Solana Memecoins: Fartcoin, WIF, and a16z traders gain $962M as Trump backs his token

- The Solana memecoin sector surges 11.6% on Monday, attracting $962 million in inflows.

- US President Trump reaffirmed his support for the TRUMP token, calling it the ”greatest of all”.

- Fartcoin, a16z and TRUMP emerged as the most-searched tokens, fueling double-digit gains.

Solana memecoins recorded 11.6% gains on Monday as the sector’s valuation increased by nearly $1 billion, driven by Donald Trump-related catalysts that fueled a global market rally. Market reports show that Fartcoin, a16z, and TRUMP memecoins were among the three most in-demand assets.

Solana memecoin sector outperforms Bitcoin and top altcoins

Solana memecoins took center stage on Monday, outperforming Bitcoin and the broader altcoin market.

While BTC surged 4% before facing resistance at $89K, Solana’s memecoin sector saw gains more than twice that figure.

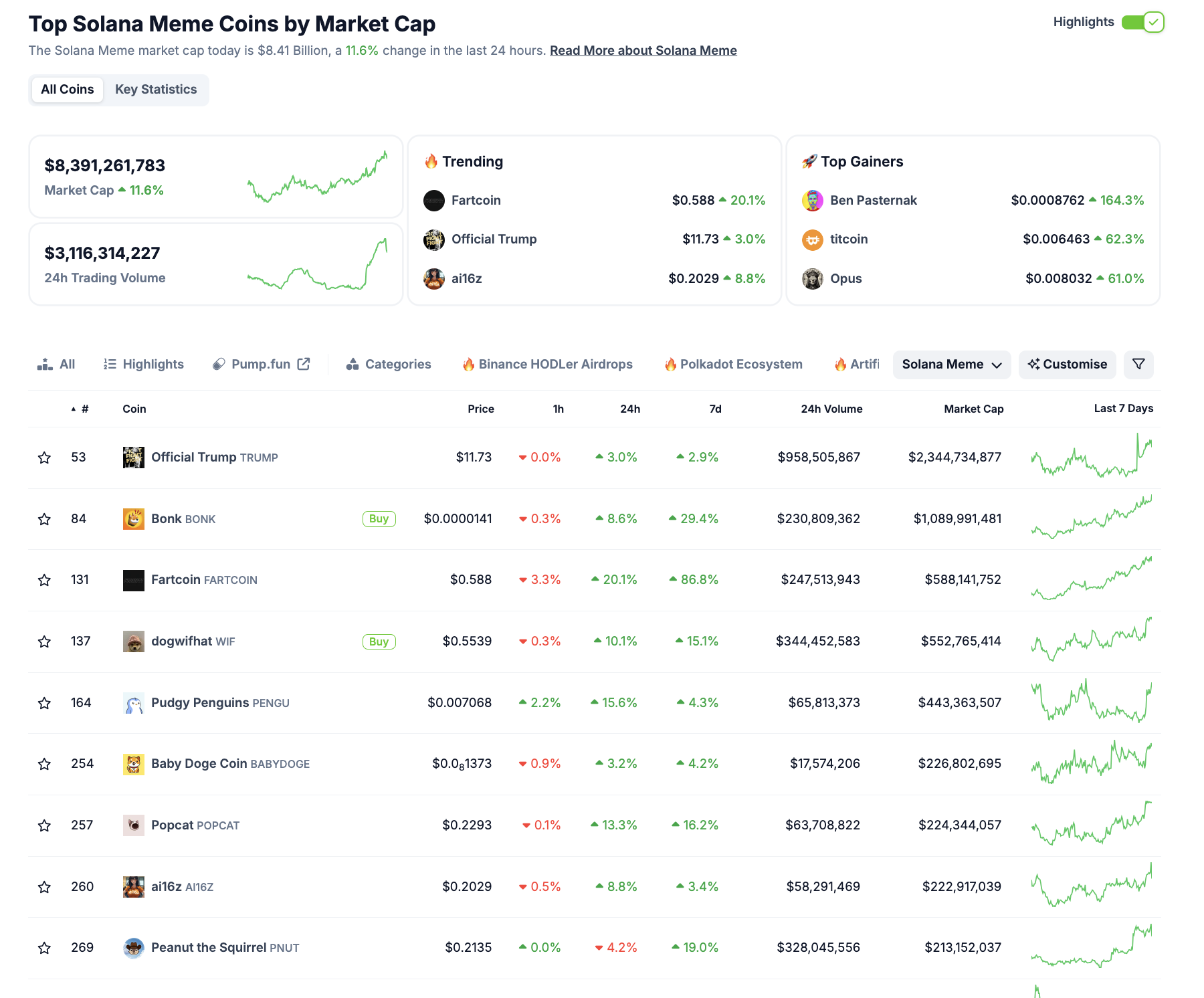

Solana Memecoin Performance | Source: Coingecko

Solana Memecoin Performance | Source: Coingecko

According to Coingecko data, the sector’s valuation rose by 11.6%, pushing the total market cap of Solana-based memecoins past $8.3 billion—an increase of $960 million in a single day.

Why are Solana memecoins rallying today?

Trump-related headlines helped Solana’s memecoin market shake off bearish catalysts that had weighed on the sector since early March. On Monday, Trump reaffirmed his support for the TRUMP token, launched on the Solana network on Inauguration Day.

In a Truth Social post, Trump declared TRUMP token is "the greatest of them all."

-638784478672283835.png) Donald Trump declares TRUMP token - Source: TruthOfficial | March 23, 2025

Donald Trump declares TRUMP token - Source: TruthOfficial | March 23, 2025

Notably, following the controversy surrounding a rug pull involving Argentine President Javier Milei and the Libra memecoin, many traders feared Trump would distance himself from his own memecoin.

This led to a major sell-off, causing TRUMP and MELANIA tokens to plunge 80% from their all-time highs.

However, Trump’s Monday post reignited investor confidence in the broader Solana memecoin sector.

Market data shows that Fartcoin, a16z, and TRUMP were the most-searched tokens on Coingecko, sparking double-digit gains for each.