MMA Star Conor McGregor’s REAL Token Draws Backlash Over Structure and Execution

Conor McGregor, the former UFC champion, has entered the crypto scene with the launch of a new memecoin dubbed REAL.

Despite the star power behind it, REAL is off to a sluggish start, struggling to attract investor interest in a memecoin market that is still reeling from recent scandals.

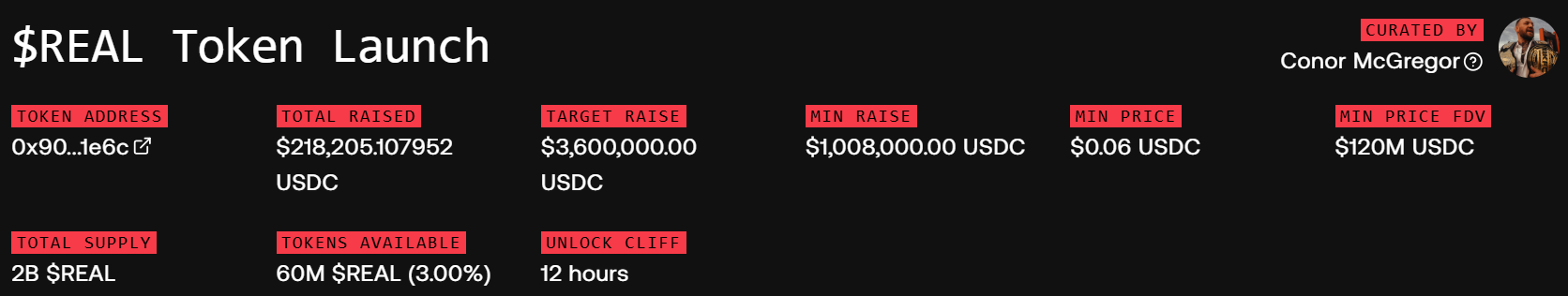

Conor McGregor’s REAL Token Raises Just $218,000

Announced on April 5, McGregor unveiled his plans to disrupt the digital asset space, claiming he had already changed the fight, whiskey, and stout industries.

“I changed the FIGHT game. I changed the WHISKEY game. I changed the STOUT game. Now it’s time to change the CRYPTO game. This is just the beginning. This is REAL,” McGregor announced on X.

His latest move involves a partnership with Real World Gaming DAO to launch REAL. The token promises staking rewards and governance rights through a decentralized autonomous organization.

According to the project’s website, the team opted for a sealed-bid auction model to launch the token, aiming to prevent bot manipulation and create fairer pricing.

Under this system, participants submitted bids using USDC. Successful bidders would receive REAL tokens based on a clearing price, while those who didn’t meet the mark would be refunded.

“The auction will be open for 28 hours, after which a single clearing price will be determined. Tokens will be locked for 12 hours after auction close to facilitate a snipe-free deployment of on-chain liquidity. Proceeds from the auction will seed this pool and fund the DAO treasury,” the project added.

However, the community’s response to the project has been underwhelming. The team aimed to raise $3.6 million, with a minimum threshold of $1 million. As of press time, the auction has raised just $218,000, far below expectations.

REAL Token Fundraise. Source: REAL Website

REAL Token Fundraise. Source: REAL Website

Several issues appear to be fueling investor hesitation. Critics have called out the token’s short unlock window, warning that it creates ideal conditions for rapid sell-offs.

Others raised concerns about the project’s use of third-party logos on its site, hinting at misleading promotional tactics.

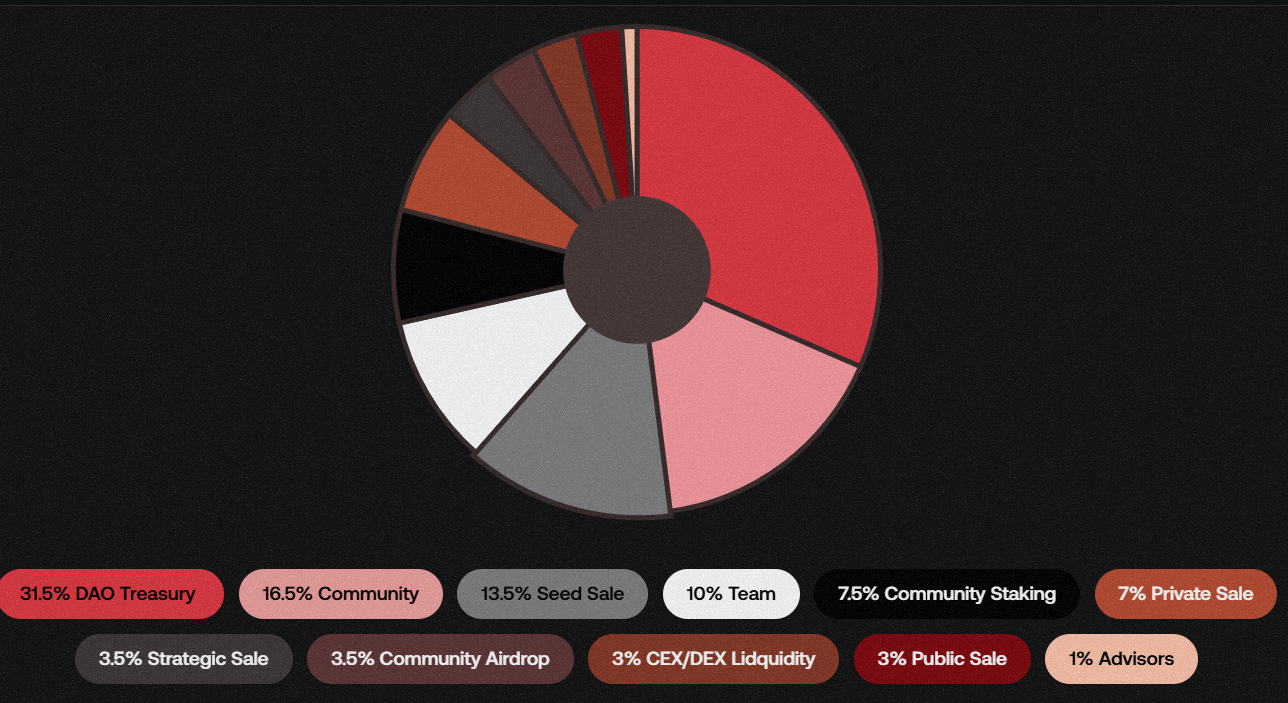

Moreover, community feedback about the project has also been overwhelmingly negative. Many users labeled the tokenomics as flawed and accused the team of focusing on short-term hype rather than sustainable value.

“If you’re buying REAL token, prepare to get dumped on. The tokenomics are absolute trash, and the unlock cliff is only 12 hours. You’re essentially giving your money away if you buy this token,” Crypto Rug Muncher wrote.

Conor McGregor’s REAL Token Tokenomics. Source: REAL Website

Conor McGregor’s REAL Token Tokenomics. Source: REAL Website

Meanwhile, the dismal launch reflects broader exhaustion in the meme coin sector, which has been rattled by recent scandals involving other celebrity-backed tokens.

Tokens tied to Donald Trump and Melania, for instance, have seen sharp declines that have caused investors significant losses.

“Celebrity coins like McGregor’s REAL and Trumps’ are toxic for crypto! Driven by hype, they lack utility, $Trump crashed 81%, $Melania 92%. These [tokens] hurt investors and crypto’s reputation. We need utility tokens for real value and growth,” Maragkos Petros, the founder of MetadudesX said on social media platform X.