Ripple Unlocks $1 Billion in XRP as Bearish Momentum Builds

XRP is under pressure, down nearly 6% in the past 24 hours and teetering just above the $2 mark as bearish momentum builds. A $1.02 billion unlock from Ripple’s escrow has sparked fresh concerns about oversupply, with tokens moved to operational wallets possibly poised for distribution.

At the same time, network activity has collapsed 87% since mid-March and technical indicators like DMI and EMA lines suggest growing downside risk. With weakening trend strength and fading demand, XRP may struggle to hold key support levels unless a catalyst revives bullish sentiment.

Ripple Wallet Activity Sparks Fears

Onchain data shows that Ripple has unlocked 500 million XRP—worth around $1.02 billion—from its escrow account.

The tokens were moved from the “Ripple (27)” escrow address to two operational wallets, “Ripple (12)” and “Ripple (13),” potentially positioning them for distribution or sale.

While the escrow account still holds another 500 million XRP, the movement of such a large amount into accessible wallets often raises concerns about increased market supply. If Ripple sells a portion of these tokens, it could create short-term selling pressure on XRP’s price.

XRP DMI. Source: TradingView.

XRP DMI. Source: TradingView.

From a technical standpoint, XRP’s DMI chart is flashing bearish signals. The ADX, which measures trend strength, has sharply declined to 26.68 from 42.45 just two days ago, suggesting the recent trend is weakening.

Meanwhile, the +DI has dropped to 12.91, down from 22 yesterday—indicating a decline in bullish momentum. At the same time, the -DI has surged to 27.43 from 15.64, pointing to rising bearish pressure.

This shift in directional strength, combined with the large token unlock, suggests XRP may face further downside unless demand quickly absorbs the incoming supply.

XRP Network Activity Collapses 87%

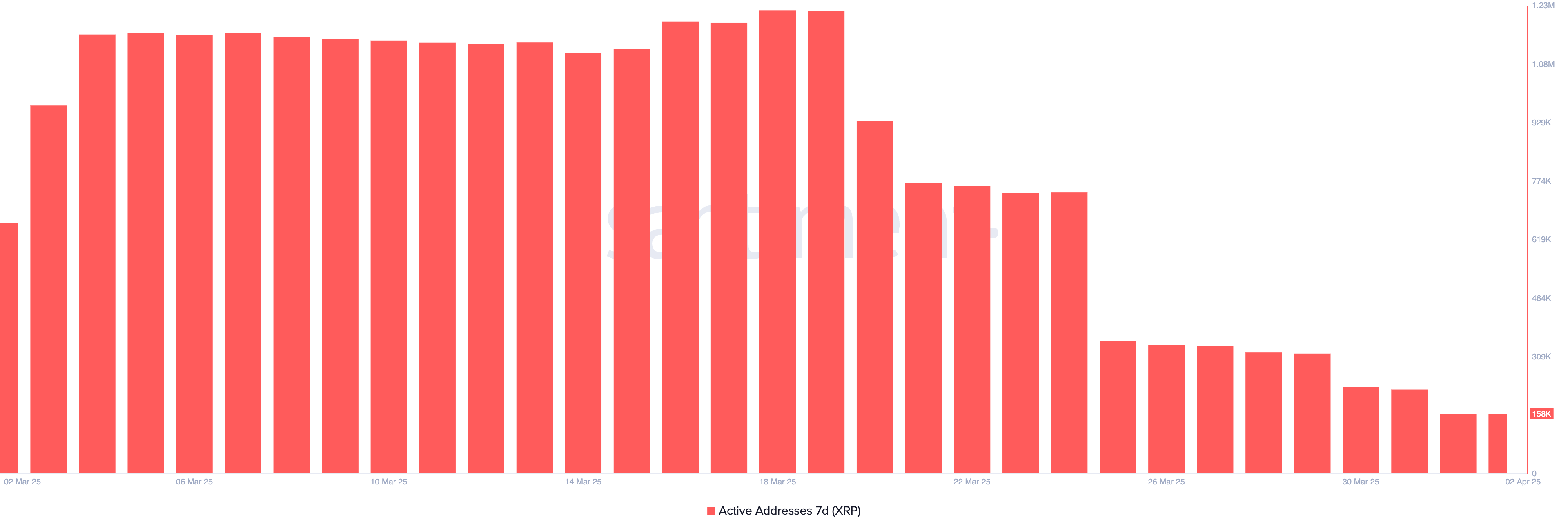

XRP’s network activity surged to record highs in March, with 7-day active addresses reaching an all-time peak of 1.22 million on March 18.

However, that momentum quickly faded, with the number now plummeting to just 158,000—an 87% drop in less than three weeks.

This dramatic reversal suggests that the recent spike in engagement may have been short-lived or event-driven rather than indicative of sustained adoption or growing user demand.

7-Day XRP Active Addresses. Source: Santiment.

7-Day XRP Active Addresses. Source: Santiment.

Tracking 7-day active addresses is a key on-chain metric, offering insight into how frequently a token’s network is being used. High activity can signal strong user interest and utility, often aligning with price support or rallies.

On the other hand, sharp declines in active addresses—like what XRP is now experiencing—can signal waning demand, decreasing network usage, and potential selling pressure.

With such a steep drop in activity, XRP’s price may struggle to find an upside unless new catalysts reignite user engagement.

XRP Faces Strong Downtrend, But Eyes Rebound If Key Levels Break

XRP’s EMA structure clearly reflects a strong ongoing downtrend, with short-term moving averages positioned well below the long-term ones and a wide gap between them—signaling persistent bearish momentum.

Unless bulls step in soon, XRP price may be on track to test support around $1.90, a key level that has held in the past.

XRP Price Analysis. Source: TradingView.

XRP Price Analysis. Source: TradingView.

A break below it could expose the asset to further downside toward $1.77.

However, if XRP manages to reverse the current trend and regain upward momentum, it could climb to challenge resistance at $2.06.

A successful breakout above that level might pave the way for a continued rally toward $2.22.