Tether adds to Bitcoin reserves with over $735 million withdrawals from the Bitfinex hot wallet

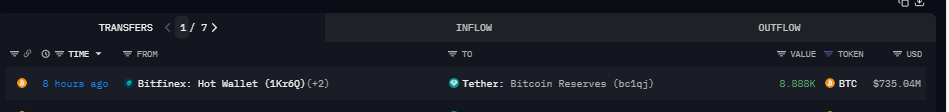

- Arkham intelligence data shows that Tether added 8,888 BTC worth $735 million from the Bitfinex hot wallet.

- The address currently holds 92,000 BTC, worth $7.65 billion, and is also the sixth-ranked BTC wallet address.

- This move is part of Tether’s strategy as it would regularly use 15% of the company’s profits to purchase Bitcoin to enhance its reserves.

Arkham intelligence data shows that Tether added 8,888 BTC worth $735 million from the Bitfinex hot wallet. The address currently holds 92,000 BTC, worth $7.65 billion, and is also the sixth-ranked BTC wallet address. This move is part of Tether’s strategy as it would regularly use 15% of the company’s profits to purchase Bitcoin to enhance its reserves.

Tether adds $735 million worth of BTC to its reserve

Arkham intelligence data shows that Tether, the company that issues the USDT stablecoin, withdrew 8,888 BTC worth $735 million from Bitfinex’s hot wallet on Tuesday, adding to its Bitcoin reserves. The firm’s Bitcoin reserve wallet currently holds $92,647 BTC, worth $7.65 billion, making it the sixth-largest Bitcoin wallet.

Tether’s BTC reserve transfer chat. Source: Arkham

This move is part of Tether’s strategy to allocate 15% of its net realized operating profits to regularly purchase Bitcoin to diversify and strengthen its reserves, including Gold and US Treasury bonds.

Such an event is generally a positive sign for Bitcoin. The withdrawals from an exchange’s hot wallet to a non-exchange address (like Tether’s reserve wallet) are often interpreted as a positive price signal because Bitcoin is no longer readily available for sale on the exchange, reducing selling pressure in the short term. Tether’s purchase also signals strong institutional demand for Bitcoin. At the time of writing on Tuesday, Bitcoin trades slightly higher by 0.77% at $83,170.