BinaryX (BNX) Leads the Market with 41% Surge as Token Swap Approaches

BinaryX (BNX) has emerged as the market’s top gainer today, surging 41% in the past 24 hours. The altcoin currently trades at $1.75, noting a 412% uptick in daily trading volume during that period.

The rally comes as traders position themselves ahead of the highly anticipated BNX-to-FORM token swap, scheduled for March 21.

BNX Gains Momentum as Traders Bet Big Ahead of Token Swap

BinaryX launched the Four.Meme platform on July 3, 2024, and later rebranded to Four for a more cohesive identity. However, due to the widespread use of FOUR in the meme coin community, the team opted to change to FORM, announcing a 1:1 token swap from BNX to FORM scheduled for March 21.

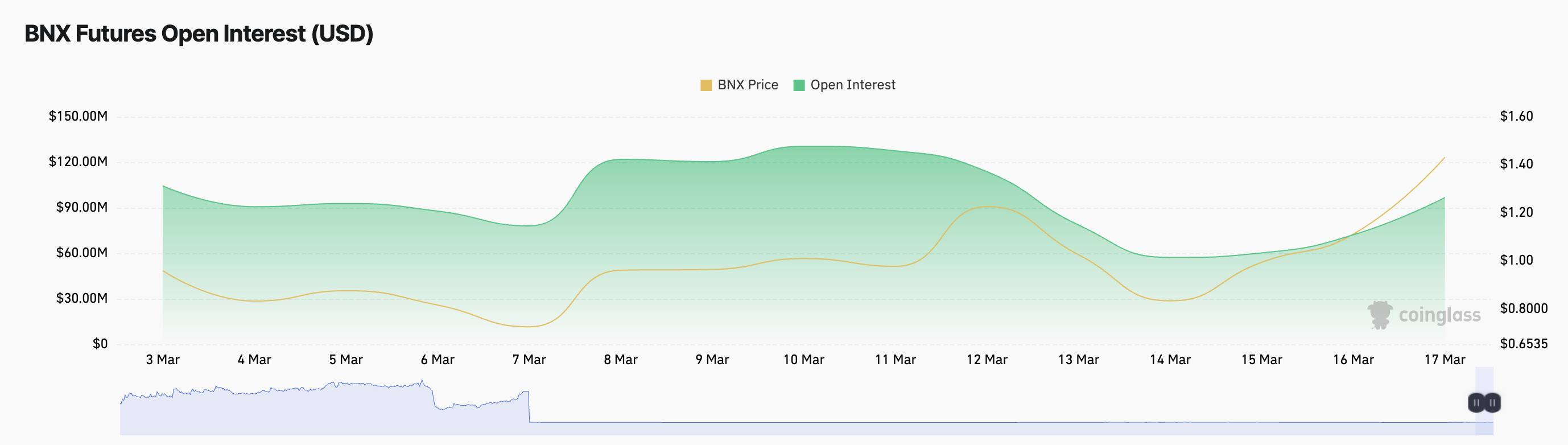

As the market awaits this swap, traders have increased their accumulation of the BNX token. This is reflected by the altcoin’s open interest, which has climbed 33% in the past 24 hours and stands at $96 million at press time.

BNX Open Interest. Source: Coinglass

BNX Open Interest. Source: Coinglass

Open interest tracks the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it rises during a price rally like this, it indicates increasing market participation. It signals the bullish conviction among BNX holders as more traders open new positions to capitalize on the upward momentum.

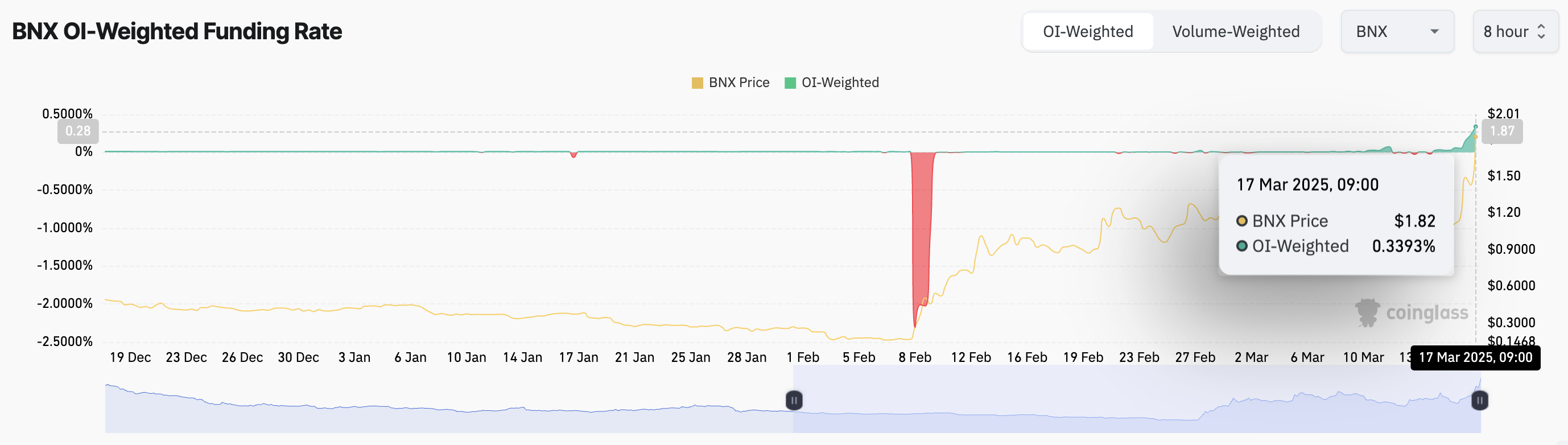

Moreover, its funding rate is also positive, supporting this bullish outlook. This is currently at 0.339%.

BNX Funding Rate. Source: Coinglass

BNX Funding Rate. Source: Coinglass

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep prices aligned with the spot market. A positive funding rate such as this means long traders are paying short traders. It indicates strong buying pressure among BNX traders and confirms the bullish sentiment in the market.

BNX Trades Above Key EMA—Can Bulls Push It Past $1.85?

BNX trades above its 20-day exponential moving average (EMA) at its current price. This key moving average measures an asset’s price over the past 20 trading days, giving more weight to recent prices to help identify short-term trends.

When it sits below an asset’s price, it is a bullish signal suggesting that the market is in an uptrend and buyers are in control.

If BNX buyers strengthen their control and demand soars, they could drive the altcoin’s price past the resistance at $1.77 and toward $2.19.

BNX Price Analysis. Source: TradingView

BNX Price Analysis. Source: TradingView

However, if selloffs gain momentum, BNX could shed its recent gains and plunge to $1.77.