Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

Despite a widespread weekly gain in the crypto market, Chainlink (LINK) remains under significant bearish pressure printing losses across multiple time frames. Since hitting a local price peak of $29.28 in December, the altcoin has slipped into a downtrend losing over 56% since then. Amid this negative performance, top crypto analyst Ali Martinez postulates LINK could soon experience some short-term price gain.

LINK Recovery Depends On Critical Trendline Support

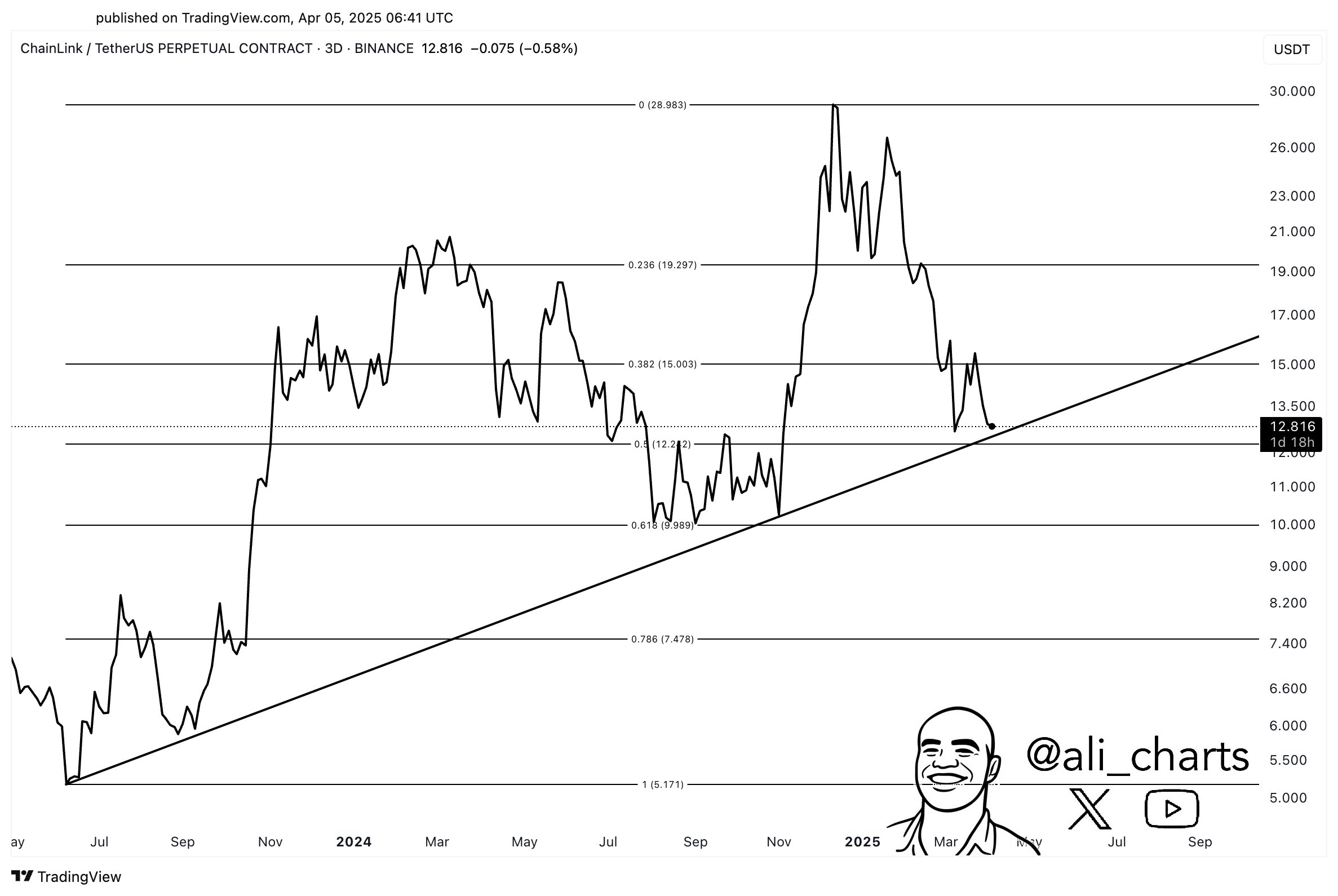

In a recent post on X, Martinez shares a positive technical outlook on LINK hinting the altcoin is likely to experience an upswing. This price forecast is based on a crucial ascending trendline that has acted as price support since mid-2023, ensuring a consistent formation of higher lows and higher highs.

Based on the trading chart by Martinez, Chainlink is currently heading for a retest with the identified trendline near the 0.5 Fibonacci retracement level at $12.00. If LINK bulls can induce a sufficient surge in demand at this level, the following price bounce could ignite a bullish reversal. Looking at historical price patterns, such a price rally could drive Chainlink’s price to around $19, which represents the next resistance zone.

In the presence of robust buying pressure, the altcoin could even rise as high as $30 suggesting a potential 147% price increase on current market prices. On the other hand, a failure to stay above $12.00 would cause an initial price decline to around $10.00, with the potential to trade as low as $5.00.

Chainlink Integrated Into PayPal’s Ecosystem

In other news, prominent American payment platform PayPal Holdings has announced the inclusion of Chainlink in its crypto offerings. In a statement released on April 4, PayPal stated that users will now be able to buy, hold, send, and receive Chainlink and Solana (SOL) on both their PayPal and Venmo wallets.

This development marks a significant step in the mainstream integration of LINK which is crucial to driving token demand in the future. In addition to both tokens, PayPal also offers users access to Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Bitcoin Cash (BCH).

At press time, LINK continues to trade at $12.91 reflecting a 0.62% decline in the past 24 hours. On larger time frames, the token maintains a bearish form with losses of 5.03% and 21.81% in the past seven and thirty days respectively.

According to data from Coincodex, investor sentiments in the LINK market remain highly bearish with a Fear & Greed Index of 26 signaling near-extreme fear. However, the analysts at this firm foresee a price rebound similar to Martinez’s with a forecast of $15.32 in five days and $17.46 in a month.