Bitcoin Price Correlation with M2 Money Supply Signals a Bullish Q2

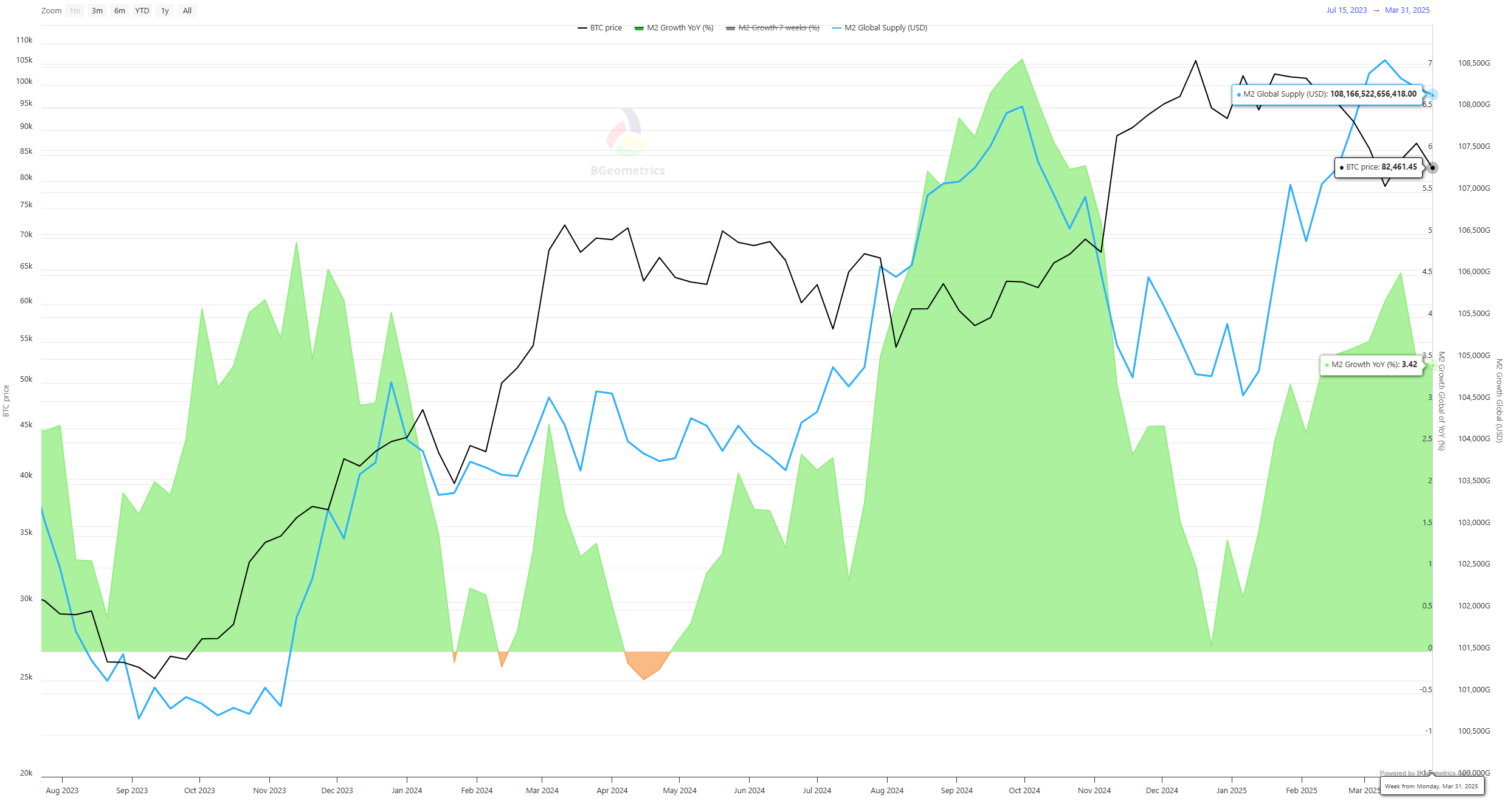

The global M2 money supply has surged to an all-time high of $108.4 trillion, raising fresh questions about Bitcoin’s next move.

The milestone comes amid escalating economic uncertainty following former President Donald Trump’s new “Liberation Day” tariffs and China’s swift retaliatory measures, which together have roiled global markets.

What is M2 and Why Does It Matter for Bitcoin?

Despite the extreme volatility over the past two weeks, Bitcoin’s average value has remained almost unchanged.

Analysts claim that Bitcoin’s latest volatility reflects macroeconomic fears and fluctuating long/short ratios – but the largest cryptocurrency is nowhere near a bear market.

This is largely due to the historical correlation between rising M2 levels and significant Bitcoin rallies.

M2 is a broad measure of a country or region’s money supply. It includes physical cash, checking and savings deposits, and other liquid assets that can be quickly converted to cash.

Bitcoin and M2 Money Supply Chart In the Past Year. Source: BGeometrics

Bitcoin and M2 Money Supply Chart In the Past Year. Source: BGeometrics

When M2 increases, it typically signals greater liquidity in the financial system. It simply means more money that often seeks returns in riskier assets such as equities, real estate, or cryptocurrencies like Bitcoin.

Past surges in the M2 money supply have preceded major Bitcoin rallies. Following the COVID-era stimulus programs in 2020-2021, the US M2 supply jumped by over 25%.

This correlated with Bitcoin’s rise from under $10,000 in mid-2020 to an all-time high of over $69,000 by November 2021. Analysts point to a similar pattern today, albeit with a lag.

“Market proponents say that Trump’s tariffs are primarily a negotiation strategy, and their effect on businesses and consumers will remain manageable. Adding to the uncertainty are the inflationary pressures that could challenge the US Federal Reserve’s rate-cutting outlook. Also, resolving the debt ceiling remains a pressing issue, as the Treasury currently relies upon ‘extraordinary measures’ to meet US financial obligations. The exact timeline for when these measures will be exhausted is unclear, but analysts anticipate they may run out after the first quarter,” said Maksym Sakharov, Co-Founder of WeFi Deobank.

Also, Bitcoin’s price often trails global M2 growth by roughly two months.

With M2 accelerating since late February and the current spike taking it to its highest level ever, market watchers suggest that Bitcoin could see a delayed but strong upside if liquidity continues to expand.

However, macroeconomic headwinds could temper near-term gains. Trump’s tariff shock and China’s tit-for-tat response have already triggered the steepest Wall Street losses in five years.

Investors may delay allocating capital to high-volatility assets until trade tensions stabilize.

Still, with M2 surging and Bitcoin supply capped, the setup for a renewed bullish move remains in place. That is if historical patterns hold and markets regain confidence.