Why Did MicroStrategy Pause its Bitcoin Acquisitions Last Week?

Strategy (formerly MicroStrategy) did not buy any Bitcoin or sell any common stock this week, breaking a long-running streak. The firm officially disclosed that it has $5.91 billion in unrealized losses due to downturns in the crypto market.

Two likely scenarios explain this pause: Strategy is either waiting for more favorable market conditions or is forced into caution by these losses. Either way, the uncertainty may signal further apprehension among institutional investors.

MicroStrategy’s Bitcoin Purchase Pause: Cautious Signal or Liquidity Move?

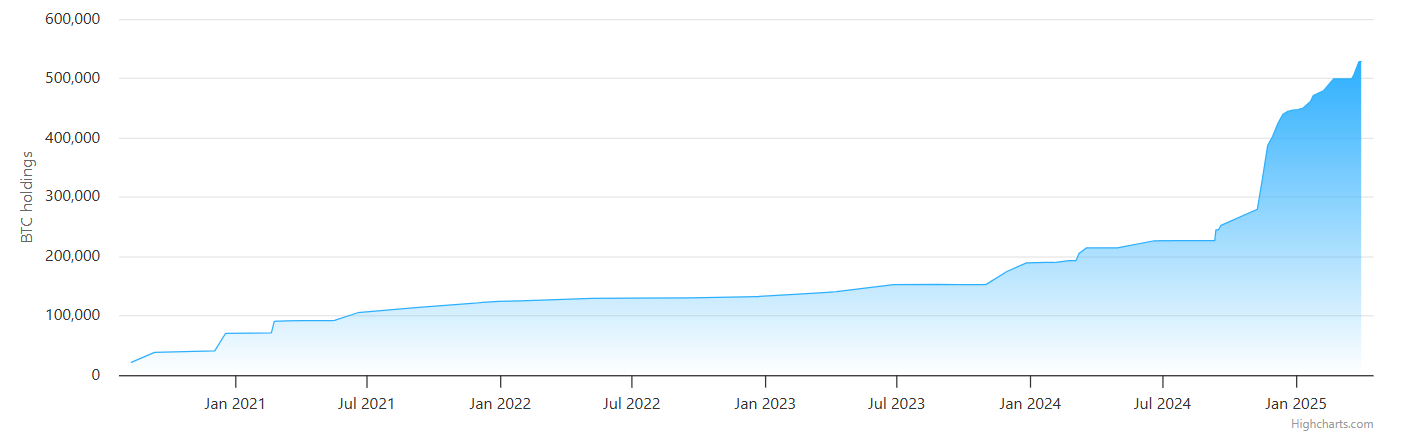

Since Michael Saylor directed Strategy (formerly MicroStrategy) to start acquiring Bitcoin, it has become one of the world’s largest BTC holders. So far, it’s been a major purchaser in 2025, acquiring around $2 billion in Bitcoin on two occasions.

However, according to its most recent Form 8-K, Strategy bought zero BTC last week and didn’t sell any stock, either.

This isn’t the first interruption in Strategy’s Bitcoin purchases this year; it also paused acquisitions in February. Unlike that incident, this time feels substantially different due to fears of a US recession.

The pause in Bitcoin buying may suggest that Strategy’s management is taking a wait-and-see approach amid ongoing market volatility, possibly indicating that they believe Bitcoin could bottom out further before resuming purchases.

Billions have been liquidated from crypto and TradFi alike, and corporate Bitcoin holders have suffered serious losses.

MicroStrategy Bitcoin Holdings Over Time. Source: Bitcoin Treasuries

MicroStrategy Bitcoin Holdings Over Time. Source: Bitcoin Treasuries

The firm may also be trying to break its historic streak of consecutive purchases to avoid further downside risk until clearer market trends emerge.

However, a few prominent voices are taking a much more critical approach. The same Form 8-K shows that Strategy currently has $5.91 billion in unrealized losses in its Bitcoin holdings. There were already concerns about the firm’s liquidity, tax obligations, and over-leveraged debts.

MSTR Stock Price Chart. Source: Google Finance

MSTR Stock Price Chart. Source: Google Finance

Some community members are wondering how Saylor can avoid a crisis:

“Michael Saylor’s average BTC cost basis is ~$67,500. A 15% drop puts MicroStrategy deep in the red. That’s the thin line between ‘visionary CEO’ and ‘leveraged lunatic with a God complex,'” claimed Edward Farina via social media.

What’s Next for Strategy?

Essentially, Strategy serves as a major pillar of confidence in Bitcoin. If the firm sells, the market will notice. The crypto ecosystem carefully documents minor discrepancies in the firm’s BTC purchasing strategy, and a sale would be highly bearish.

Meanwhile, firms are already inventing novel ETF tools to short the company, praying for its collapse. What’s the best path to move forward?

So far, Saylor has been quiet about these market turns. MicroStrategy may be biding its time, planning to pull out another huge Bitcoin purchase whenever the market bottoms out.

It may also be paralyzed, unable to act due to its debt crisis and unrealized losses. For now, the uncertainty may signal broader apprehension among institutional investors.

This cautious stance may signal broader apprehension among institutional investors regarding current crypto market conditions, hinting at a potential pause before a renewed accumulation phase if market fundamentals improve.