Cardano Whales Offload Holdings as ADA Faces Uncertainty

Cardano (ADA) has struggled over the past week, dropping more than 23% and remaining below $1 for over seven days. Despite this bearish pressure, technical indicators suggest that the current downtrend may be losing strength.

ADX readings show that selling momentum is fading, while whale addresses continue to decline, signaling that large investors have been offloading their holdings. Given these indicators, ADA price could soon test key resistance levels at $0.64.

Cardano’s Current Downtrend Is Fading

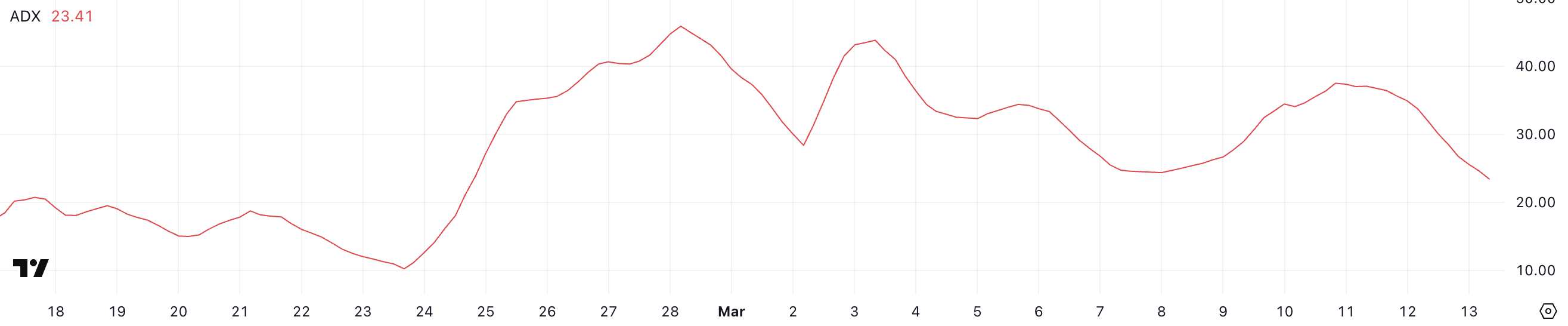

ADA’s Average Directional Index (ADX) has dropped to 23.4, declining from 34 yesterday and 37 two days ago. ADX is a key indicator used to measure the strength of a trend, regardless of direction, on a scale from 0 to 100.

Generally, readings above 25 indicate a strong trend, while values below 20 suggest weak or consolidating market conditions. A falling ADX signals that the current trend is losing strength, even if price movement continues in the same direction.

With ADA’s ADX declining significantly, it suggests that the ongoing downtrend may be weakening.

ADA ADX. Source: TradingView.

ADA ADX. Source: TradingView.

Since Cardano remains in a downtrend, the ADX drop to 23.4 indicates that bearish momentum is slowing, though it has not fully disappeared.

If ADX continues to decline and falls below 20, it would suggest that selling pressure is fading, potentially leading to consolidation or a reversal. However, for a true trend shift, ADA would need buying volume to increase alongside a rise in ADX, confirming renewed strength.

If the ADX stabilizes near current levels and turns upward again, the downtrend could regain momentum, keeping ADA under pressure in the short term.

ADA Whales Are Steadily Dropping In The Last Few Days

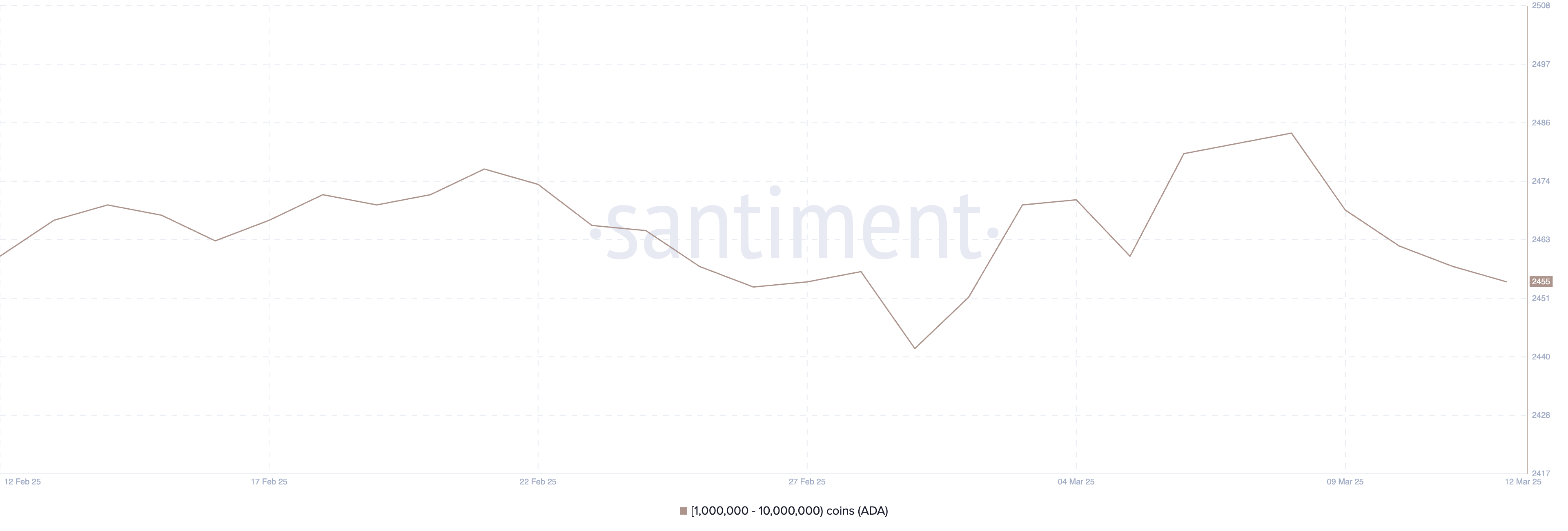

The number of Cardano whale addresses – those holding between 1 million and 10 million ADA – has dropped to 2,455, down from 2,484 on March 8.

This steady decline suggests that large holders have been offloading their positions over the past few days. Tracking whale activity is crucial because these high-value investors often influence market trends.

When whales accumulate, it signals confidence in the asset and can lead to price increases, while declining whale numbers suggest distribution, which can add selling pressure to the market.

Addresses Holding Between 1 Million and 10 Million ADA. Source: Santiment.

Addresses Holding Between 1 Million and 10 Million ADA. Source: Santiment.

With ADA whale addresses now at their lowest level since March 2, this trend could indicate weakening confidence among large holders despite Cardano being included in the US strategic crypto reserve.

If this pattern continues, it may lead to increased volatility as smaller investors absorb the selling pressure. A sustained drop in whale holdings could also suggest that ADA lacks strong buy support at current levels, potentially prolonging its downtrend.

However, if whale numbers stabilize or begin to rise again, it could signal renewed accumulation, potentially helping ADA regain momentum.

Will Cardano Rise Back To $1 Soon?

ADA’s EMA lines indicate that Cardano is in a consolidation phase. The short-term EMAs remain below the long-term ones, but their gap is not significant.

This suggests that bearish momentum is not dominant, and a shift in trend could occur if buying pressure increases. If ADA can test the resistance at $0.75 and establish an uptrend, it could climb toward $0.81.

A stronger bullish breakout could push Cardano’s price higher. The potential upside targets are $1.02 and even $1.17, if momentum continues to build.

ADA Price Analysis. Source: TradingView.

ADA Price Analysis. Source: TradingView.

On the downside, if selling pressure intensifies, ADA could test its key support at $0.64.

Losing this level would weaken its structure and increase the likelihood of further declines, potentially sending the price down to $0.58.

The relatively close EMA lines indicate that Cardano is in a pivotal phase, during which either a breakout or a breakdown could occur.