Why Was Solana Chosen for the U.S. Cryptocurrency Strategic Reserve? What Is SOL's Future Outlook?

TradingKey - In recent years, Solana (SOL) has rapidly gained prominence, not only being included in the U.S. cryptocurrency strategic reserve but also challenging Ethereum's dominance with its unique advantages, earning the title of "Ethereum Killer."

This article explores Solana's technical strengths, use cases, market performance, and future trends to provide a comprehensive understand SOL's potential and investment opportunities.

What Is Solana (SOL)?

Solana is a high-performance public blockchain platform, with SOL as its native token. Its core mission is to address scalability issues in the blockchain space, offering fast, low-cost transactions and smart contract support—areas where Ethereum faces significant challenges.

Solana's founder, Anatoly Yakovenko, is a Ukrainian-American with a degree in computer science from the University of Illinois. A seasoned entrepreneur with a strong technical background, Yakovenko has worked at Apple, Microsoft, Qualcomm, Dropbox, and Mesosphere. Recognizing the scalability and efficiency limitations of Bitcoin and Ethereum, he founded Solana in 2020 to overcome these challenges.

Solana | Ethereum | Bitcoin | |

Blockchain | Solana | Ethereum | Bitcoin |

Token | SOL | ETH | BTC |

Token Supply | 596 million | 121 million | 21 million |

Launch Year | 2020 | 2015 | 2009 |

Founder | Anatoly Yakovenko | Vitalik Buterin | Satoshi Nakamoto |

Differences Between Solana, Ethereum, and Bitcoin, Source: TradingKey.

What Are Solana's Technical Advantages?

Solana is often referred to "Ethereum Killer" due to its technical strengths, positioning it as a high-performance, low-cost blockchain platform capable of supporting high-throughput transactions and complex decentralized applications (DApps).

The following are Solana's most notable technical advantages:

Technology | Description | Advantages |

Proof of History (PoH) | Generates a verifiable timeline for efficient time synchronization | Increases transaction speed, reduces latency, supports high throughput (65,000 TPS). |

Turbine Protocol | Data propagation protocol based on BitTorrent, sharding data across nodes | Improves network scalability, reduces congestion risks. |

Gulf Stream | Transaction forwarding protocol, allowing validators to process transactions pre-block | Reduces confirmation time (to seconds), enhances network efficiency. |

Sealevel | Parallelized smart contract execution engine, enabling simultaneous processing | Boosts processing power, supports complex DApps. |

Cloudbreak | Horizontally scalable account database for high parallel read/write operations | Enhances data processing, lowers storage costs. |

Archivers | Decentralized storage system for historical data | Improves data availability, reduces validator storage burden. |

Cross-Chain Interoperability | Collaborates with other blockchain networks (e.g., Ethereum, Polkadot) to achieve cross-chain interoperability | expanding use cases and enhancing network value. |

Low Cost | Average transaction fee of $0.00025 | Ideal for micro-payments and high-frequency transactions, reducing user costs. |

What Are Solana's Use Cases?

Like Ethereum, Solana supports a wide range of application, including finance, social networks, supply chain management, public welfare, and more.

In fact, whenever a popular application emerges on Ethereum, developers often replicate it on the Solana network, leading to a high degree of similarity between the two, as illustrated below:

Application Area | Specific Scenarios | Representative Projects |

| Lending platforms | Solend |

Decentralized exchanges (DEX) | Serum、Raydium | |

Stablecoins | USD Coin (USDC) | |

| Collectibles | Metaplex、Degenerate Ape Academy |

Gaming | Aurory | |

Supply Chain Management | Product tracking | Hedera Hashgraph |

Food safety | IBM Food Trust | |

Social | Decentralized social networks | Mango Markets |

Decentralized identity | Solana Name Service (SNS) | |

Content distribution | Audius | |

| donations | Giveth |

Disaster relief | AidCoin |

How Has Solana Performed in the Market?

Despite being less than five years old, Solana (SOL) has established itself as a significant player in the crypto space, particularly in market capitalization, DeFi total value locked (TVL), and on-chain activity.

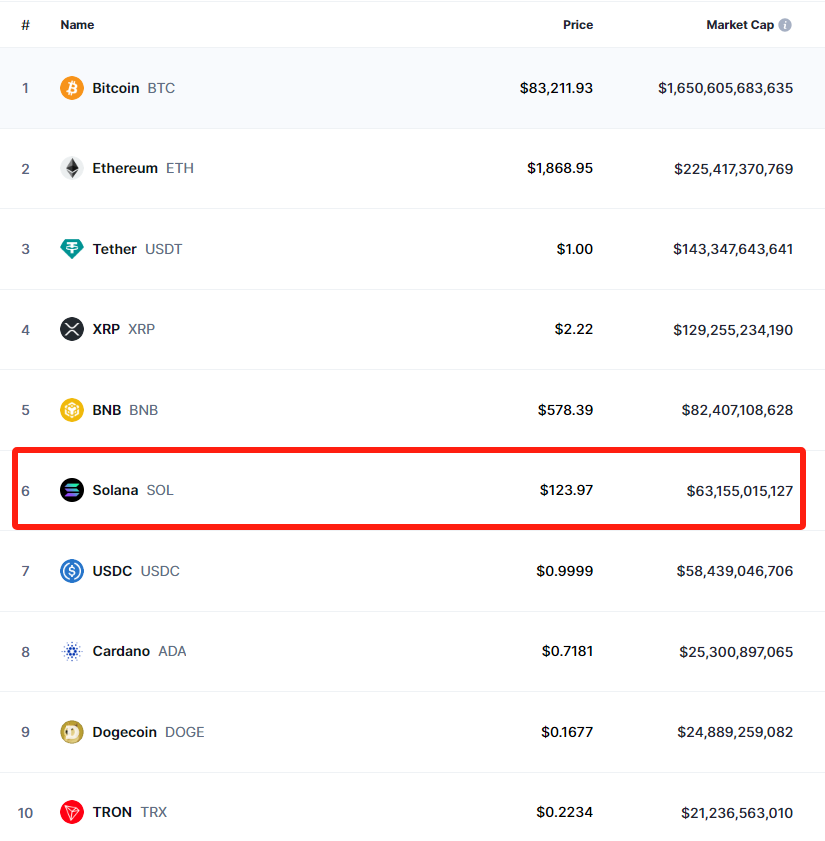

As of March 13, 2025, SOL's capitalization market stands at $63 billion, ranking sixth among all cryptocurrencies, behind BTC, ETH, USDT, XRP, and BNB. As a result, SOL is listed on major exchanges such as Binance and Coinbase, consistently maintain in high trading volumes.

Top 10 Cryptocurrencies by Market Cap, Source: CoinMarketCap.

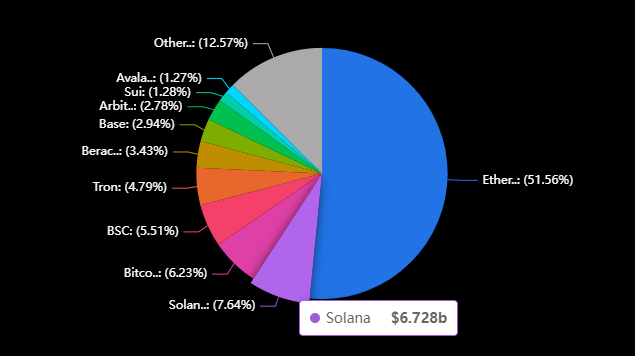

Solana's DeFi TVL exceeds $6.7 billion, accounting for 7.6% of the total and ranking second among all public blockchains, trailing only Ethereum. Additionally, while Ethereum remains the largest smart contract platform, Solana surpasses it in on-chain transaction volume, recording 382.1 billion transactions compared to Ethereum's 2.1 billion.

DeFi TVL Share Across Public Blockchains, Source: DefiLlama.

What Is Solana's Future Outlook?

Solana's strengths—blazing-fast transaction speeds, low fees, and a robust ecosystem—form the foundation for its future growth. These advantages have not only attracted investors but also gained recognition from the U.S. government. On March 2, 2025, President Trump announced the establishment of a cryptocurrency strategic reserve on Truth Social, including BTC, ETH, SOL, ADA, and XRP.

What does SOL's inclusion in the U.S. strategic reserve mean? The U.S. government will accumulate and hold SOL long-term, effectively reducing its circulating supply and potentially driving its price higher. Whether through confiscation, donations, or taxpayer funds, this move is expected to have a long-term positive impact.use of fiscal funds could further attract additional investment.

Another potential catalyst for Solana is the approval of a SOL spot ETF, which would allow SOL to enter the U.S. stock market and attract more institutional and retail investors. Since Trump's re-election in January 2025, efforts to improve crypto regulations and position the U.S. as a global crypto hub have led to multiple applications for SOL and other altcoin spot ETFs. The SEC has confirmed receipt of these applications, with high market expectations for approval this year.

Conclusion

As a rising star, Solana has quickly established itself in the crypto market with its technical advantages and strong market performance, earning the title of "Ethereum Killer." Now, as part of the U.S. cryptocurrency strategic reserve, SOL's demand is likely to increase further.