Bitcoin Open Interest Climbs 13% From Recent Low — Bull Run Restart?

After a torrid start to the week, the price of Bitcoin appears to be finally stabilizing and building some bullish momentum. On Friday, March 14, the flagship cryptocurrency demonstrated this growing momentum, as it steadily climbed the charts and briefly crossed the $85,000 mark to close the week.

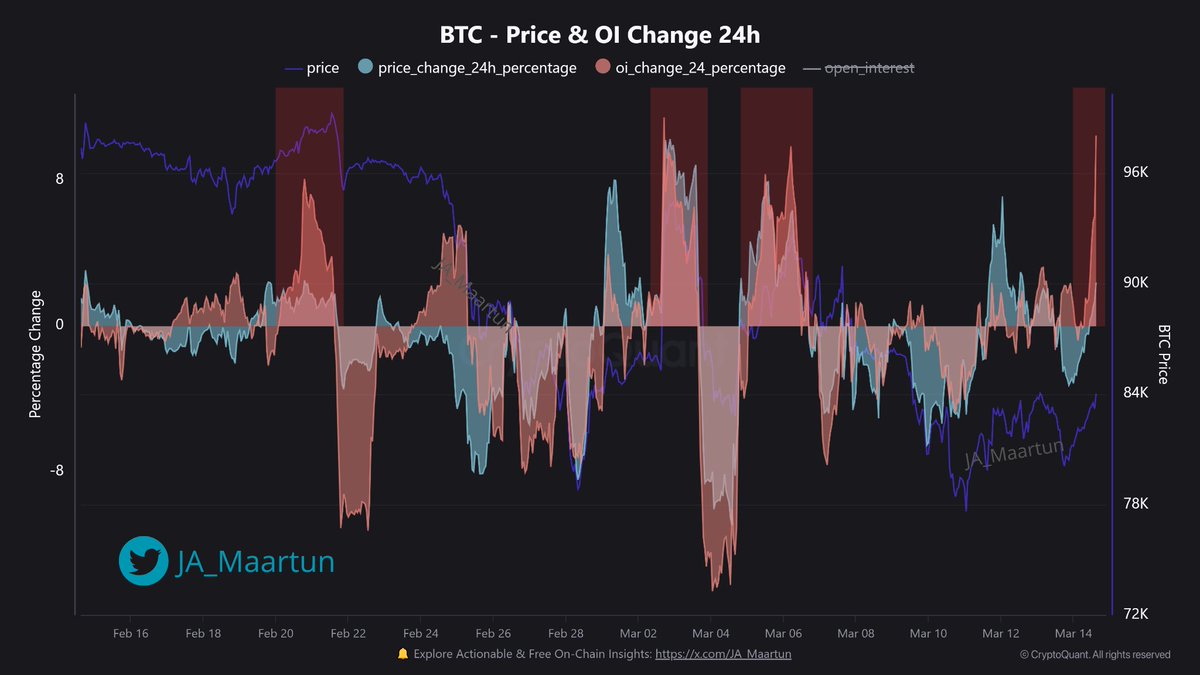

Interestingly, the BTC open interest (OI) has also been moving in a similar direction as the price over the past few days. With the rising open interest, the pressing question that demands a quick answer is — is the Bitcoin bull run back on track?

BTC Open Interest Jumps To $27.9 Billion — What Does It Mean?

In a new post on the X platform, a CryptoQuant community analyst with the pseudonym Maartunn revealed that the Bitcoin open interest is on the rise. For context, the open interest metric tracks the total amount of money poured into BTC derivatives at any given time.

According to data from CryptoQuant, the Bitcoin OI witnessed a notable upswing on Friday, rising to $27.9 billion. Maartunn noted that this significant move marked an over 13% jump (more than $3.3 billion) from the metric’s most recent low.

Typically, an increase in the Bitcoin open interest suggests that investors are opening up new positions in the futures and options market. It implies that investors are pouring money into BTC derivatives at the time. Conversely, a falling OI value indicates that derivatives traders are leaving their positions or getting liquidated in the market.

A growing open interest could be a healthy bullish sign for the premier cryptocurrency — especially if historical precedence is anything to go by. The influx of fresh capital into the market suggests surging investor sentiment (typically confidence) or speculation on the Bitcoin price trajectory.

As more investors flood the derivatives market and continue to bet on BTC’s price, the rising open interest could further heighten volatility in the Bitcoin market. Increased volatility signals that the flagship cryptocurrency could potentially experience large price movements soon.

What Next For Bitcoin Price?

BTC’s price does appear to be gearing for a significant move to the upside. Chartered Market Technician Tony Severino shared on the X platform that the market leader could make a run to around $95,000 over the next few days.

As of this writing, the price of Bitcoin stands at around $84,500, reflecting an almost 5% increase in the past 24 hours.