Tether on-chain activity surges to a six-month high with 143,000 daily transfers

- Santiment data shows that Tether’s on-chain activity has risen rapidly, with over 143,000 daily transfers.

- The USDT Network growth metric also increased, indicating greater blockchain usage.

- Tracy Jin, COO of MEXC, told FXStreet that lifting OCC restrictions for banks on dealing with stablecoins in the US lowers barriers for new market participants.

Tether (USDT) stablecoin on-chain activity has rapidly risen, with over 143,000 daily transfers, surging to a 6-month high. Moreover, the USDT Network growth metric increases, indicating greater blockchain usage. In an exclusive interview, Tracy Jin, COO of MEXC, told FXStreet that lifting OCC restrictions for banks dealing with stablecoins in the US lowers barriers for new market participants.

On-chain activity hints at a market recovery

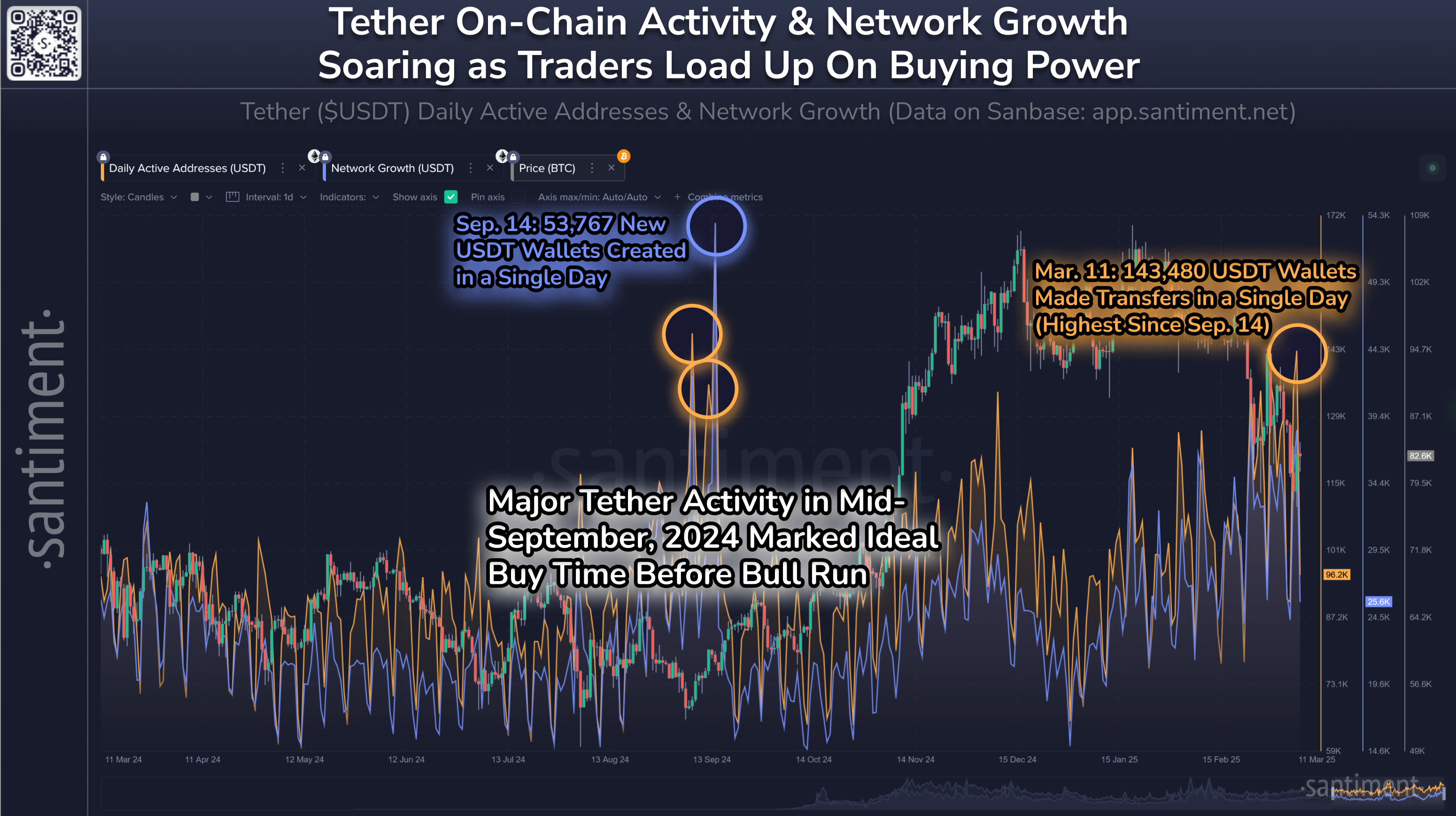

Santiment data shows that Tether on-chain activity has rapidly risen; its daily active addresses reached 143,480 on Tuesday, surging its 6-month high. Moreover, its Network growth metric also increases, indicating greater blockchain usage.

Historically, traders are generally preparing to buy when USDT & other stablecoin activity spikes during price drops, as seen in the chart during mid-September 2024. During that period, the on-chain activity in USDT spiked, followed by its price rally. Similarly, the recent activity could add buy pressure and aid in crypto prices recovering.

USDT on-chain activity chart. Source: Santiment

In an exclusive interview, Tracy Jin, COO of crypto exchange MEXC, told FXStreet, “Lifting OCC restrictions for banks on dealing with stablecoins in the US lowers barriers for new market participants.

Jin continued that the US Treasury’s statement on the gradual integration of stablecoins into the financial system may drive demand for the US dollar and provide greater stability for institutional and retail investors. Moreover, the official recognition of USDT on regulated exchanges in Thailand expands access to capital in a country where 40% of cryptocurrency trades already involve this stablecoin, potentially fueling further growth in Asia, coinciding with the approval of USDC in Japan.

“The market may witness an outflow of capital from risky assets, including Bitcoin and altcoins, which is consistent with the current bearish trend. Given the recent $3.5 billion outflow from Bitcoin ETFs, the stablecoin’s capitalization growth confirms that institutional investors are temporarily taking a pessimistic stance. However, if there are no positive macroeconomic or regulatory factors in the coming weeks, a further decline in the crypto market is possible, and the growth of stablecoins will become an indicator of capital leaving the digital life conditions,” Jin told FXStreet.