Solana Long-Term Holders In Fear — Time To Buy The Dip?

The price action of Solana was quite underwhelming over the past week, mirroring the worsening climate of the altcoin market. Interestingly, the launch of the SOL futures exchange-traded funds (ETFs) during the week did very little to jolt the altcoin’s price back to life.

Following the severe price downturn that hit the market, including the Solana token, investors were left wondering when it was best to “buy the dip.” The latest on-chain observation suggests that it might finally be time for investors to get back into the SOL market.

SOL Long-Term Investors Fearful – A Buy Signal?

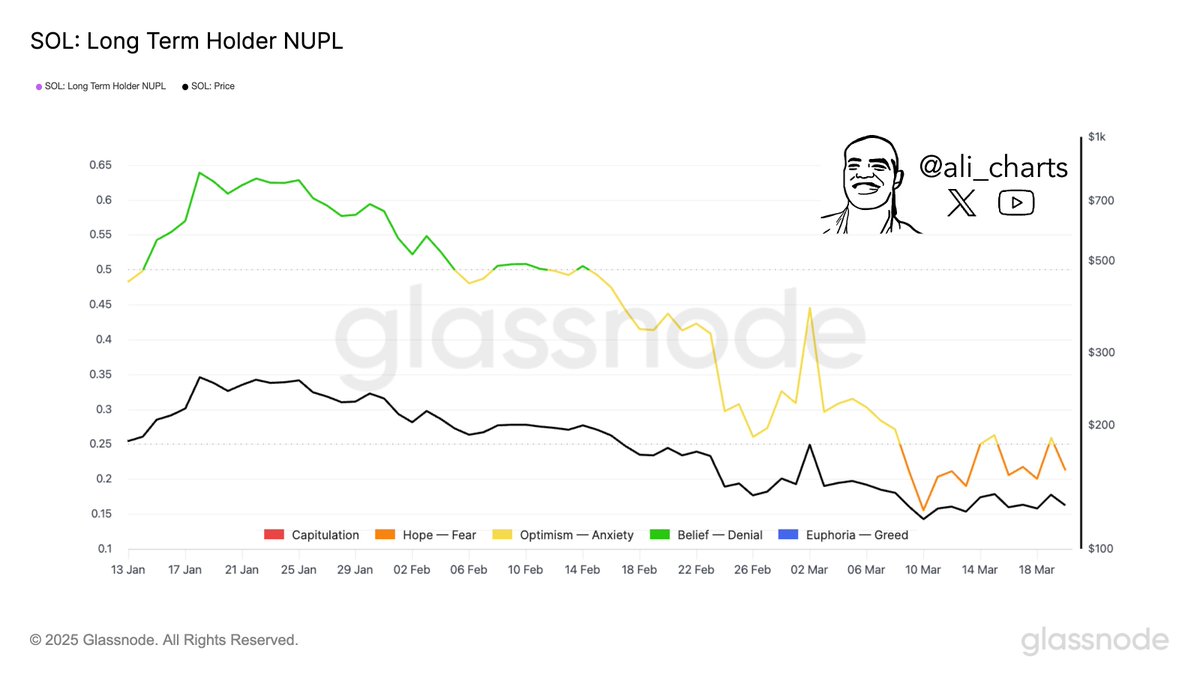

In a March 21 post on the X platform, prominent crypto analyst Ali Martinez said long-term SOL holders are now in fear. The relevant on-chain indicator here is the “Long-Term Holder Net Unrealized Profit/Loss (NUPL)” metric, which measures the difference between market cap and realized cap divided by market cap.

This NUPL indicator provides insight into the ratio of long-term investors in profit at every given time. When this metric’s value is over zero, it indicates that more investors are in profit; while a less-than-zero value for the NUPL indicator implies that more investors are in the red than those in profit.

Although an upward trend for the metric suggests that more coins are beginning to enter profit, it also means that more investors are inclined to take profit — leading to increased bearish pressure. On the other hand, a falling NUPL value indicates investors’ reduced willingness to realize loss, resulting in reduced selling pressure.

As shown in the chart above, long-term Solana investors are now in fear, as the NUPL metric slipped beneath the 0.25 mark. According to earlier logic, this class of SOL holders is less likely to sell their assets and realize their losses, signaling less bearish pressure for the altcoin.

Moreover, Martinez noted that “smart money” investors have always shown a willingness to enter the market during periods like this. “Be greedy when others are fearful,” the analyst said about the strategy.

Historically, the crypto market tends to move in the crowd’s opposite direction. Hence, it might be time to “buy the dip,” especially with the long-term investors currently skeptical about the promise of the Solana token.

Solana Price At A Glance

As of this writing, the price of SOL sits just beneath the $130 level, reflecting a 0.4% decline in the past 24 hours. According to CoinGecko data, the altcoin’s value has dropped by almost 5% in the past week.