XRP finds new lifeline as Coinbase Derivatives eyes XRP futures on April 21

- Coinbase Derivatives files with the CFTC to self-certify XRP futures, hinting at going live on April 21.

- XRP reclaims $2 support after ‘Liberation Day’ tariffs triggered a slight dip to $1.96.

- Technical indicators indicate a potential bullish turnaround, while Santiment’s MVRV sends a buy signal.

Ripple (XRP) price reclaims the $2.00 support level and trades at $2.06 at the time of writing on Friday in the wake of a drawdown to $1.96 during Thursday’s session. Traders continue to exercise caution after Trump’s tariffs hit 100 countries, as per a CryptoQuant report. Meanwhile, Coinbase Derivatives anticipates listing XRP futures later in April, allowing investors to seek exposure to one of the most liquid digital assets in the crypto industry.

Coinbase Derivatives files with the CFTC for XRP futures

Coinbase Derivatives, a subsidiary of Coinbase focusing on regulated futures trading, announced via an X post that it had submitted a self-certification application to the Commodity Futures Trading Commission (CFTC) to list XRP futures contracts. If approved, the exchange could go live with the futures contracts on April 21, 2025, adding to its growing list of regulated assets, including Bitcoin (BTC), Ethereum (ETH) and Solana (SOL), among others.

The application is monumental for XRP, a token directly linked to Ripple Labs, which was entangled in a four-year legal battle with the Securities and Exchange Commission (SEC). XRP has historically faced challenges with classification, but with the SEC dropping the lawsuit against Ripple in March 2025, the token could turn a new leaf, paving the way for more regulated investment vehicles such as exchange-traded funds (ETFs).

Following the futures contracts announcement, open interest surged 0.74% to $3.65 billion, according to Coinglass data. Rising open interest (OI) suggests that new positions are being opened in derivatives markets (futures/options). It is also indicative of growing market participation among traders and capital inflow.

XRP futures open interest

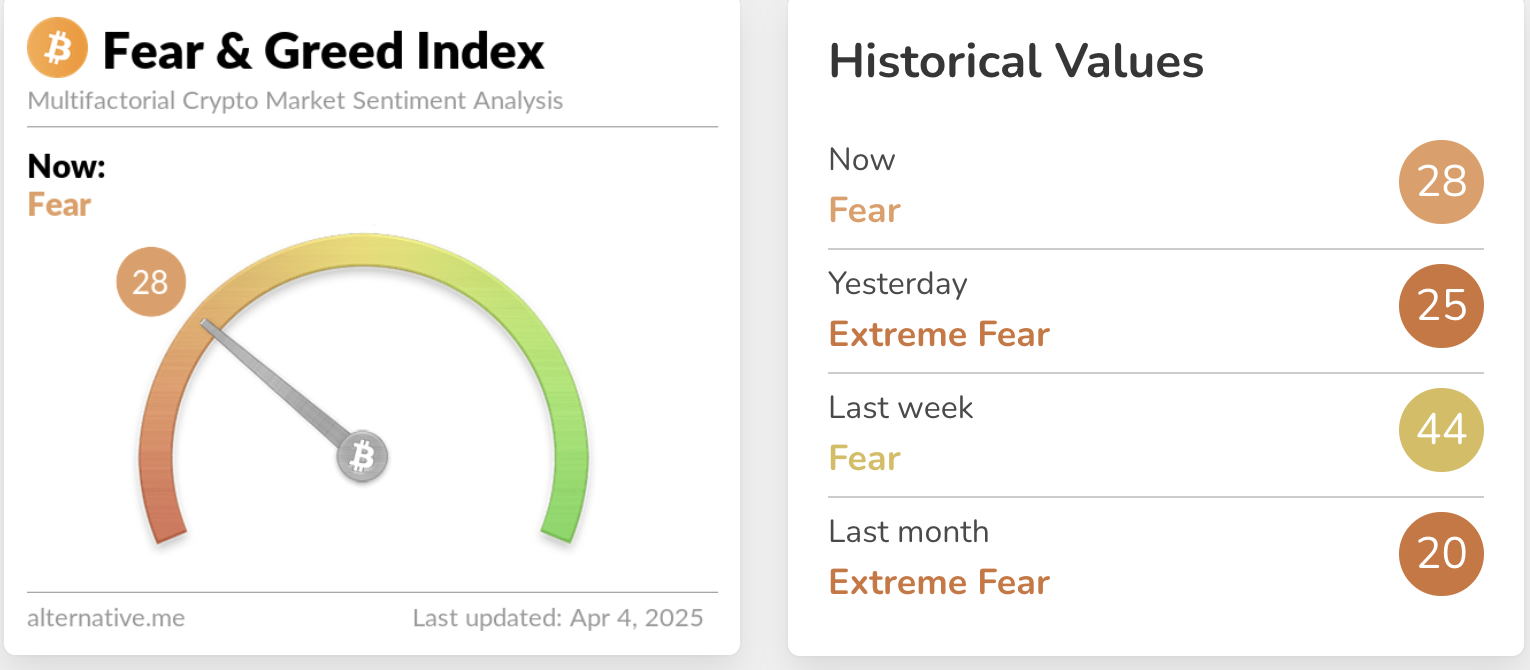

Despite the spike in OI, volatility could remain a major concern across the cryptocurrency market. The fear and greed index has recovered slightly from 25 (extreme fear) recorded on Thursday due to ‘Liberation Day’ tariffs to 28 at the time of writing. Risk-off sentiment tends to grip investors during such conditions, which could push XRP below its $2.00 support.

Crypto fear and greed index

XRP technicals could flip bullish on one condition

XRP sits above $2.00, a support that the token respected on February 28 and March 11, 2025. Traders will require confirmation that this level is strong enough to hold and limit downside exposure to book more long positions in the next few days.

The Relative Strength Index (RSI) is higher than the previous day’s low of 35. However, it must extend from 42 (its current position), above the trendline resistance, to validate a sustainable XRP recovery to $2.50 and $3.00, respectively.

XRP 4-hour chart

The Moving Average Convergence Divergence (MACD) stuck below the meanline points to the apparent sell-side pressure. However, traders should consider watching out for a confirmed buy signal if the MACD crosses above the moving average and starts moving aggressively upwards.

Investors may want to consider Santiment’s Market Value Realized Value (MVRV) ratio as a buy signal. In the chart below, the MVRV sits 27.44% below XRP’s intrinsic value.

[05.40.24, 04 Apr, 2025]-638793389571879690.png)

Santiment’s MVRV ratio

In other words, many investors are holding the asset at a loss and are unlikely to sell as they would realize a loss. As this may translate to reduced selling pressure, XRP bulls could find room to wiggle, breaking through and pushing for drastic recovery.

.