World Liberty Financial Invests $4 Million in Avalanche and Mantle

World Liberty Financial (WLFI), a DeFi project with ties to the Trump family, has expanded its digital asset holdings by acquiring $4 million worth of Avalanche (AVAX) and Mantle (MNT) tokens.

This investment came a few days after the project denied investing in Binance.

Trump-Backed WLFI Invests $2 Million Each in AVAX and MNT

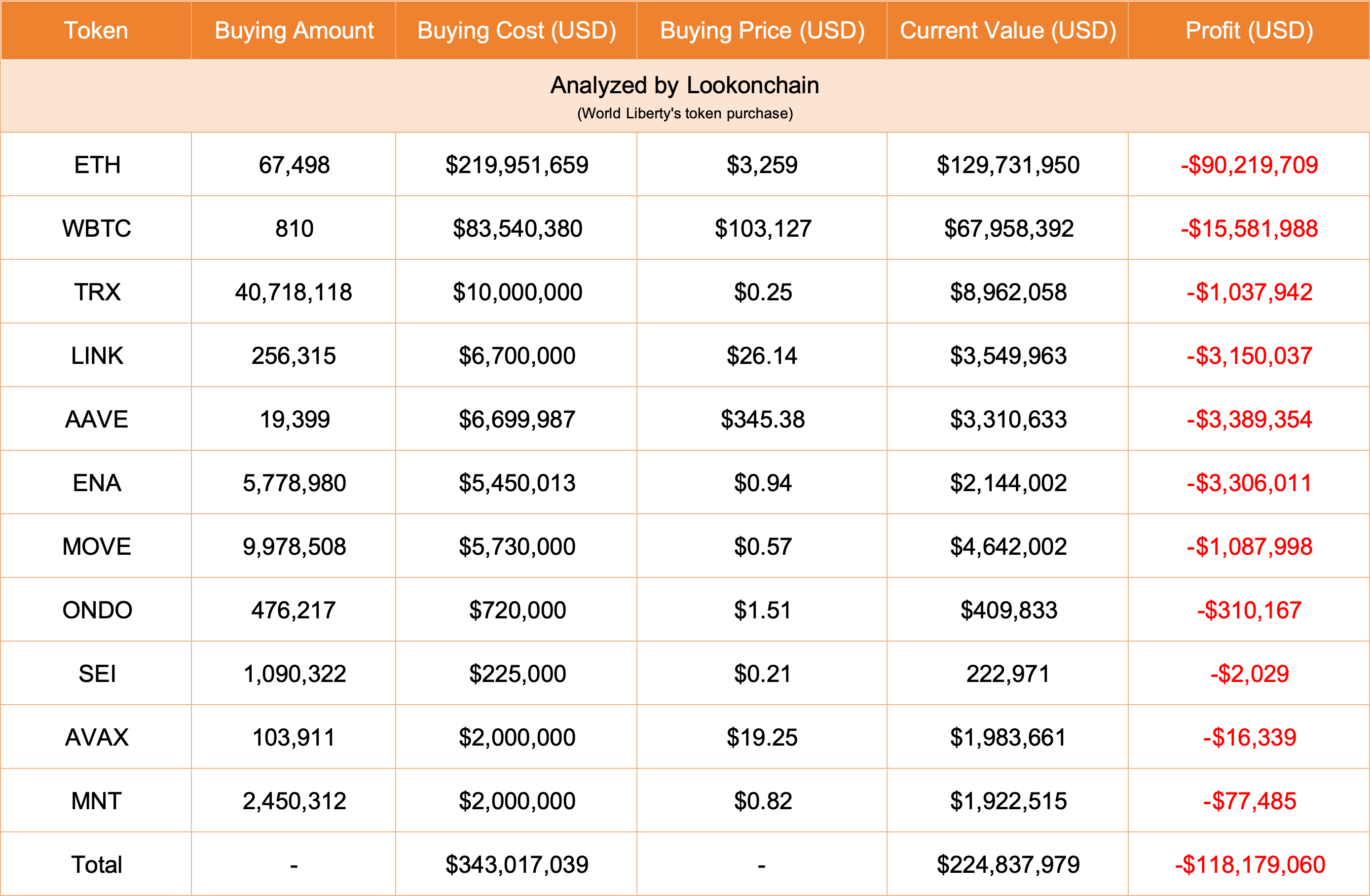

On March 16, blockchain analytics firm Lookonchain reported that WLFI spent $2 million USDT to acquire 103,911 AVAX at an average price of $19.25 per token. Another $2 million USDT was used to purchase 2.45 million MNT at approximately $0.81 per token.

This latest move pushes WLFI’s total crypto investments beyond $340 million, spanning 11 assets.

The portfolio now includes Ethereum (ETH), Wrapped Bitcoin (WBTC), Tron (TRX), Chainlink (LINK), Aave (AAVE), Ethena (ENA), Movement (MOVE), Ondo (ONDO), and SEI, alongside the recently acquired AVAX and MNT.

WLFI’s increasing investment activity suggests strategic expansion, but some analysts speculate that these purchases might be part of a broader token swap arrangement.

Crypto researcher EmberCN pointed out that several assets in WLFI’s portfolio have reciprocal investment ties with the project. According to EmberCN, various projects appear to “support” WLFI by subscribing to its ecosystem, while WLFI’s portfolio subsequently invests in its tokens.

“There are actually many tokens that ‘support’ World Liberty Financial. That is, the project party subscribes to WLFI, and then the WLFI investment portfolio purchases the project’s tokens,” EmberCN stated.

WLFI’s Crypto Investment. Source: Lookonchain

WLFI’s Crypto Investment. Source: Lookonchain

Despite its aggressive expansion, WLFI’s holdings remain underwater. Lookonchain data estimates an unrealized loss of around $118 million, with Ethereum alone accounting for an $88 million deficit.

Binance Deal Rumors

These acquisitions follow recent reports from major media outlets, including The Wall Street Journal and Bloomberg, alleging that WLFI had engaged in discussions with Binance regarding a potential investment with the trading platform.

However, WLFI denied any formal agreements with Binance. The project called the reports politically motivated, claiming they misrepresented its objectives. It also argued that the coverage aimed to discredit the crypto industry.

Instead, the company reaffirmed its commitment to decentralized finance (DeFi).

“To set the facts straight: World Liberty Financial is a DeFi project with a tremendous mission to build and democratize a new financial system for the benefit of millions. It’s as simple as that. We are proud to partner with many of the leading protocols and organizations advancing the blockchain industry,” WLFI stated.

Meanwhile, WLFI recently completed its token sale, raising approximately $590 million.

The token will serve as the governance mechanism for the World Liberty Financial Protocol. Token holders can propose and vote on key decisions, ensuring a decentralized decision-making process that gives stakeholders direct influence over the project’s direction.