BTC, LTC, and BCH static as US SEC exempts Proof-of-Work Mining from Securities regulations imposed on Ripple

- The U.S. SEC confirms that Proof-of-Work (PoW) mining activities do not fall under securities regulations, providing regulatory clarity for miners.

- Despite adding 1.7% in market cap, major PoW assets like Bitcoin and Dogecoin posted losses as investors rotated funds into lower-cap PoW altcoins.

- Lower-cap PoW coins led gains with Nexa, Lightning Bitcoin, and Metaverse ETP outperformed all top 10 ranked PoW assets.

On Thursday, the U.S. Securities and Exchange Commission (SEC) has officially clarified that Proof-of-Work (PoW) cryptocurrency mining activities will not be subject to existing securities laws. This decision marks a significant regulatory milestone, providing greater certainty for participants in the mining sector and fueling optimism across the broader cryptocurrency industry.

SEC confirms Proof-of-Work Mining falls outside Securities laws

As part of its ongoing efforts to refine cryptocurrency regulations, the SEC’s Division of Corporation Finance has issued guidance confirming that Proof-of-Work mining does not fall under the jurisdiction of existing securities obligations.

The statement specifies that this exemption applies solely to PoW mining operations conducted on public blockchain networks.

According to the SEC’s statement, participants in mining activities—whether individuals or mining pool members—are not required to register their transactions with the Commission under the Securities Act.

US SEC issues statement excluding Proof-of-Work Mining from securities regulations | March 20, 2025

The regulator further clarified that PoW mining does not meet the criteria of an investment contract under the Howey Test, reinforcing that mining-generated proceeds do not classify as securities.

This clarification follows the SEC’s recent stance that memecoins do not constitute securities, and the ending of a 5-year litigation battle with Ripple SEC this week.

The key developments further emphasize positive shifts in the US’ regulatory approach toward clearer, more defined Cryptocurrency regulations rather than enforcement-driven oversight.

Market Impact: Traders overlook Mega-Cap PoW Coins as sector adds $3.1B on SEC news

Following SEC's confirmation that Proof-of-Work (PoW) mining falls outside securities regulations, market reaction remained muted.

Notably, Bitcoin’s classification as a commodity had already been inferred from previous rulings and the SEC’s broader regulatory approach, meaning the announcement did not introduce a major shift in sentiment.

More so, U.S. President Donald Trump’s speech at Blockwork’s Digital Asset Summit dominated the day’s headlines, overshadowing the SEC’s latest clarification.

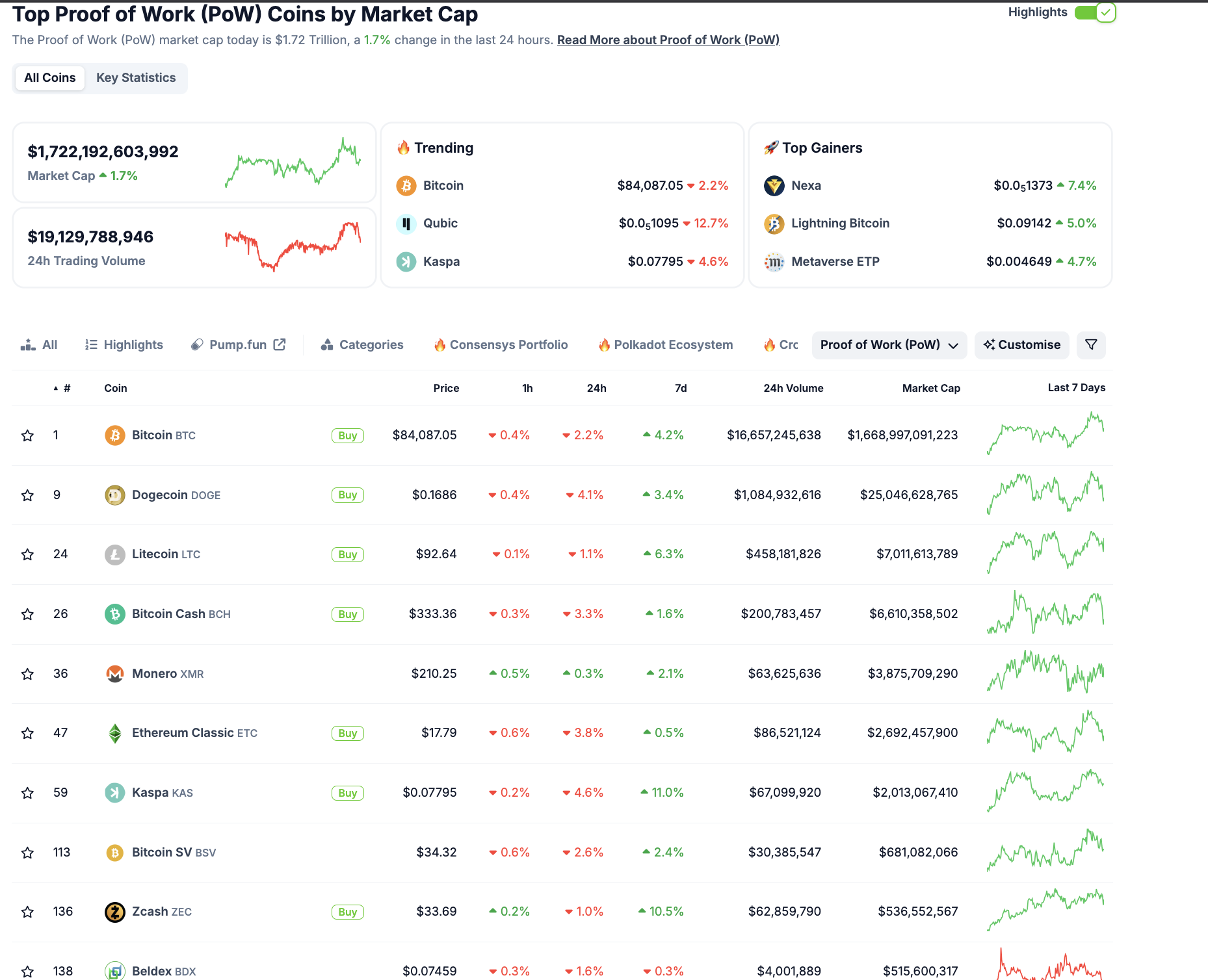

Proof-of-Work Sector Performance, March 20, 2025 | Source: Coingecko

According to Coingecko data the Proof-of-Work sector saw a net inflow of $3.1 billion, reflecting a 1.7% gain in overall market capitalization on Thursday.

However, a closer look at the market data shows investors side-stepped large cap PoW assets, including Bitcoin (BTC), Dogecoin (DOGE), and Ethereum Classic (ETC), with each posting daily losses. BTC fell 2.2% to $84,087, while Dogecoin dropped 4.1%, in contrast to lower-cap PoW altcoins, which led the day’s gains.

As seen in the chart above Nexa surged 7.4% to $0.0137, while Lightning Bitcoin (LBTC) and Metaverse ETP (ETP) posted 5.0% and 4.7% gains, respectively.

These movements suggest investors strategically rotated funds from large cap coins, towards under-the-radar PoW assets following the SEC’s confirmation of the assets’ commodities status.