Black Swan Capitalist CEO Claims XRP’s Price Is Predetermined

Versan Aljarrah, CEO of Black Swan Capitalist, has stirred controversy on platform X by claiming that global financial institutions set XRP’s price long ago.

His statement has fueled intense debates in the crypto community. It also raises concerns about the transparency of the XRP market. Recent data highlights a major gap between its market value and real-world utility.

Controversial XRP Theory: Did Major Banks Fix Its Value?

Aljarrah argues that XRP’s price is not shaped by open-market trading. Many retail investors assume otherwise. He compares XRP’s pricing process to the pre-IPO phase in traditional finance. In this phase, hedge funds, banks, and financial institutions negotiate an asset’s price before it goes public.

He claims that JP Morgan, BlackRock, BIS, and the IMF participated in this process. However, he provides no concrete evidence to support this claim.

“In this case, the ‘pre-IPO’ phase for XRP has already occurred. The world’s biggest financial players have adopted XRP behind closed doors and have already agreed on its price for use in their systems,” Aljarrah said.

Aljarrah also claims that Ripple—the company behind XRP—has integrated its technology into central banks worldwide. This includes both major economies and smaller nations like Barbados and Caribbean countries. He believes global institutions have committed to using XRP as a bridge currency for cross-border transactions.

His view aligns with stakeholder capitalism, a model the World Economic Forum (WEF) promoted. In this model, major financial institutions and central banks shape the direction of the global economy.

Aljarrah further states that XRP’s price was “locked in” through private agreements before it became widely available to the public. He predicts XRP could reach three or even four-digit price levels, far beyond its current valuation of $2.08.

“Financial modeling and market projections suggest that the price could reach three to four-digit ranges, but this is still speculative based on the actual utility and the demand for XRP in the future global financial system,” Aljarrah predicted.

While some in the crypto space support Aljarrah’s theory, others argue that if institutions knew XRP’s predetermined price, they could have strategically placed low buy orders to accumulate more, disadvantaging retail investors.

“If institutions already know the pre-set price, it makes sense they’d place low buy orders to push the price down and accumulate XRP at retail’s expense. This isn’t just unethical—it contradicts the entire purpose of crypto,” Investor SVS commented.

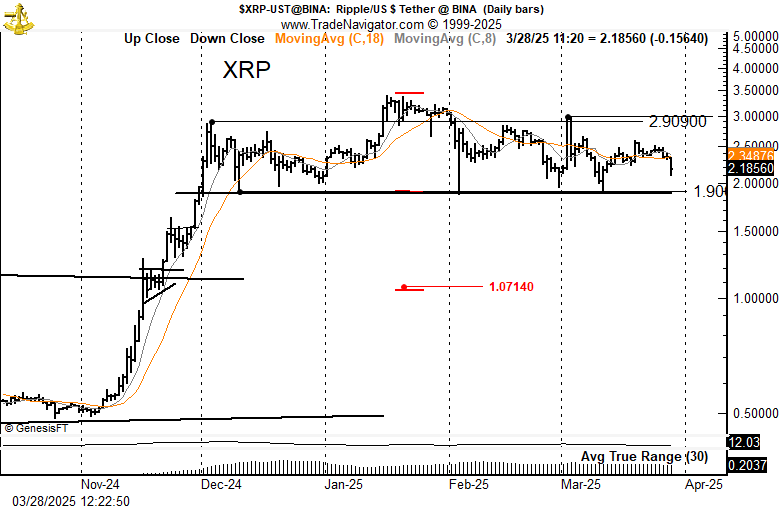

Veteran Trader Peter Brandt Predicts XRP Could Drop to $1

Other analysts hold opposing views. Veteran trader Peter Brandt predicts that XRP’s price could fall to $1 in the short term—far below Aljarrah’s expectations.

Peter Brandt’s XRP Price Prediction. Source: Peter Brandt.

Peter Brandt’s XRP Price Prediction. Source: Peter Brandt.

Meanwhile, a BeInCrypto report reveals that despite XRP’s $120 billion market cap, its network records less than $50,000 daily DEX trading volume. The XRP Ledger lacks sufficient nodes and validators compared to other leading blockchains.

On-chain researcher Aylo called XRP “the biggest financial scam the world has ever seen.”