Onyxcoin (XCN) Rockets Past $0.01 Barrier as Buy Orders Flood the Market

Onyxcoin has surged by nearly 30% in the past 24 hours, riding the wave of a broader crypto market rally.

But beyond the market-wide momentum, on-chain data suggests that XCN’s spike, its strongest in over a month, is driven by genuine demand for the altcoin.

Onyxcoin Rallies, But There Is a Catch

XCN’s double-digit rally has been accompanied by a surge in its daily trading volume. This totals $128 million at press time, rocketing 480% over the past day.

XCN Price/Trading Volume. Source: Santiment

XCN Price/Trading Volume. Source: Santiment

When an asset’s price and trading volume spike simultaneously, it signals strong market interest and momentum. This means more participants are actively trading XCN and validating its price movement.

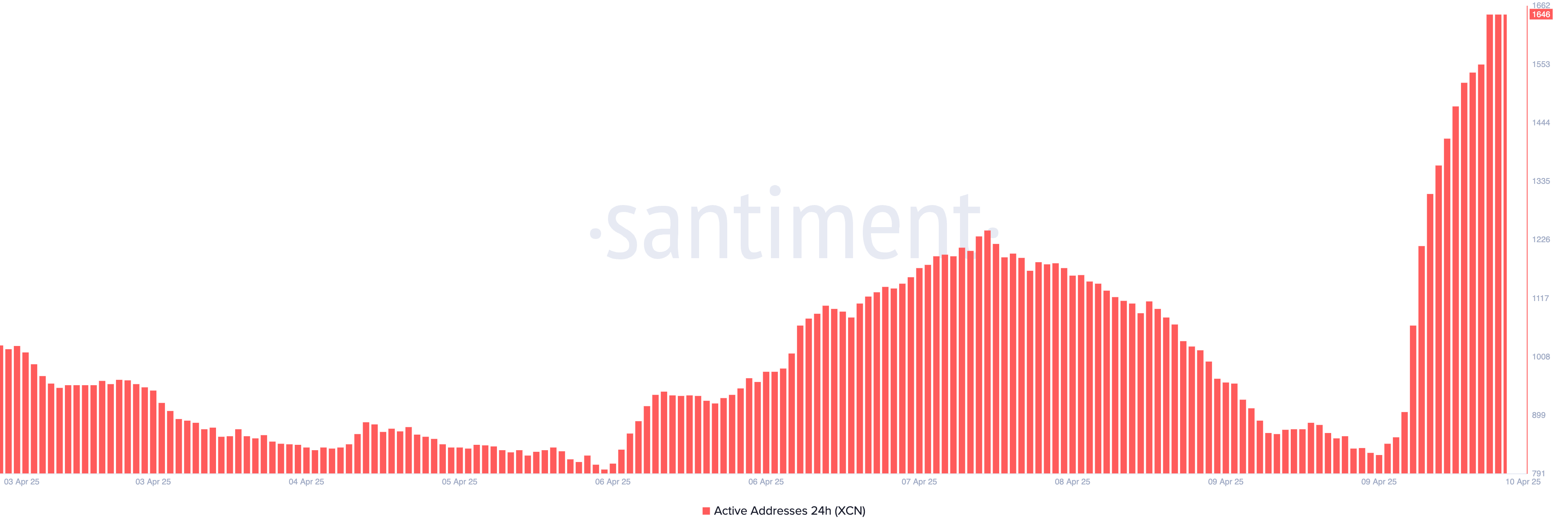

Moreover, the daily count of active addresses that have traded XCN today has climbed to a 60-day high of 1,646.

XCN Active Addresses. Source: Santiment

XCN Active Addresses. Source: Santiment

This spike in active addresses reflects growing retail and possibly institutional interest in XCN. More wallets transacting the token typically suggests broader network participation and confidence, which can serve as a strong bullish signal for the asset.

However, not all traders share this bullish sentiment. In the XCN futures market, the outlook is persistently bearish, as reflected by the token’s negative funding rate. This is at a two-month low of -0.18% at press time.

XCN Funding Rate. Source: Coinglass

XCN Funding Rate. Source: Coinglass

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures to keep the contract price in line with the spot price.

When an asset’s funding rate is negative like this, short traders pay long traders. This indicates bearish sentiment and that more XCN traders are betting on the price to fall.

XCN Clears Key Barrier as Accumulation Grows — Is $0.015 Next?

Apart from the broader market recovery, the price rally is also supported by a visible uptick in on-chain user engagement, signaling that XCN traders are not just following hype but are actively accumulating.

On the daily chart, XCN has broken above the crucial $0.01 resistance level—a price point it struggled to break for two weeks. If the rally persists, XCN’s price could climb to $0.015, a high it last reached on March 5.

XCN Price Analysis. Source: TradingView

XCN Price Analysis. Source: TradingView

However, if market participants begin profit-taking, XCN could shed its recent gains and fall below the $0.011 support toward $0.0075.