What does $5 billion in open interest mean for Solana price forecast in April 2025?

- Solana price holds steady above the $140 mark on Tuesday despite bearish headwinds from the Trump administration hinting at new tariffs.

- SOL open interest increased by $700 million in 24 hours, surpassing $5 billion, following Donald Trump’s post endorsing the Solana-hosted TRUMP memecoin.

- Rising trading volumes and renewed investor optimism suggest SOL could be on the verge of another leg up.

Solana (SOL) continues to defy marketwide bearish sentiment, surging past $145 as open interest crosses the $5 billion mark. But can this momentum hold?

Solana reclaims $145 despite marketwide pullback

Solana's price has remained resilient above the $140 mark on Tuesday, navigating through a volatile market triggered by macroeconomic and political developments. Notably, Donald Trump’s administration hinted at new tariffs, fueling uncertainty across risk assets.

Solana price action, March 25 | Coinmarketcap

Solana price action, March 25 | Coinmarketcap

While Bitcoin (BTC) remains stagnant below $90,000, other major altcoins, such as Ripple (XRP) and Cardano (ADA), have been consolidating around $2.40 and $0.70, respectively.

Despite the broader market's lackluster performance, Solana has recorded a 2% daily gain, pushing its price toward $145, according to CoinMarketCap. This bullish price action indicates investor confidence in SOL's ability to outperform amid turbulence.

Solana Open Interest surges by $700 million after Trump’s post

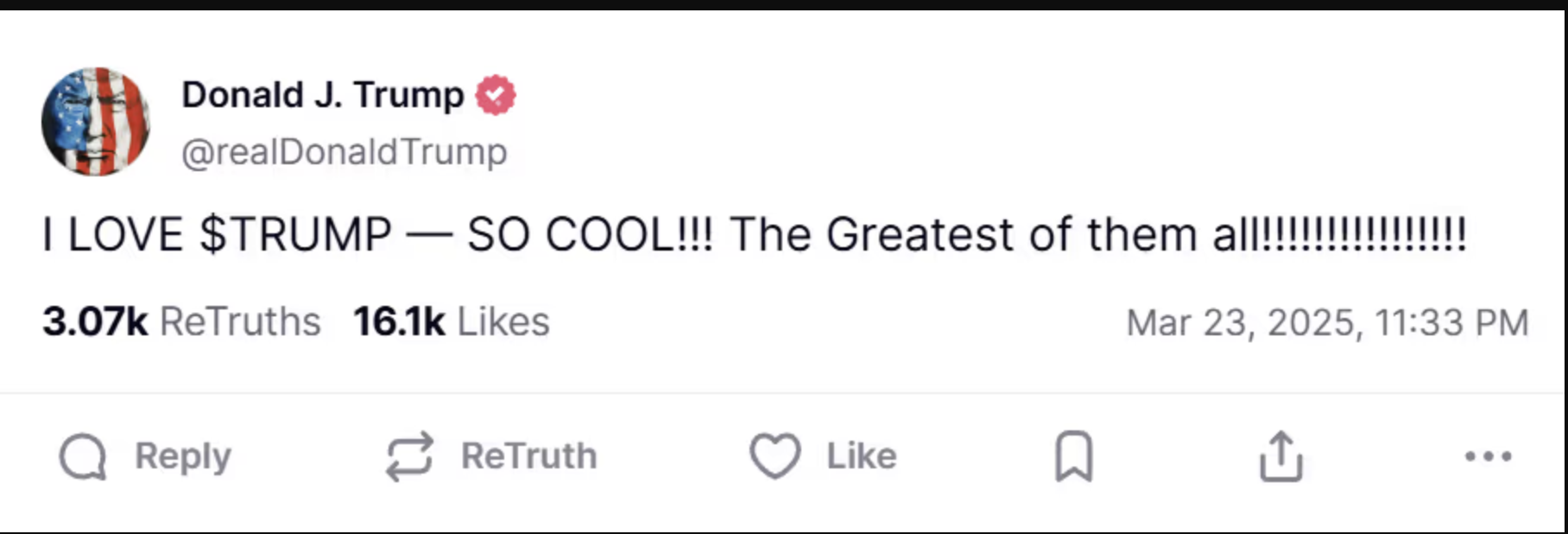

Trump’s reemphasized support for the Solana-native $TRUMP token on Monday, sparking a bullish turn of events. Traders reacted positively with SOL prices rising 2% in the spot markets. However, a closer look at the market's data shows that speculative traders are returning to the SOL markets after nearly a month of low activity.

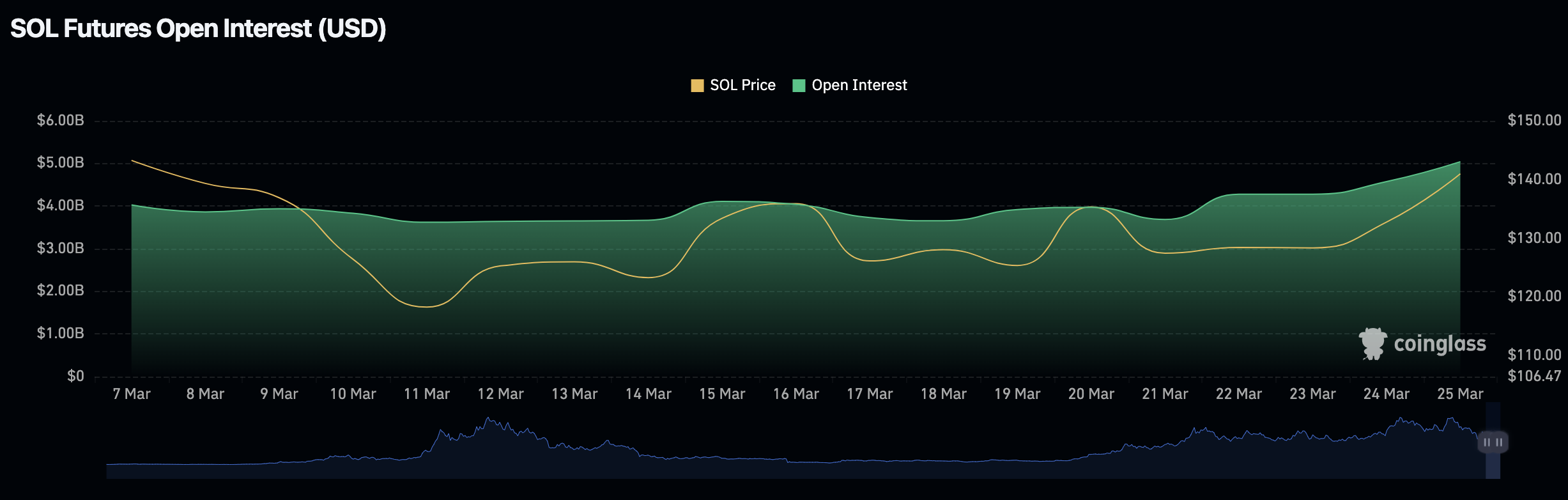

Solana open interest | SOLUSD, March 25 | Source: Coinglass

The Coinglass chart above shows SOL's open interest surged by $700 million in just 24 hours, crossing the $5 billion mark at press time on Tuesday.

This spike followed a social media post from the US President Donald Trump, who endorsed the Solana-hosted TRUMP memecoin, calling it “the greatest of them all.”

Trump emphasizes support for $TRUMP token | March 24

Solana’s ecosystem had faced headwinds in early March, particularly after FTX began unlocking millions in SOL tokens to repay creditors, raising fears of selling pressure.

Beyond that, the Libra meme coin rug-pull incident involving Argentine President Javier Milei created uncertainty over the legitimacy of political memecoins.

Trump’s high-profile endorsement appears to have reignited investor confidence, leading to a surge in new positions. SOL open interest jumped from $4.28 billion to $5 billion within a day, signaling renewed institutional and retail optimism.

Derivatives metrics signal bullish sentiment swing for April

Beyond open interest, other key derivatives market indicators point toward continued upside potential for Solana.

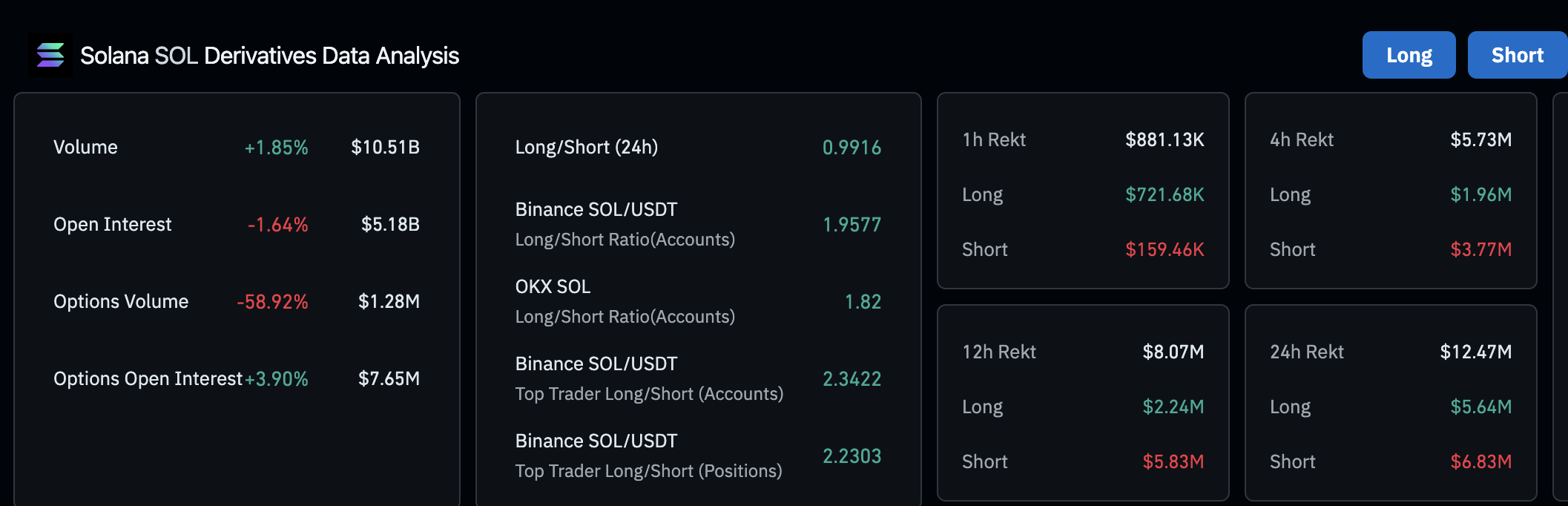

Solana derivatives markets analysis | March 24 | Source: Coinglass

Solana derivatives markets analysis | March 24 | Source: Coinglass

Trading volume surged 1.85% to $10.51 billion, indicating heightened market activity.

Options open interest climbed 3.90%, showing increasing investor demand for leveraged positions. Considering options trading is more popular among large investors this emphasizes increased bullish sentiment among whales.

With rising trading volumes and renewed investor optimism, SOL could be gearing up for another breakout in April. If momentum persists, analysts expect a potential test of the $160-$180 resistance zone in April 2025.