Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

- Cardano price declined 5% before stabilizing around the $0.70 mark on Thursday.

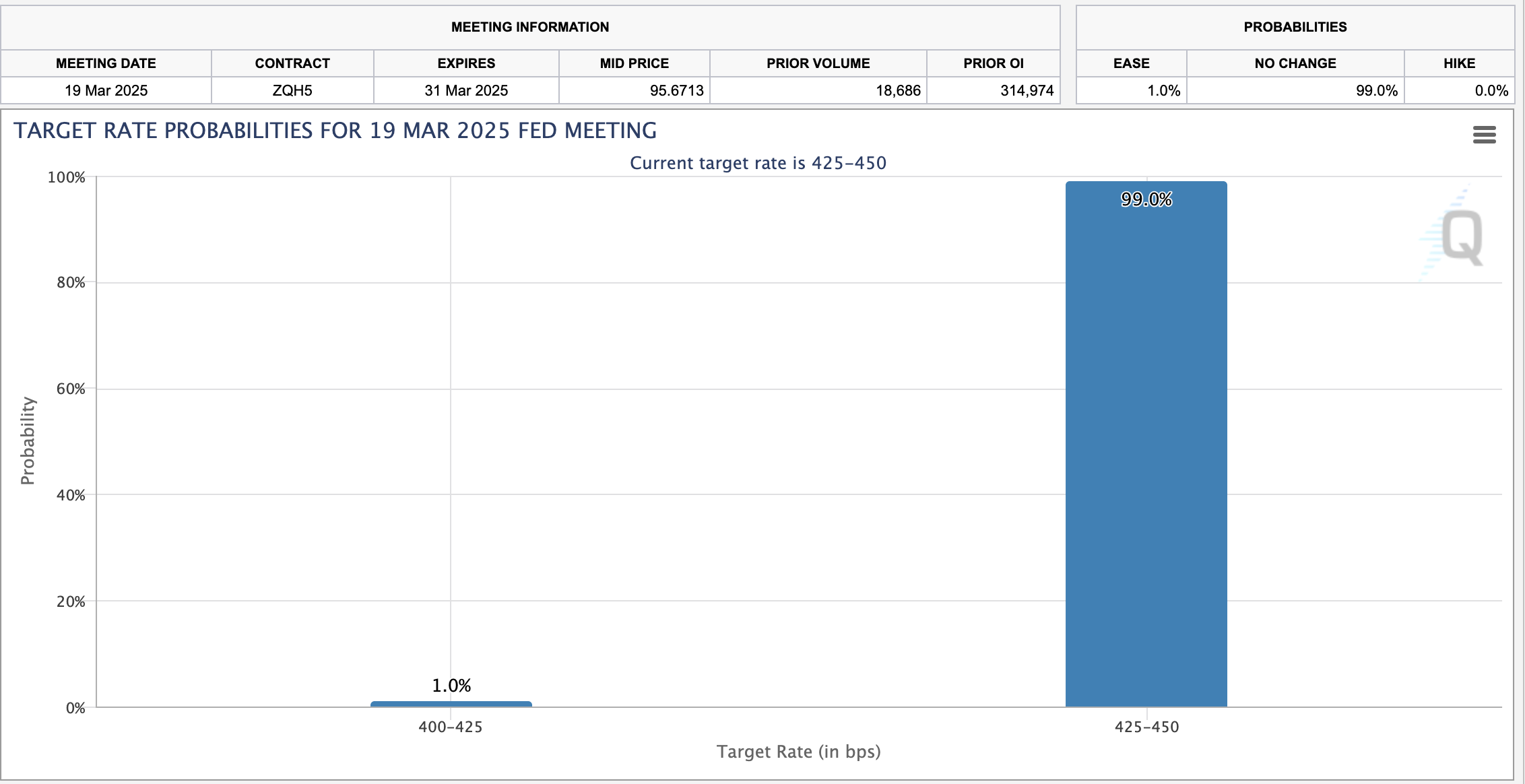

- Following the positive CPI and PPI readings, CME Group data shows a 99% chance of a delayed Fed rate hike.

- Multiple derivative markets reflect bearish momentum intensifying among ADA short-term traders.

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Cardano finds support at $0.70 as bears tighten grip

After a failed attempt to reclaim the $1 mark earlier in the week, Cardano has faced intense selling pressure, underperforming its layer-1 competitors on Thursday. While broader market sentiment has turned negative, ADA has been hit particularly hard.

By contrast, Binance Coin (BNB) maintained stability above $573, gaining mildly on Thursday following reports that the Trump family is in talks about acquiring Binance. Similarly, XRP price found strong support above $2.20 as it surged on news of securing a regulatory license to offer crypto payment services for businesses in Dubai.

Cardano price action | ADA

Cardano (ADA) extended its losing streak on Thursday, shedding 5% before stabilizing around $0.70. Despite U.S. inflation easing, traders remain cautious. Without an active internal bullish catalyst as observed in the BNB and XRP markets, ADA emerged as the worst-performing top-ten cryptocurrency on Thursday. The latest 5% drop brings its weekly losses to 40%, reinforcing a prolonged bearish trend.

Why is Cardano price going down?

While assets like PEPE and BNB posted gains, Cardano continued its slide, extending its weekly decline beyond 40%.

Although lower inflation figures seemingly support a delayed Fed rate cut, they have also heightened fears of an extended U.S. trade war.

FedWatch tool, March 13, 2025 | Source: CME Group

After the CPI and PPI data this week, CME Group’s FedWatch tool now signals a 99% chance that the US Fed will leave rates unchanged during the next FOMC meeting slated for March 21.

Rather than spark a buying frenzy, many crypto traders have intensified selling pressure.

Many anticipate that the low inflation readings could prompt the Trump administration to prolong or even increase tariffs on neighboring countries.

This could potentially impact retail traders' ability and willingness to invest in risk assets like ADA.

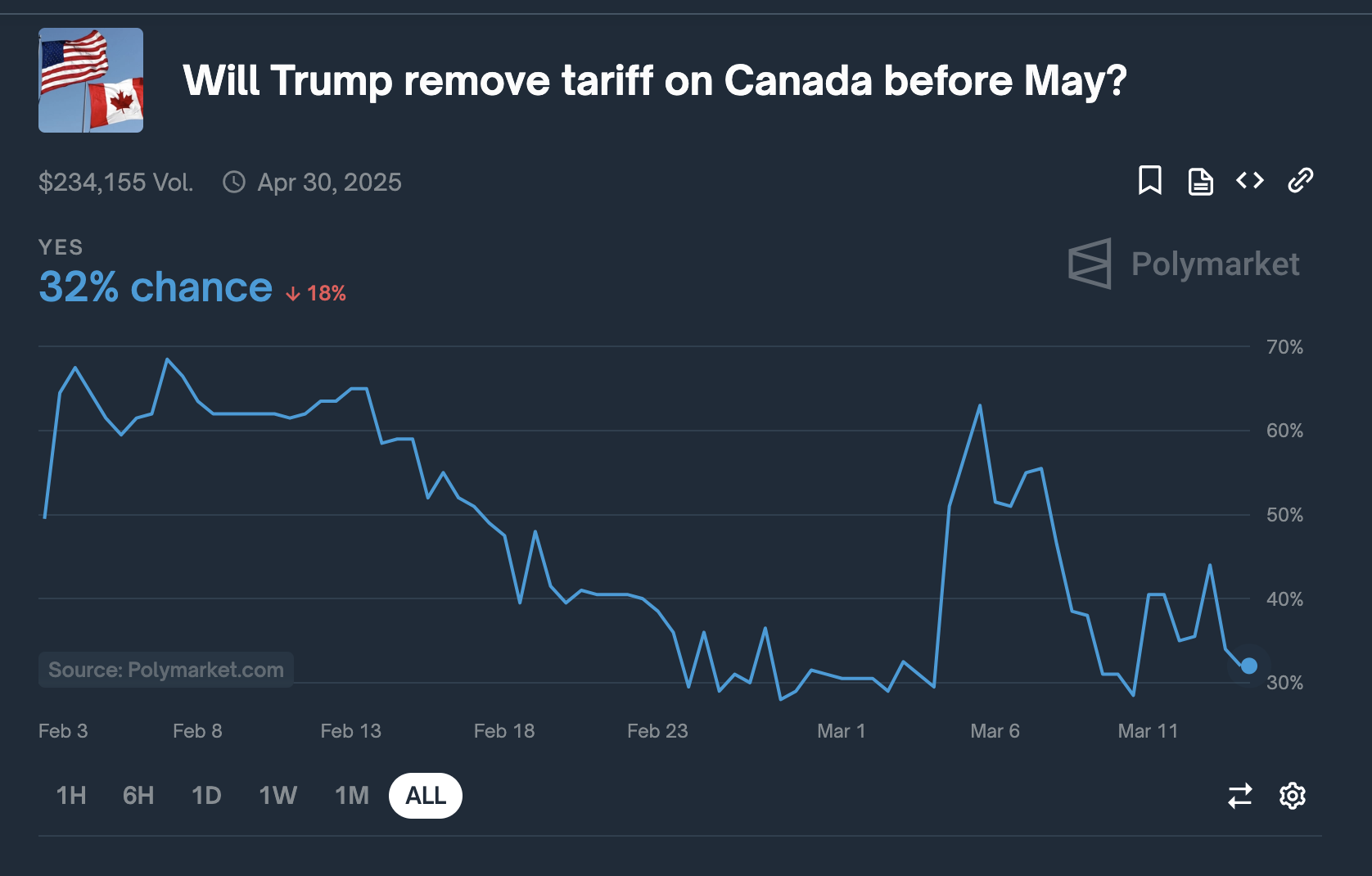

Odd on Trump Lifting Tariffs on Canada plunges by 18%, March 13 | Source: Polymarket

Latest trends on Polymarket show that the odds of Trump lifting tariffs on Canada before May 2025 dropped by 18% on Thursday.

This suggests that rather than buying in after the latest positive CPI and PPI data, the majority of crypto investors continue to take a cautious stance, expecting easing inflation to give policymakers room to maintain higher tariffs for longer.

This partly explains why Cardano's price plunged by another 5% on Thursday.

Additionally, speculation that Trump could struggle to obtain congressional approval to allocate funds toward the newly proposed crypto strategic reserve has caused some investors to reduce their exposure to ADA in recent days.

Cardano Price Forecast: Death Cross formation could see ADA retest $0.50

Cardano price is leaning bearish after breaking below short-term moving averages, signaling weakening bullish momentum.

ADA is trading around $0.70, struggling to reclaim lost ground as downside pressure intensifies.

The 5-day and 8-day simple moving averages (SMAs) have crossed below the 13-day SMA, forming a bearish death cross pattern, confirming the firm bearish dominance.

This technical pattern follows ADA’s failure to sustain its rally above $0.82, reinforcing the possibility of an extended downtrend.

Cardano Price Forecast

The MACD indicator further confirms the shift in momentum, with the MACD line crossing below the signal line, amplifying bearish sentiment.

The histogram is trending lower, indicating increasing downside momentum that could push prices toward key support levels.

If selling pressure persists, ADA risks breaking below $0.70, with the next support at $0.65.

A deeper breakdown could open the door for a test of $0.50, a level last seen in late 2023.

However, if bulls regain control and push ADA back above $0.73, it could trigger a reversal, challenging the $0.82 resistance once again.

However, given the bearish crossover and declining MACD, the path of least resistance remains downward, with ADA facing the risk of further downside toward $0.50.