Binance to delist BADGER, BAL, 12 more tokens on April 16

- Binance will delist 14 tokens on April 16 following a successful vote and standard delisting processes.

- TROY, SNT, and UFT top Binance’s first batch of the vote to delist results.

- Binance token delisting will impact futures, margin, loan and simple earn services.

- Binance users cast 103,942 votes, with 10,262 marked invalid and 93,680 deemed eligible.

- The crypto market capitalization recovers to $2.596 trillion after a gruesome sell-off over the weekend and Monday.

Binance, the largest cryptocurrency exchange by daily traded volume, is preparing to delist 14 tokens from the platform following the release of the “first batch of vote to delist results.” According an announcement made on Tuesday, the tokens to face the axe include BADGER, Balancer (BAL), Beta Finance (BETA), Cream Finance (CREAM), Cortex (CTXC), Aaelf (ELF), FIRO, Kava Lend (HARD), NULS, Prosper (PROS), SNT (SNT), TROY, UniLend (UFT) and VIDT DAO (VIDT).

How Binance selected the tokens

Binance follows a comprehensive evaluation framework to select the tokens for delisting. Some metrics followed by the exchange include the vote to delist results, the team’s commitment to the project, development activity, liquidity and trading volume. Other factors considered include the network’s safety, community engagement, the team’s responsiveness, Binance’s periodic due diligence requests and evidence of unethical or fraudulent activities.

The exchange also considers the evolving regulatory landscape and requirements, transparency, questionable or unjustified increases in the token supply, and the level of changes to the project’s core team members and community sentiments.

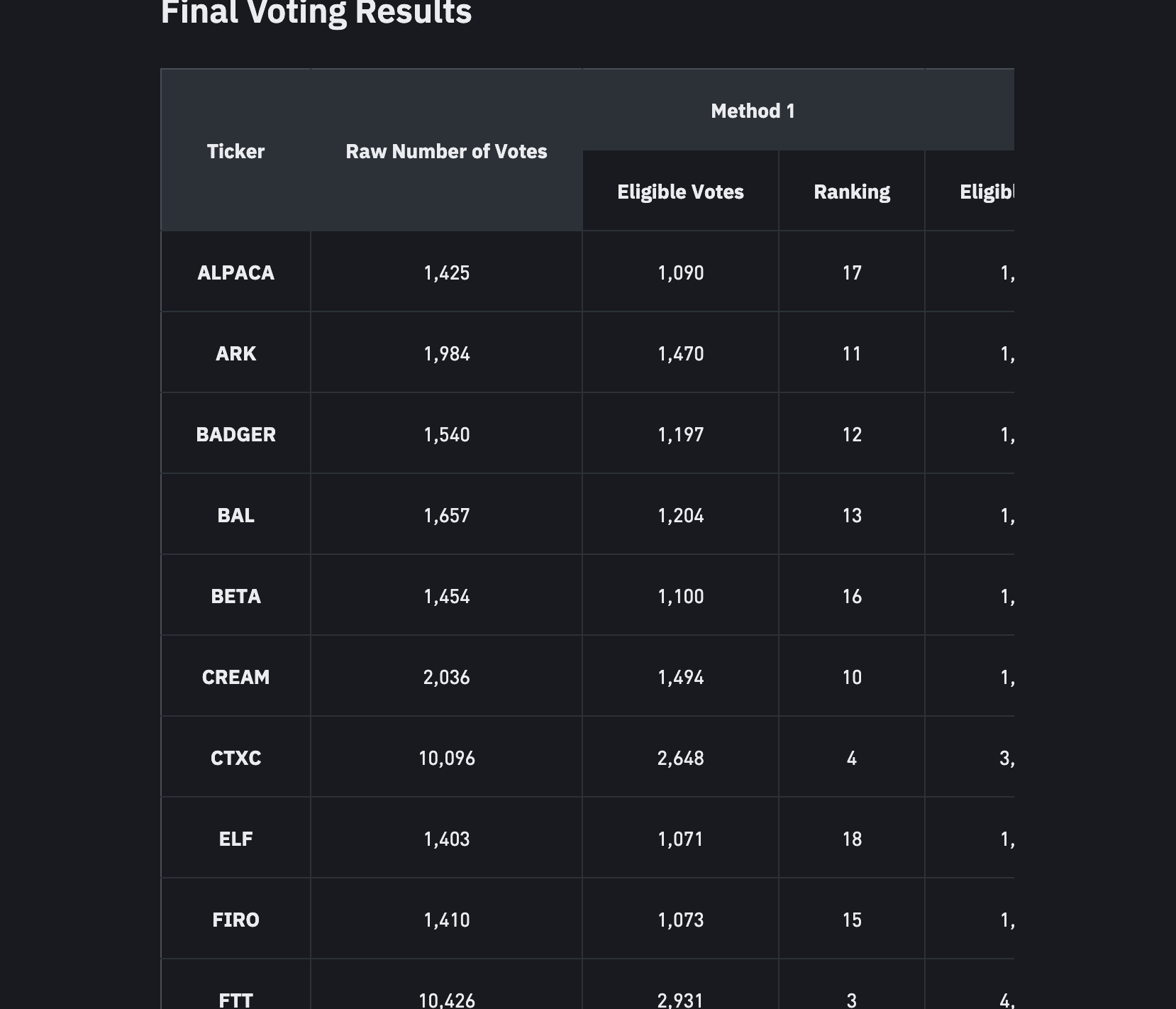

Binance reported that 24,141 participants cast 103,942 votes in total. These votes were subjected to a rigorous evaluation based on fraudulent activities, artificial voting conducted via an Internet Protocol (IP) and other unfair behaviours. Of the total votes, 93,680 were deemed eligible, leaving 10,262 invalid votes. The chart highlights the results.

Binance vote to delist results | Source: Binance

Binance to remove key services for delisted tokens

Binance users should be aware of the 14 tokens being delisted, including BADGER, BAL, BETA, CREAM, CTXC, ELF, FIRO, HARD, NULS, PROS, SNT, TROY, UFT, VIDT. Spot trading pairs for these tokens will be halted on April 16, with all orders automatically purged as they close. Users have been requested to update or cancel their trading bots to avoid possible losses. Binance is expected to remove support for spot copy trading.

Key account information, including valuations, will be removed for the tokens being delisted. Users must uncheck the “Hide Small Balances” box to view their assets. Moreover, deposits will not be credited to user accounts after April 16 at 03:00 UTC. Binance will cease support for withdrawals at the same time. On the other hand, Binance may swap token balances for affected users, but there is no guarantee.

Binance Futures is set to close all positions and automatically settle the tokens on April 14 at 09:00 UTC. Users should close their open positions to prevent automatic settlement.

Simple Earn, a feature that allows investors to provide liquidity and earn interest on idle assets, will also be removed. Dual investment, mining pool, loan services, and Binance Margin will no longer be available for the tokens.

Crypto market rebounds after tariff sell-off

The cryptocurrency market changed course during the Asian session on Tuesday, paving the way for widespread recoveries across various asset classes, including Bitcoin (BTC) and altcoins. BTC is back above $79,000 but appears weak and unlikely to break above $80,000 in the short term, especially with reciprocal tariffs expected to kick in on Wednesday.

As reported by Fxstreet, meme coins like Fartcoin and decentralized finance (DeFi) tokens like Telcoin soared in double digits gains. The crypto market capitalization is up 1.9% to $2.596 trillion at the time of writing on Tuesday.