Standard Chartered Predicts Bitcoin Likely to Break $88,500 This Weekend

Standard Chartered has predicted that Bitcoin (BTC) will likely break above $88,500 this weekend following a strong performance in the tech sector.

The bank’s Global Head of Digital Assets Research, Geoff Kendrick, shared these expectations in an exclusive with BeInCrypto.

What Standard Chartered Says About Bitcoin This Weekend

In an email to BeInCrypto, Kendrick pointed to recent price action among major technology stocks, including Microsoft, as an indicator of Bitcoin’s short-term trajectory.

“Strongest performers were MSFT and BTC. Same again so for today in Bitcoin spot and tech futures,” Kendrick said.

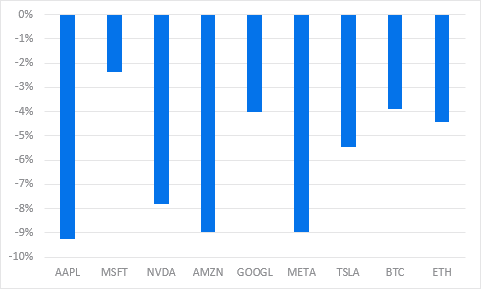

Magnificent 7 Price Performance vs. Bitcoin and ETH. Source: Standard Chartered

Magnificent 7 Price Performance vs. Bitcoin and ETH. Source: Standard Chartered

He explained that a decisive break above the critical $85,000 level appears likely post-US non-farm payrolls. The Standard Chartered executive explained that such an outcome would pave the way for a return to Wednesday’s pre-tariff level of $88,500.

However, China’s retaliatory tariffs could increase market uncertainty, driving prices down in the short term. This volatility might dampen investor confidence, overshadowing any weekend gains.

Kendrick’s assertions come ahead of the much-anticipated US employment report, Non-Farm Payrolls (NFP). The report would present a comprehensive labor market update, including jobs added, the unemployment rate, and wage growth.

A strong report could bolster faith in the economy, particularly if it comes in higher than the previous reading of 151,000 jobs. This is more so if accompanied by a steady 4.1% unemployment rate. Such an outcome could curb crypto gains if the dollar rallies.

Conversely, a disappointing tally, potentially below the median forecast of 140,000 jobs with unemployment ticking beyond 4.1%, could ignite recession worries. This would send investors flocking to Bitcoin and crypto.

Standard Chartered may be pivoting to the latter outcome, with Kendrick emphasizing Bitcoin’s growing role as a key asset.

“Bitcoin is proving itself to be the best of tech upside when stocks go up and also as a hedge in multiple scenarios…I argued that Bitcoin trades more like tech stocks than it does gold most of the time. At other times, and structurally, Bitcoin is useful as a TradFi hedge,” he added.

Standard Chartered has increasingly highlighted Bitcoin’s strategic importance within financial markets. The bank recently identified Bitcoin and Avalanche (AVAX) as likely beneficiaries of a potential post-Liberation Day crypto surge. BeInCrypto reported the forecast, which now aligns with the latest one, that institutional investors could be preparing for a market upswing.

Additionally, the bank has positioned Bitcoin as a growing hedge against inflation. It argued that its limited supply and decentralized nature make it an attractive alternative to traditional safe-haven assets.

Standard Chartered Calls to HODL Bitcoin

Amid Bitcoin’s growing role in traditional finance (TradFi), Kendrick advised investors to maintain their holdings.

“Over the last 36 hours, I think we can also add ‘US isolation’ hedge to the list of Bitcoin uses,” he added.

This suggests that Bitcoin could serve as a protective asset in geopolitical and macroeconomic uncertainty.

Meanwhile, the BTC/USDT daily chart shows a critical technical setup, with Bitcoin’s price currently trading around $82,643. A former support level of $85,000 now stands as resistance, limiting the pioneer crypto’s upside potential. The supply zone near $86,508 adds further selling pressure.

Bitcoin (BTC) Price Performance. Source: TradingView

Bitcoin (BTC) Price Performance. Source: TradingView

On the downside, a key demand zone between $77,500 and $80,708 provides support. Despite price consolidation, the Relative Strength Index (RSI) is forming higher lows, indicating sustained growing momentum and a potential reversal.

If BTC successfully reclaims $85,000, it could trigger a move toward $87,480. However, to confirm the continuation of the uptrend, BTC must record a daily candlestick close above the midline of the supply zone at $86,508.

The bullish volume profile (blue) supports this thesis, showing that bulls are waiting to interact with the Bitcoin price above the midline of the supply zone.

Failure to breach the immediate resistance at $85,000 might lead to a retest of the demand zone, potentially breaking lower. In such a directional bias, a break and close below the midline of this zone at $79,186 could exacerbate the downtrend.