PEPE price inches closer to 2024 peak with top crypto exchanges teasing PEPE memes on X

- PEPE price rallied to a high of $0.00000141 on Friday as Binance, Bitstamp and OKX teased users with related memes on X.

- Binance announced a 700,000 PEPE reward for a quiz contest for users.

- OKX and Bitstamp teased users with the PEPE logo and memes on February 23.

PEPE’s social dominance and relevance have been increasing since February 20. This week, top cryptocurrency exchanges have shared PEPE and related memes in tweets on their official X handle. The increasing social media mentions of X, alongside rising social dominance, could catalyze gains in the meme coin.

Also read: SEI, Omni Foundation propose standard to unify Ethereum NFTs

On-chain metrics and social media mentions support PEPE gains

PEPE price climbed 22% in the past month and remained nearly unchanged in the past week. The frog-themed meme coin has gained relevance and seen an increase in its social dominance as exchanges mention PEPE in their recent tweets on X.

Data from Santiment reveals social dominance climbed between February 20 and 23.

%20[19.02.18,%2023%20Feb,%202024]-638442932715372561.png)

PEPE Social Dominance. Source: Santiment.

The rising social dominance is accompanied by an increase in PEPE price. At the same time, there is an increase in volume and a decrease in PEPE supply on exchanges. These metrics support a bullish thesis for PEPE.

%20[19.03.56,%2023%20Feb,%202024]-638442932980154961.png)

PEPE Volume and Supply on Exchanges. Source: Santiment.

Binance announced a quiz contest with a reward of 700,000 PEPE and Bitstamp and OKX teased PEPE memes in their tweets.

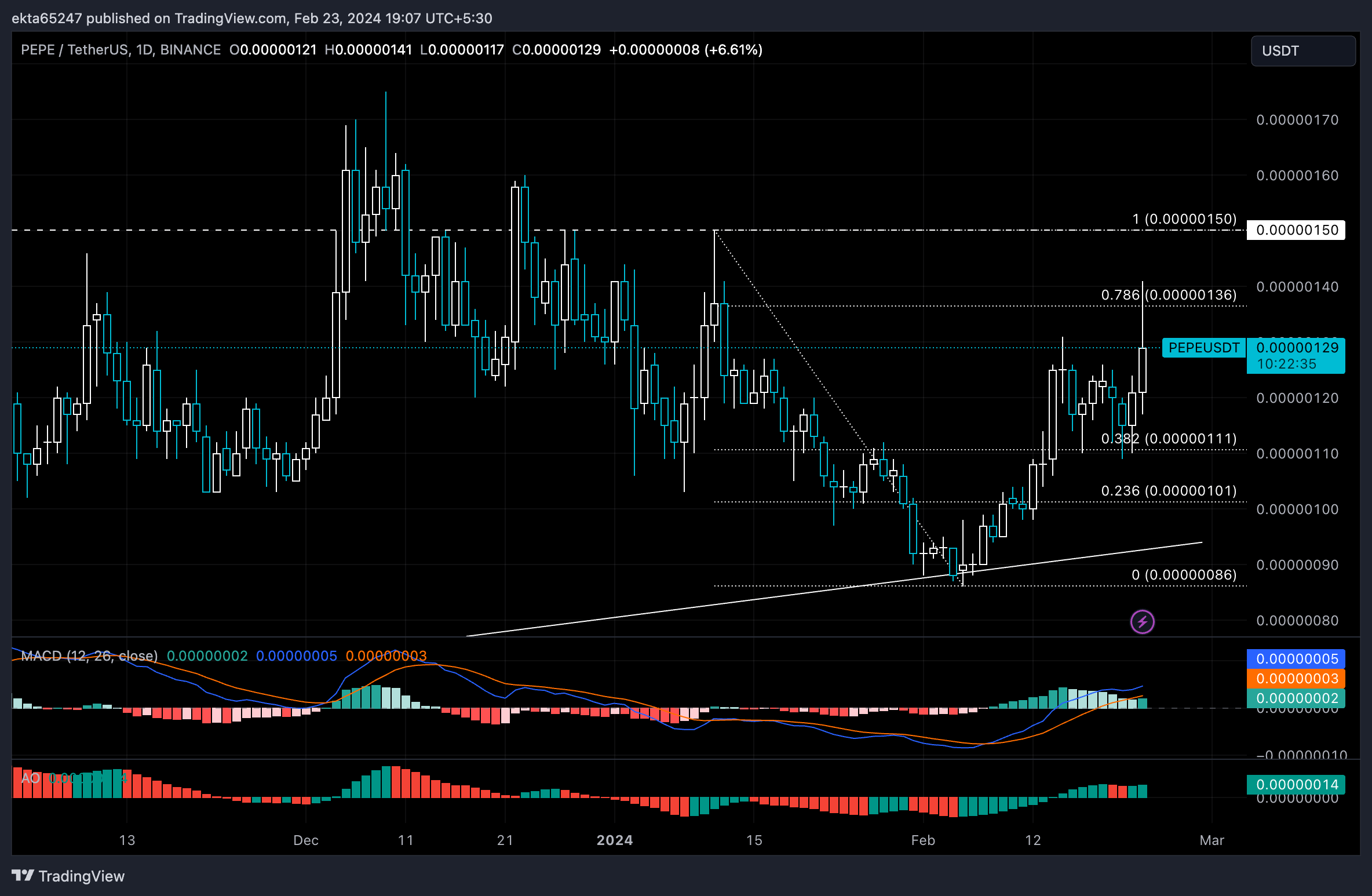

PEPE price could revisit yearly high

PEPE price hit its 2024 top of $0.00000150 on January 11, since then, the meme coin suffered a pullback and in the past two days, it has started rallying towards this peak. On Friday, PEPE price climbed to a high of $0.00000141, inching closer to the $0.00000150 target.

The Moving Average Convergence Divergence (MACD)indicator reveals that there is positive momentum in PEPE.

PEPE/USDT 1-day chart

In the event of a correction, PEPE price could find support at the 38.2% and 23.6% Fibonacci retracements of its decline from its 2024 high, at $0.00000111 and $0.00000101 respectively.