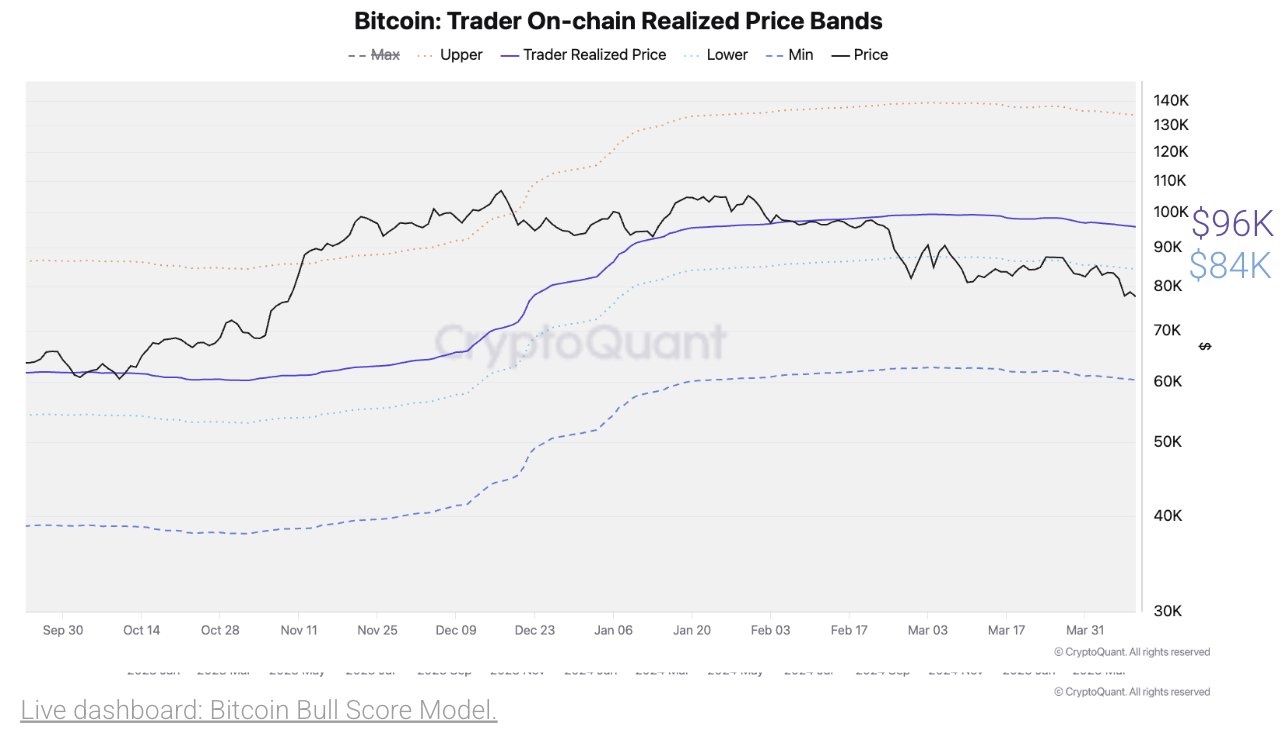

Bitcoin Realized Price Reveals Potential Strong Barriers At $84,000 And $96,000

In an X post on April 11, CryptoQuant shared an on-chain report on the BTC market indicating a potential encounter with two major resistances at $84,000 and $96,000 if Bitcoin maintains its current upward trajectory. These price barriers are revealed by the Realized Price metric which reflects the average price at which the current supply of BTC last moved on-chain thereby determining the market-wide cost basis.

When Bitcoin trades above this level, it indicates a healthy bullish momentum with the majority of holders in profit. Conversely, when BTC is below the threshold, it suggests underwater sentiment as most investors are holding a loss. Therefore, the Realized price often functions as a crucial market pivot acting as strong support during bull markets and stiff resistance in bear phases. According to Julio Moreno, Head of Research at CryptoQuant, BTC’s current on-chain realized price is $96,000 with an immediate lower price band of $84,000.

Interestingly, these two price levels have served as key support zones in the earlier bullish phase of the current market cycle. However, there is potential for both zones to act as resistance amidst the ongoing market correction. However, if Bitcoin is able to move past $84,000 and $96,000, it could signify the resumption of the bull market with the potential for the premier cryptocurrency to trade as high as $130,000. This projected gain would represent a 55% increase in current market prices.

BTC Price Overview

At press time, Bitcoin continues to trade at $83,180 reflecting a 3.65% gain in the past day. Meanwhile, daily trading volume is down by 11.99% and valued at $39.19 billion.

Amidst continuous macroeconomic developments driven by the US Government tariff changes, the crypto market continues to exhibit a strong level of uncertainty and assets fail to establish a clear momentum. However, blockchain analytics Glassnode reports that Bitcoin investors have formed a strong support zone at $79,000 and $82,080 at which over 40,000 BTC and 51,000 BTC have been accumulated respectively.

In the advent of any downtrend, both price levels are to offer short-term support and prevent a further price fall. With a market cap of $1.66 trillion, Bitcoin remains the largest digital asset accounting for over 60% of the crypto market cap.