Crypto Today: BTC price taps $81K, PEPE and BNB lead gainers as Binance and Ripple enter Dubai market

- The global cryptocurrencies sector surges 0.26% on Thursday, with aggregate market capitalization sitting at $2.7 trillion.

- Bitcoin price stabilizes at $81,000, having wobbled 3% from the 24-hour peak of $84,476.

- Recent announcements surrounding Binance, Ripple and Dubai authorities have seen investors predominantly lean into altcoins.

Bitcoin market update: BTC ETFs finally see first inflows in March

- Bitcoin price plunged as low as $79,000 on Thursday, having remained range-bound below $84,500 since the start of the week.

- Escalating trade war between US and its North American neighbours continues to limit capital inflows towards BTC.

After bleeding $1.6 billion in seven consecutive days of outflows, Bitcoin ETF recorded $13.3 million inflows on Wednesday. This marks the first day of inflow since the start of March.

Bitcoin ETF Flows, March 2025 | Source: SosoValue

Bitcoin ETF Flows, March 2025 | Source: SosoValue

However, the $13 million inflows pale significantly compared to the outflows of $1.6 billion in the previous seven days of trading. However, it hints that US-based corporate investors reacted positively to positive readings in the US CPI inflation data published on the day.

But with the overhang of US trade war rhetoric with Mexico and Canada, it remains to be seen if the prospect of delayed rate hikes could be enough to prompt the Bitcoin ETFs to enter a prolonged buying spree.

Altcoin Market Updates: Ethereum, XRP, and Cardano extend losses as crypto market sheds $106 billion

The global crypto market had raced to a positive start to the day as the US PPI data released on Thursday confirmed easing inflation signals seen in the CPI data.

However, as markets digest the fresh macroeconomic indices, many market watchers anticipate that the slow inflation could now embolden the Trump administration to press ahead with tough tariffs.

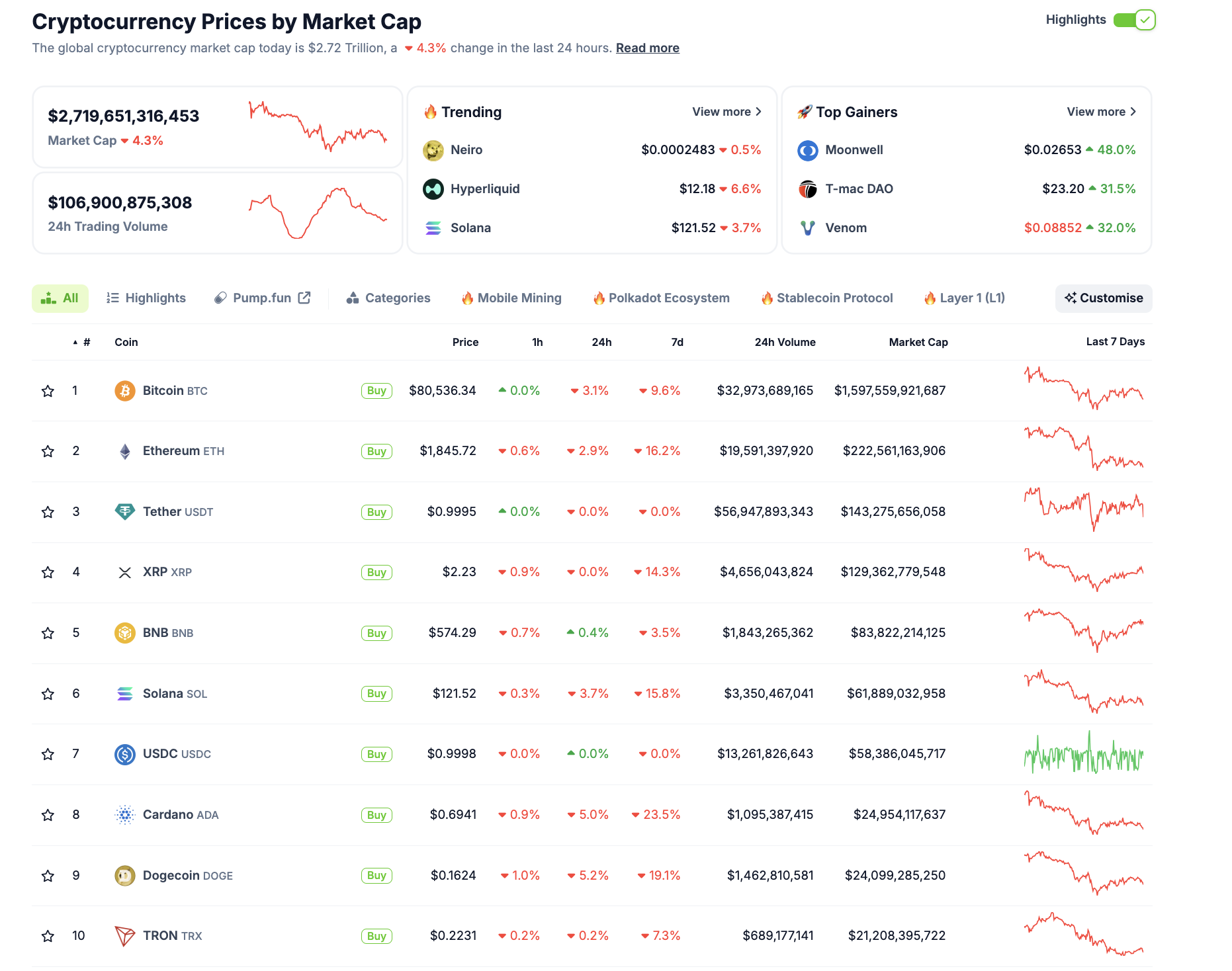

Top 10 Cryptocurrencies Performance | Source: Coinmarketcap

Top 10 Cryptocurrencies Performance | Source: Coinmarketcap

According to CoinGecko data, the crypto market has plunged 4.3% in the last 24 hours, shedding over $106 billion in valuation. Bitcoin, Ethereum, and major altcoins extended their declines.

BTC fell 3.1% to $80,536, while ETH dropped 2.9% to $1,845.72, marking a 16.2% weekly decline. XRP, Solana, and Cardano recorded steeper losses, with ADA down 23.5% in the past week.

BNB was among the few to show resilience, posting a slight 0.4% gain in the past 24 hours.

Altcoin market highlights:

- Ripple (XRP) price traded at $2.23, flat in 24 hours but down 14.3% in a week, reflecting weak investor confidence, despite Ripple bagging a license to offer crypto payments to businesses in Dubai.

- Ethereum (ETH) price dropped 2.9% daily and 16.2% weekly, breaking below $1,900 and flashing bearish momentum on technical indicators.

- Cardano (ADA) price saw the steepest losses among top altcoins, plunging 5.2% daily and 23.5% weekly, signaling heavy selling pressure.

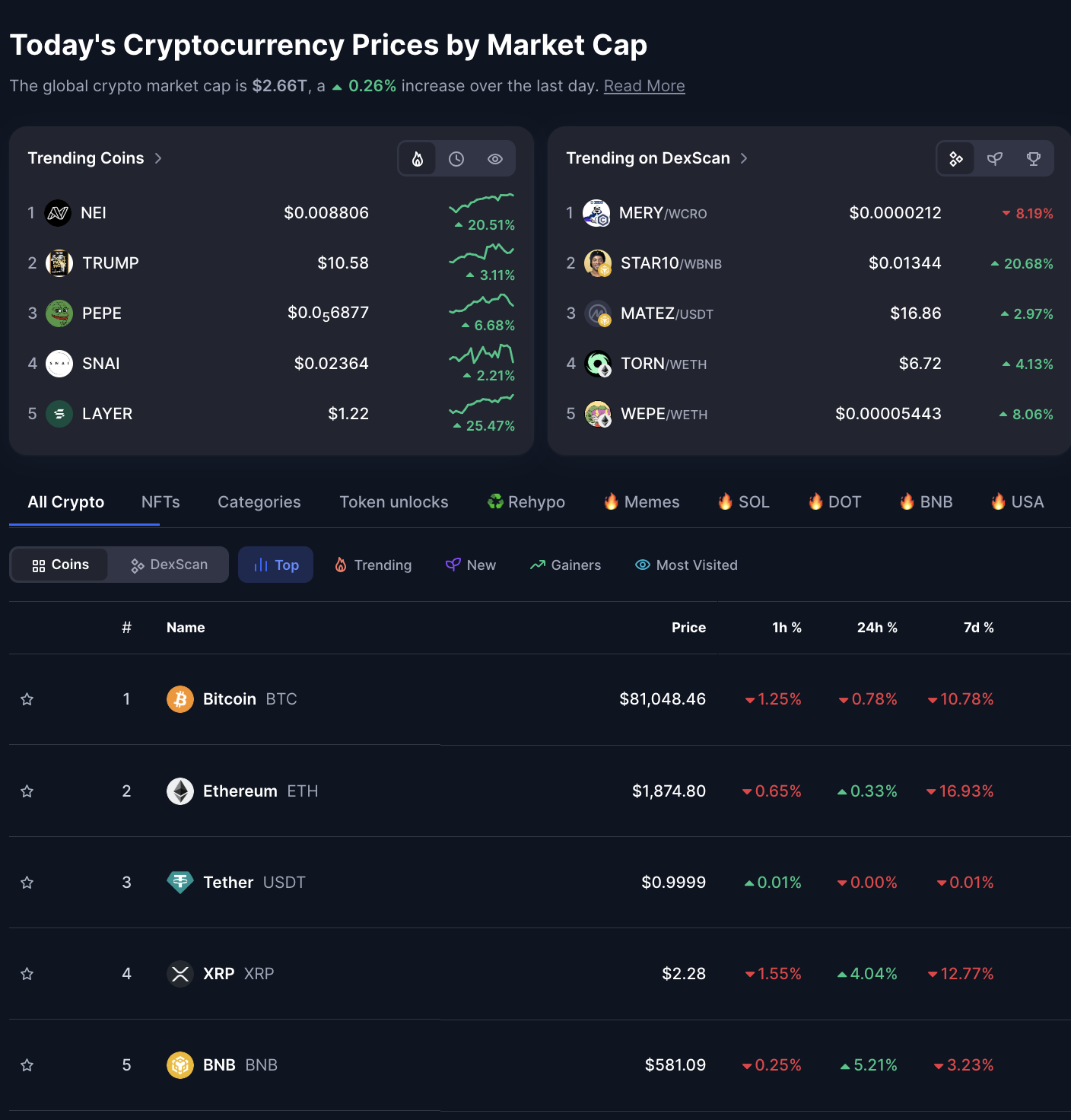

Top Trending Coins, March 13 | Source: CoinMarketCap

- Posting 6% and 3% gains respectively, PEPE and TRUMP are among the top five most-searched tokens on Coinmarketcap.

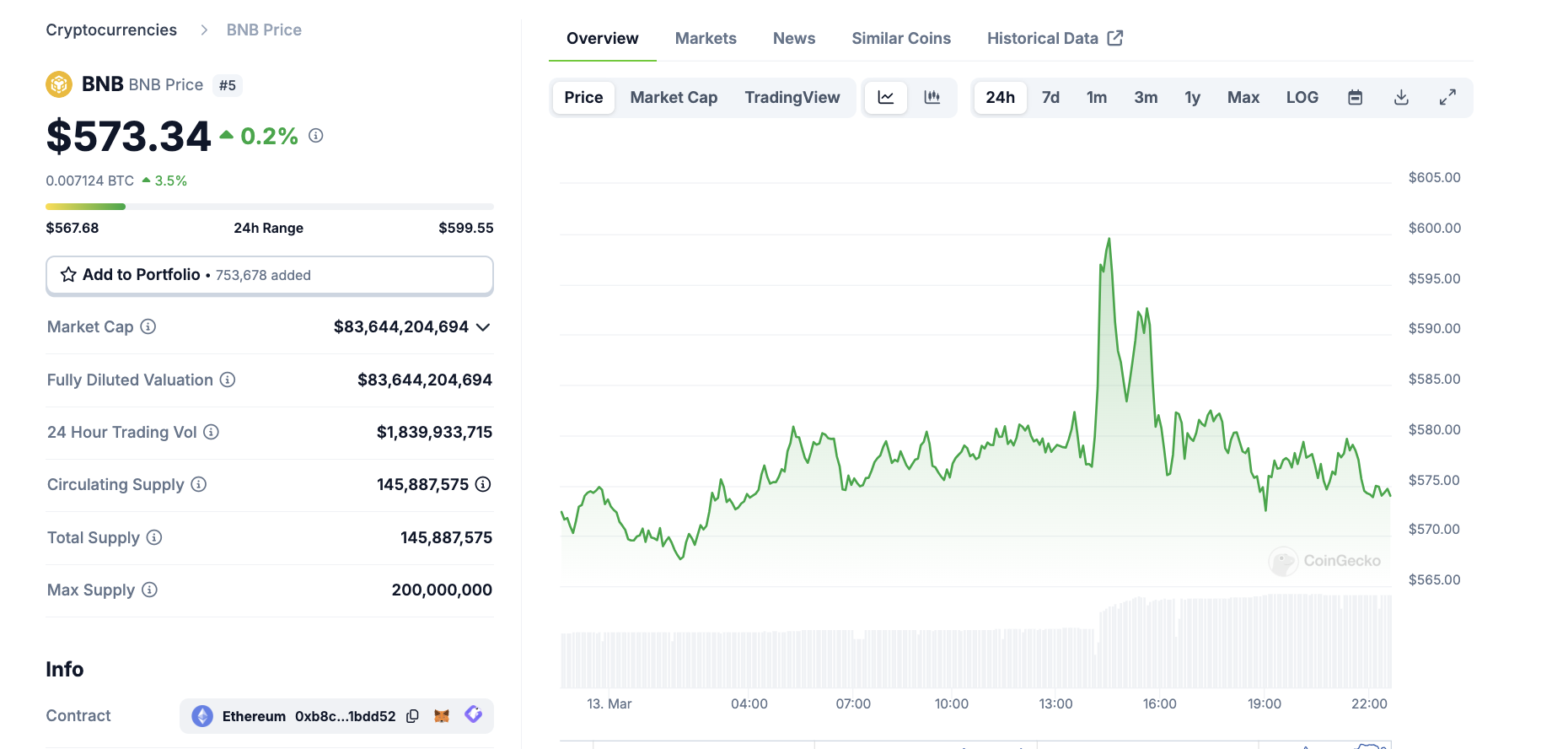

Chart of the Day: BNB price delivers rare gains despite market dip

Binance Coin (BNB) was one of the few gainers, rising 0.2% and holding above $570 despite market-wide declines. However, conflicting catalysts suggest BNB could experience heightened volatility in the days ahead.

BNB Price Action

BNB Price Action

Increased demand for exchange tokens amid heightened market volatility, coupled with a recent $2 billion investment inflow from Dubai-based firm GMX, has provided short-term bullish momentum for BNB.

Meanwhile, growing controversy surrounding Changpeng Zhao’s rumored plea for a pardon from U.S. President Donald Trump introduces downside risks. Any of these factors could play a decisive role in determining BNB’s next price movement.

Crypto news updates:

-

Trump’s cabinet members declare Bitcoin holdings amid Crypto policy push

Six members of President Donald Trump’s cabinet disclosed significant Bitcoin holdings in their latest financial filings, underscoring the administration’s deepening ties to cryptocurrency.

The disclosures, released in January, come as Trump positions the U.S. as a global leader in the digital asset market, according to a report from Fortune.

Health and Human Services Secretary Robert Kennedy Jr. reported the largest Bitcoin stake, with a Fidelity crypto account valued between $1 million and $5 million.

Treasury Secretary Scott Bessent disclosed holdings in BlackRock’s iShares Bitcoin Trust ETF worth up to $500,000, though he must divest within 90 days.

Transportation Secretary Sean Duffy revealed Bitcoin investments totaling as much as $1.1 million, while other cabinet members, including Director of National Intelligence Tulsi Gabbard and Defense Secretary Pete Hegseth, reported smaller holdings.

Meanwhile, Trump’s AI and crypto czar David Sacks confirmed he sold all his crypto holdings before assuming office.

-

Trump family in talks to acquire stake in Binance.US as CZ seeks pardon

The Trump family is in discussions to acquire a stake in Binance.US, potentially through their investment firm, World Liberty Financial, according to a Wall Street Journal report citing sources familiar with the matter.

The talks come as Binance’s U.S. operations seek to strengthen ties with policymakers amid regulatory scrutiny. News of the potential deal pushed Binance’s native token, BNB, higher.

Meanwhile, Binance founder Changpeng “CZ” Zhao is reportedly lobbying for a presidential pardon from Donald Trump after serving prison time and paying fines for regulatory violations.

CZ previously hinted at his willingness to receive clemency, stating in a since-deleted December 2 post on X that he “wouldn’t mind a pardon,” while maintaining that he has no plans to return as Binance’s CEO.

Aave Labs unveils Horizon to integrate real-world assets into institutional DeFi

Aave Labs has launched Horizon, a new initiative aimed at expanding institutional adoption of Decentralized Finance (DeFi) by incorporating real-world assets (RWAs).

The initiative seeks to merge traditional finance with DeFi by allowing institutions to use tokenized money market funds as collateral for stablecoin liquidity.