Is Canada’s economy in a recession?

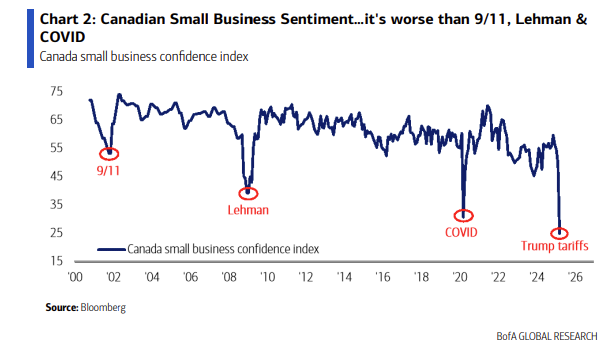

Canada’s economy is getting smoked. The Small Business Confidence Index has collapsed nearly 60% in just a few months. That’s not a typo. Even at the lowest point of the 2008 financial crisis, confidence was 10 points higher than it is now. Things are falling apart. And no one’s even bothering to sugarcoat it.

Confidence is crashing faster than it did during the March 2020 lockdowns. By early 2025, small business sentiment had already started slipping. But once the trade war with the U.S. kicked off, it dropped to 25—the lowest reading ever recorded. Nothing else comes close.

Consumer confidence collapses as inflation and housing kill demand

Meanwhile, Consumer sentiment in Canada just hit a new all-time low. In the U.S., consumer confidence is bad too—but Americans are still three times more optimistic than they were in 2008. In Canada, it’s 15 points below where it was during that global meltdown. It’s a record low. And it’s dragging everything else down with it.

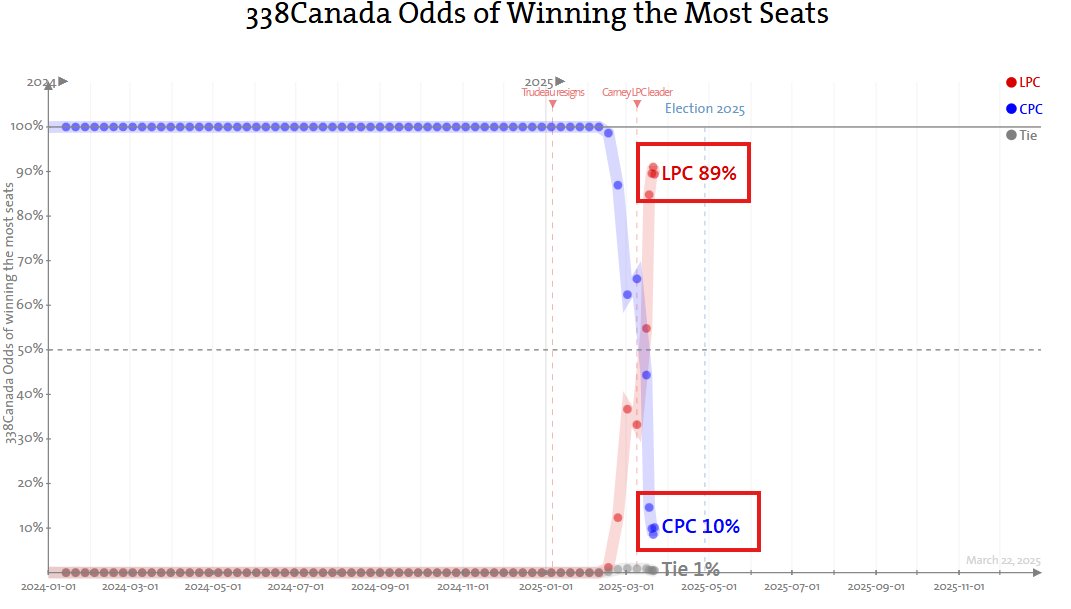

The economic chaos is starting to flip Canadian politics upside down. On February 16, the Liberal Party had about a 1% chance of winning the most seats in Parliament. That’s not an exaggeration. But now? They’ve got an 89% chance of taking the lead. That’s one of the biggest electoral reversals ever seen.

Just two months ago, the Liberals were projected to grab 35 seats. The Conservatives were on track to grab 236. Now, the numbers show the Liberals with 178, and the Conservatives with just 131. A total reversal. Blame the economy.

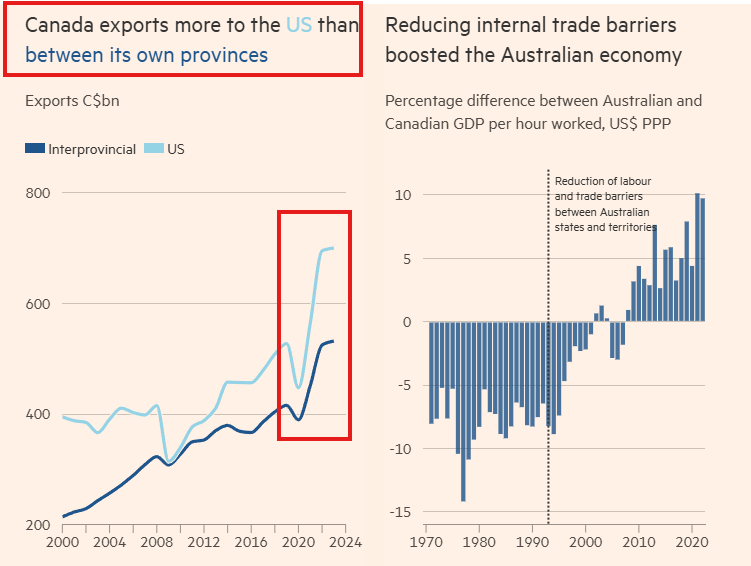

The trade war is ripping into what little confidence was left. Tariffs are brutal for Canada, and everyone knows it. Imports from Canada only make up 14% of what the U.S. buys. But on the flip side, the U.S. takes 78% of Canada’s exports. That’s not a trade relationship. That’s dependence. In 2023, Canada exported CAD$700 billion to the U.S.

Meanwhile, interprovincial trade was only CAD$532 billion. Canada trades more with one foreign country than with itself. No surprise that tariffs are wrecking things.

But confidence was already falling before tariffs showed up. Since 2020, Canada’s population grew by over 9%, but real GDP per worker dropped by 2%. At the same time, housing prices have gone up 300% since 2000.

Tariffs didn’t cause this mess—but they might be the final blow. Canada’s housing shortage is so bad that people aren’t even hoping for price drops anymore. The country is running a structural deficit of 250,000 housing units every quarter. That’s a full-on crisis. Housing starts have been falling since 2021, while demand has doubled. People literally don’t know where they’re supposed to live.

Inflation rebounds while businesses cut spending and jobs

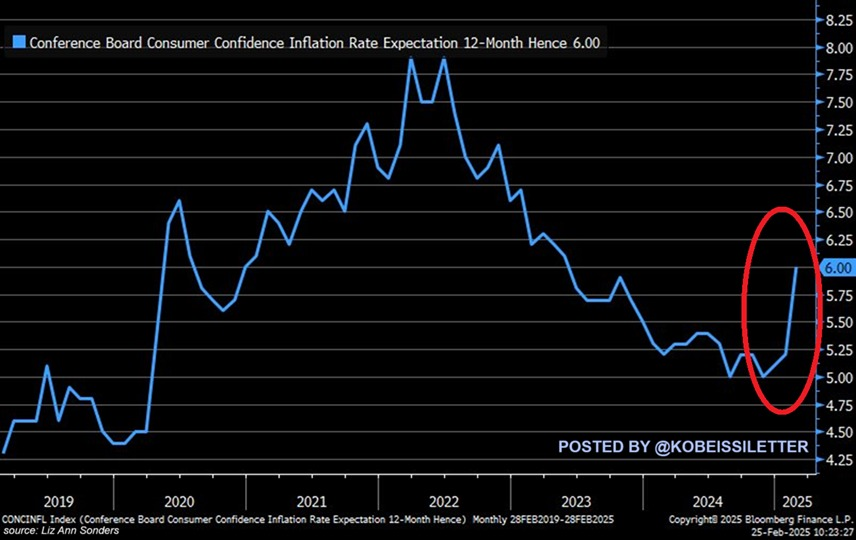

The U.S. inflation outlook isn’t helping. Americans now expect inflation to hit 6.0% over the next year. That’s the highest since May 2023. Long-term inflation expectations in the U.S. just hit 3.9%, the highest in 30 years. And Canada’s not immune.

In February, Canadian CPI jumped from 1.9% to 2.6%, or 1.1% month-over-month. The forecast was 2.2% year-over-year and 0.6% month-over-month. Reality came in way worse. And those numbers don’t even include the full impact of the retaliatory tariffs yet.

Give it a few more weeks and Canada’s inflation could easily blow past 3%. All this is happening while wages are flat, housing is unaffordable, and businesses are slamming the brakes on everything.

According to the Bank of Canada, “the threat of tariffs is already affecting financial markets and business decisions.” The January Monetary Policy Report ran multiple scenarios.

Under the baseline case—25% U.S. tariffs, with Canada retaliating—Canada’s GDP is expected to shrink by 2.5 percentage points in year one, 1.5 points in year two, and stay flat in year three. That’s three years of economic zero growth or worse.

Another Bank of Canada report looked at how workers and businesses are reacting to trade tensions. People are planning to spend less because they’re worried about their jobs and financial health.

Sectors like oil, mining, manufacturing, and agriculture are getting hit hardest. Those jobs are directly tied to exports and sensitive to tariffs. Workers in those industries are bracing for layoffs.

Released on March 12, that report also showed businesses are preparing to cut hiring, reduce investments, and raise prices in response to the tariffs. In plain English: less work, less growth, more inflation. The report also said: “Inflation expectations are on the rise.” No surprise.

Meanwhile, Canada’s canola industry is walking straight into a buzzsaw. Starting March 20, China hit Canadian canola oil and meal with 100% tariffs. On top of that, the U.S. might slap a 25% tariff on Canadian canola beginning April 2. This is on top of Trump’s new wave of aggressive trade policies.

Saskatchewan, Alberta, and Manitoba have been begging the federal government for help, especially for farmers. But so far? Nothing. No assistance. No relief. Just tariffs and silence.

So let’s run the full list: record low consumer confidence, a massive trade war, a housing shortage no one’s fixing, GDP per worker going down, inflation bouncing back hard, and a government trying to figure out how the hell it’s suddenly winning an election.

“People are scared to spend, worried about their jobs, and businesses are reacting with layoffs and price hikes,” one Bank of Canada researcher said. “We’re watching real economic activity fall apart.”

The confidence numbers don’t lie. The inflation numbers don’t lie. The trade numbers don’t lie. This isn’t a soft landing. It’s a crash.

Canada is deep in it. Whether they call it a recession or not.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now