SUI’s $642 million leads token unlocks this week

Cryptocurrency markets have over $642 million worth of digital assets planned for release during the period between March 31 through April 7, 2025.

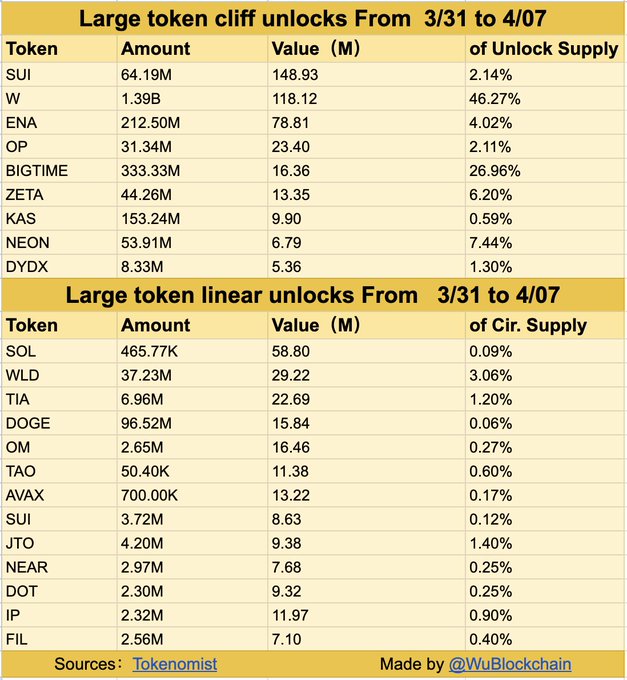

Tokenomist data shows these releases are split between single “cliff” one-time releases and regular “linear” releases distributed across various blockchain projects.

Cliff unlocks are led by SUI

SUI leads this week’s cliff unlocks with 64.19 million tokens valued at $148.93 million set to be released. This unlock represents 2.14% of SUI’s supply. Second in terms of value is the W token, which will release an enormous 1.39 billion tokens valued at $118.12 million. This unlock represents 46.27% of W’s unlock supply and is among the biggest percentage increases of major tokens this week.

ENA takes the third spot with 212.50 million tokens worth $78.81 million (4.02% of unlock supply). This is then followed by OP with 31.34 million tokens worth $23.40 million (2.11% of unlock supply). BIGTIME will unlock 333.33 million tokens worth $16.36 million, which is 26.96% of its unlock supply.

Some of the other significant cliff unlocks apart from SUI are ZETA (44.26 million tokens, $13.35 million, 6.20% of supply), KAS (153.24 million tokens, $9.90 million, 0.59% of supply), NEON (53.91 million tokens, $6.79 million, 7.44% of supply), and DYDX (8.33 million tokens, $5.36 million, 1.30% of supply).

The varying percentages of supply being unlocked suggest different potential market impacts across these tokens. As per the data, W and BIGTIME face the largest proportional increases in circulating supply at 46.27% and 26.96%, respectively.

Solana leads linear unlocks

Solana (SOL) remains at the top of the linear unlock space. According to the data, 465,770 SOL tokens worth $58.80 million are set for release over a period of time in the coming week. In spite of this large dollar amount, the unlock represents only 0.09% of the circulating supply of SOL.

Coming in second to SOL in the linear unlock category is Worldcoin (WLD), which will distribute 37.23 million tokens valued at approximately $29.22 million. This distribution represents 3.06% of WLD’s circulating supply. TIA comes in third with 6.96 million tokens valued at $22.69 million, representing 1.20% of its circulating supply.

A number of other top cryptocurrencies will also have linear unlocks throughout this time. Optimism (OM) will unlock 2.65 million tokens valued at $16.46 million (0.27% of supply), and meme favorite Dogecoin (DOGE) will have 96.52 million tokens valued at $15.84 million unlocked.

Avalanche (AVAX) will release 700,000 tokens worth $13.22 million (0.17% of supply), and TAO will unlock 50.40K tokens worth $11.38 million (0.60% of supply). There are smaller linear unlocks such as IP ($11.97 million), JTO ($9.38 million), SUI ($8.63 million), DOT ($9.32 million), NEAR ($7.68 million), and FIL ($7.10 million).

Interestingly enough, SUI is listed under both cliff and linear unlock types, with the total combined releases exceeding $157 million. The two unlock types have varying vesting schedules for different token allocations.

Linear unlocks typically create less immediate market pressure than cliff unlocks. This is because tokens are gradually released over time rather than becoming available all at once.

Less popular token unlocks

Beyond the headline-grabbing unlocks from major tokens, several smaller cryptocurrency projects are also releasing substantial portions of their token supply this week as per CoinMarketCap data.

GUNZ will unlock 604.5 million GUN tokens, though the token currently shows no price or market capitalization data. With no active trading yet visible, this initial distribution may establish baseline market conditions for the token.

Shockwaves (NEUROS) is also ahead in its unlock plan at 72.13% done. The token has a future release of 1.89 million NEUROS tokens equating to about $12,083.78. This comparatively small unlock accounts for 1.89% of the total locked supply for a token trading at $0.006382 currently.

Hooked Protocol (HOOK) is near the mid-point of its unlock process with 47.33% of the process complete. The impending release will unlock 8.33 million HOOK tokens worth $1.05 million.

The AC Milan Fan Token (ACM) has surpassed 52.79% of its unlock schedule. It will unlock 205,263 ACM tokens representing approximately $190,467 soon. This is equivalent to 1.03% of locked tokens for a project currently valued at $0.9279 per token.

MAXX AI (MXM) has completed 33.70% of its unlock process, and 19.71 million MXM tokens worth $32,019.42 are available for release. The smaller unlocks may then be subject to more pronounced price effects in relation to their size in the marketplace.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now