Ethereum (ETH) Consolidates Within Tight Range As Key Support Level Forms – Details

Ethereum (ETH) prices have surged by over 3% in the past day in line with a bullish upswing across the broader crypto market. However, Ethereum on-chain data reveals the altcoin has stumbled in a range-bound market hinting at a potentially prolonged sideways movement.

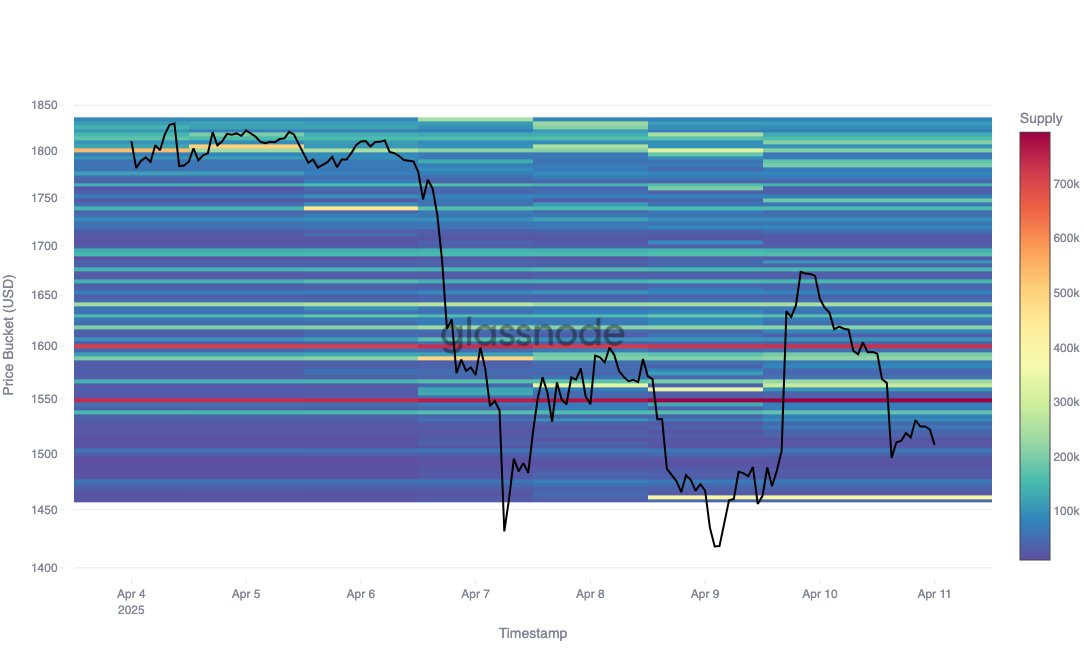

Ethereum Trapped In $1,548 – $1,599 Range – Glassnode

In a recent post on X, prominent blockchain analytics firm Glassnode reports that Ethereum is trading in a tight range between $1,548 and $1,599. This development is revealed by the asset’s cost basis distribution (CBD), which shows the various price levels at which current ETH holders bought their coins.

CBD is an important on-chain metric used to identify potential support or resistance levels based on the accumulation levels seen at price zones. According to Glassnode, a combined 1.53 million ETH, valued at $2.4 billion, was acquired between $1,548 and $1,599 indicating a high level of investor interest at these price regions.

In particular, 793,900 ETH currently in circulation was purchased at $1,548, ultimately transforming this price floor into a major support zone for the current Ethereum price. Meanwhile, 732,400 ETH is held by investors at $1,599 representing a significant price barrier to any upward price movement.

Interestingly, Ethereum has tested both price zones over the past day failing to produce either a price breakout or breakdown. Considering the accumulation level at both prices, the altcoin might maintain a range-bound movement barring the introduction of a market catalyst. Interestingly, such price behavior would align with the broader market uncertainty amidst unstable macroeconomic factors and tightening liquidity conditions.

Important Ethereum Support Forms At $1,461

In other developments, Glassnode also notes that Ethereum bulls are building a critical support zone at $1,461 at which 380,000 ETH, valued at $595.8 million have been acquired. In the case of any breakdown from the current consolidation zone, this price level is expected to act as the next major support preventing any further downside. However, a daily price close below $1,461 could cause ETH to trade as low as $1,400 or $1,200.

At the time of writing, Ethereum trades at $1,562 reflecting a 3.35% gain in the past 24 hours. However, the ETH market remains in a deep corrective phase with 14.56% and 18.45% losses in the last seven and thirty days, respectively. Meanwhile, the asset’s daily trading volume has declined by 34.06%, indicating a fall in market participation and a potential reversal of the recent rally, which would allow Ethereum to maintain a range-bound movement.