Donald Trump’s tariff policies set to increase market uncertainty and risk-off sentiment

- The Kobeissi Letter post warns that while markets see Trump's April 2 tariffs as the "end of uncertainty," Kobeissi expects increased volatility.

- The upcoming tariff policy and its implementation will likely create short-term headwinds for crypto markets, including Bitcoin, as they face heightened uncertainty, inflation concerns, and a risk-off market environment.

- FXStreet interviewed some crypto market experts regarding their views on how crypto markets would react to these tariff policies.

United States (US) President Donald Trump’s tariff policies are expected to escalate market uncertainty and risk-off sentiment, with the Kobeissi Letter’s post on X this week cautioning that while markets may view the April 2 tariffs as the "end of uncertainty," it anticipates increased volatility.

The crypto markets, including Bitcoin, will likely face short-term challenges as they grapple with heightened uncertainty, inflation concerns, and a risk-off market environment with the impending tariff policy and its implementation. To gain more insight into how crypto markets would react to these tariff policies, FXStreet interviewed some experts in the crypto markets.

Rising market uncertainty

According to The Kobeissi Letter post on X this week, markets expect Trump’s April 2 reciprocal tariffs day to be the “end of uncertainty,” but Kobeissi expects the exact opposite, which is why tech stocks are down over $400 billion this week.

The report explains the market drop, as shown in the graph below, after a Bloomberg report about Trump preparing auto tariffs early on Wednesday, reversing earlier optimism from a The Wall Street Journal (WSJ) report on tariff “leeway” on Monday.

NASDAQ chart. Source: Kobeissi Letter

Moreover, the report mentions that Barclays believes that the April 2 reciprocal tariffs imposed by President Trump will impact as many as 25 countries. The US sectors likely affected include autos, pharma, and semiconductors.

“We also expect countries to respond to these reciprocal tariffs, ramping up the trade war,” says the Kobeissi Letter’s X post.

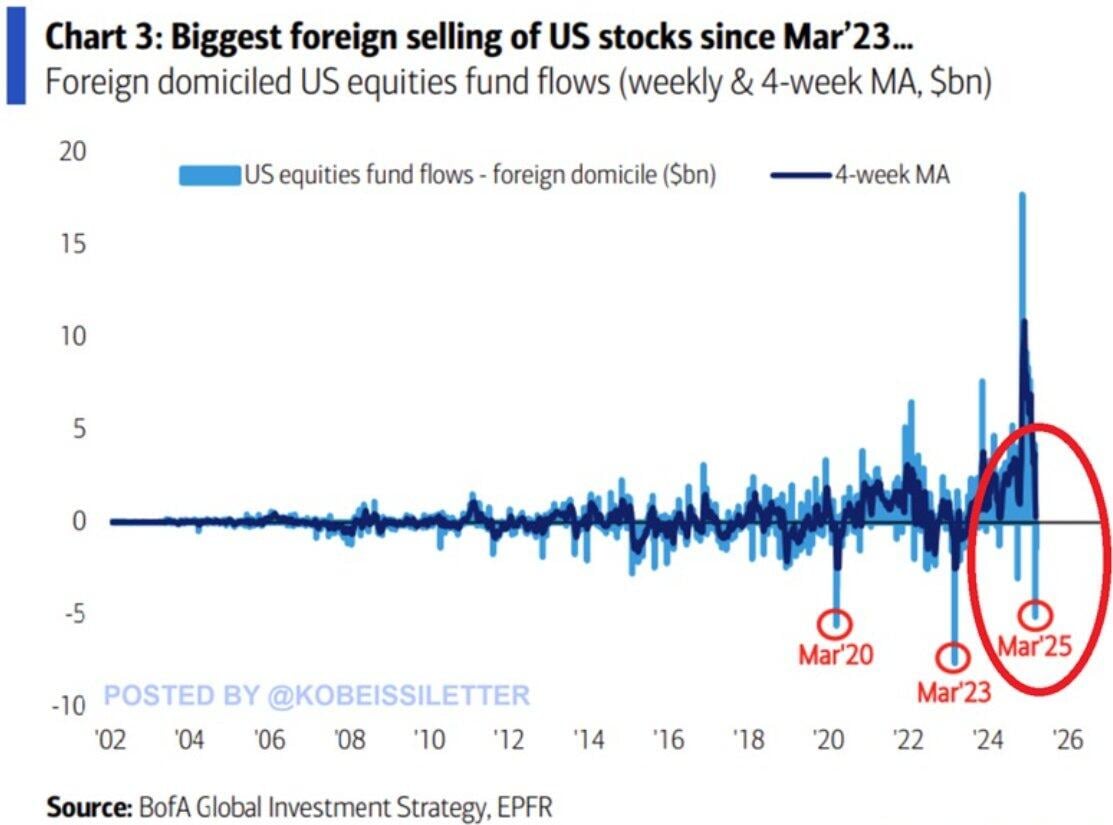

Kobeissi’s post also highlights a disconnect in investor sentiment, noting that while retail investors are buying the dip, foreign and institutional investors are pulling out of US stocks amid tariff uncertainty, with $6 billion withdrawn last week — the third-largest on record.

Kobeissi summarizes the situation by saying, “not the best recipe,” pointing to factors such as incorrect investor risk perception, rising tariff uncertainty, foreign and institutional capital pulling out of US stocks, large-cap tech no longer leading the market, and Trump’s willingness to endure near-term weakness.

How crypto markets could react to the upcoming tariff war

The upcoming tariff policy and its implementation will likely create short-term headwinds for the crypto markets due to increased uncertainty, inflation concerns, and a risk-off market environment. Cryptocurrencies, including Bitcoin, are highly correlated with the equities markets like NASDAQ, which may face downward pressure as tech-heavy indices decline. As explained above, the foreign investors pulled $6 billion from US equity funds, the third-largest withdrawal on record, signaling a broader flight from risk assets. This could lead to a short-term decline in Bitcoin’s price as investors seek safer havens like the US Dollar (USD) or Gold.

On the other hand, tariffs on tech imports, particularly semiconductors, could increase the cost of crypto mining equipment. Bitcoin mining relies heavily on specialized hardware like GPUs and ASICs, many of which are manufactured in China. Higher costs for importing this equipment into the US could reduce mining profitability, potentially leading to lower mining activity, temporarily reducing BTC’s hash rate network and increasing selling pressure if miners offload BTC to cover higher operating costs.

To gain more insight into how crypto markets would react to these tariff policies, FXStreet interviewed some experts in the crypto markets. Their answers are stated below:

Dan Greer, Co-Founder at Defi App

Q: Given its historical correlation with tech-heavy indices like the NASDAQ, how do you expect the current tariff-driven market uncertainty to impact Bitcoin’s price in the short term?

Short term, we’ll likely see Bitcoin mirror broader market volatility. When tech stocks swing on macro headlines, Bitcoin tends to follow. But BTC has also shown it can decouple when the narrative shifts from risk asset to hedge. Economic disruption might just be that catalyst.

Q: Given the inverse relationship between the US dollar and Bitcoin, how might the potential strengthening of the dollar due to tariffs affect Bitcoin’s price in the coming weeks?

A stronger dollar typically pressures Bitcoin, but only temporarily. If tariffs fuel inflation and geopolitical instability, Bitcoin’s role as a non-sovereign asset could outweigh short-term forex dynamics, especially as global capital looks for alternatives.

Q: What impact could tariffs on semiconductors have on Bitcoin mining profitability, and how might this influence Bitcoin’s price and network security?

Absolutely. Higher chip costs = higher mining capex, especially for operations upgrading hardware. If margins shrink, smaller players could exit, reducing hash rate—but over time, this tends to rebalance difficulty and stabilize the network. Short-term pressure, long-term resilience.

Q: How might a prolonged trade war with retaliatory tariffs from countries like Canada affect global demand for Bitcoin as a store of value in regions facing currency devaluation?

Trade wars erode trust in fiat systems. If major currencies wobble under retaliatory tariffs, Bitcoin becomes a lifeboat—especially in countries seeing devaluation or capital controls. Expect interest in BTC to grow in places where local currency stability is threatened.

Ramon Recuero, CEO at Kinto

Q: What role do you see stablecoins playing in the crypto market during this period of tariff-driven uncertainty, and how might this impact Bitcoin’s market dynamics?

Stablecoins are already playing a critical role as on-ramps, off-ramps, and trading pairs—and during volatile macrocycles, they become essential. Their growth highlights the insatiable demand for dollars worldwide. Under uncertain conditions, we expect this growth to accelerate. The Stablecoin bill will provide further clarity and legitimacy.

Q: How do you interpret the high market concentration in tech stocks and its potential to amplify volatility in the crypto market, particularly for Bitcoin?

The correlation between tech and crypto reflects a deeper issue: both have been driven by liquidity, not fundamentals. But that’s changing. As narratives evolve, projects focused on real-world use, revenue, and resilience will start to decouple. That’s where the long-term capital will flow.

Q: How might a prolonged trade war with retaliatory tariffs from countries like Canada affect global demand for Bitcoin as a store of value in regions facing currency devaluation?

Whenever trust in fiat currencies erodes—whether through inflation, tariffs, or geopolitical instability—demand for self-sovereign assets like Bitcoin grows. But real adoption won’t come through price action alone. It’ll come through infrastructure that makes self-custody and borderless finance usable. That’s where the next evolution lies.

Mike Cahill, CEO at Douro Labs

Q: Do you think Bitcoin will act as a hedge against inflation in the long term if tariffs lead to sustained price increases, as suggested by the potential 25% rise in car prices?

If tariffs drive sustained inflation—like a 25% jump in car prices—Bitcoin’s hedge narrative only gets stronger. Over time, people look for assets that can’t be printed, politicized, or inflated away. Bitcoin doesn’t react to inflation headlines because it thrives under inflation regimes.

Q: Considering Trump’s pro-crypto stance, such as his support for stablecoin legislation, how might his policies mitigate the negative impacts of tariffs on the crypto market in the long term?

If Trump follows through on pro-crypto policies—like stablecoin legislation and ending Operation Chokepoint 2.0—it could more than offset tariff-related headwinds. Clear rules and regulatory support will help unlock capital, boost innovation, and attract institutions. In the long term, strong policy always beats short-term macro noise.

Q: How might the April 2, 2025, reciprocal tariffs on 15-25 countries, as forecasted by Barclays, influence the long-term adoption of cryptocurrencies in global trade and cross-border transactions?

Reciprocal tariffs are causing economic friction, but at the end of the day, crypto is the workaround. As global trade gets messier, the appeal of neutral, borderless settlement rails only grows. More tariffs mean more incentive to adopt stablecoins and crypto infrastructure for cross-border transactions that don’t rely on politicized payment systems.

Q: What are the chances that institutional investors, currently pulling out of US equities, might reallocate capital to Bitcoin as a hedge against tariff-related economic instability?

Now is the time for institutional investors to reallocate capital from US equities to Bitcoin as a hedge against tariff-related economic instability. I think institutions are waking up to the power of crypto, and we’re going to start seeing more and more institutional adoption this year. As a result, we’re going to move into a new phase of finance that combines the best of both DeFi and TradFi.

Sandeep Rao, Senior Researcher at Leverage Shares

Q: How do you interpret the high market concentration in tech stocks and its potential to amplify volatility in the crypto market, particularly for Bitcoin?

High market concentration in tech stocks is inherently a volatility-inducing event and will inevitably translate to Bitcoin volatility as well – as evidenced in recent patterns.

Q: What are the chances that institutional investors, currently pulling out of US equities, might reallocate capital to Bitcoin as a hedge against tariff-related economic instability?

The relatively low-but-stable fungibility of Bitcoin implies that there won’t be a substantial reallocation of resources of Bitcoin as opposed to, say, increasing exposure to Indian equities and debt assets, Thai industrial stocks, Vietnamese commodities firms, etc. Nonetheless, given the establishment of Crypto Reserves and continued government support for stablecoins by select nations, there might be a slight uptick.

Q: What impact could tariffs on semiconductors have on Bitcoin mining profitability, and how might this influence Bitcoin’s price and network security?

If semiconductors become more expensive, the infrastructure for mining becomes more expensive, thus reducing supply and increasing the price. As a result, network strength might also decline if fewer miners are in operation. This will, however, be a temporary blip: if Bitcoin becomes more expensive, mining will become profitable again – in effect, it becomes a self-correcting trend.

Varun Jain, Chief Revenue Officer at BITA

Q: Given its historical correlation with tech-heavy indices like the NASDAQ, how do you expect the current tariff-driven market uncertainty to impact Bitcoin’s price in the short term?

Despite market participants sometimes touting Bitcoin as a store of value, it has traditionally behaved like a risky asset. In fact, the correlation in recent weeks has been particularly high, with Bitcoin moving in lockstep with Nasdaq. In the short term, that is likely to continue. But the sensitivity of the market to tariff news has been declining, and a lot of positioning in crypto has been reset (especially in alts). Funding is now very healthy, Open Interest is low, so it's possible that if BTC clears $87,000-$88,000, we can see a squeeze up to $95,000.

Q: Do you think Bitcoin will act as a hedge against inflation in the long term if tariffs lead to sustained price increases, as suggested by the potential 25% rise in car prices?

Unlikely. So far, Bitcoin has not shown itself to be an inflation hedge (whereas Gold has been remarkably strong in recent months, potentially sniffing out a rise in inflation from tariffs).”

Q: How do you interpret the high market concentration in tech stocks and its potential to amplify volatility in the crypto market, particularly for Bitcoin?

High investor concentration in MAG7 is indeed a risk and something the market has been de-risking in the last few weeks. In fact, since 2019, there have been $10T of inflows into US Equities from other countries (chart from Apollo's Torsten Slok). A lot of this was on an fx-unhedged basis, causing a "double whammy" to these investors as US assets and USD both have gone down. It may still have further to go, but the Fed will likely support any crisis-type situation, and the resulting liquidity injection will support the Bitcoin price.