Crypto Today: BTC, Pi Network and HBAR rally as US CPI triggers $40B buying spree

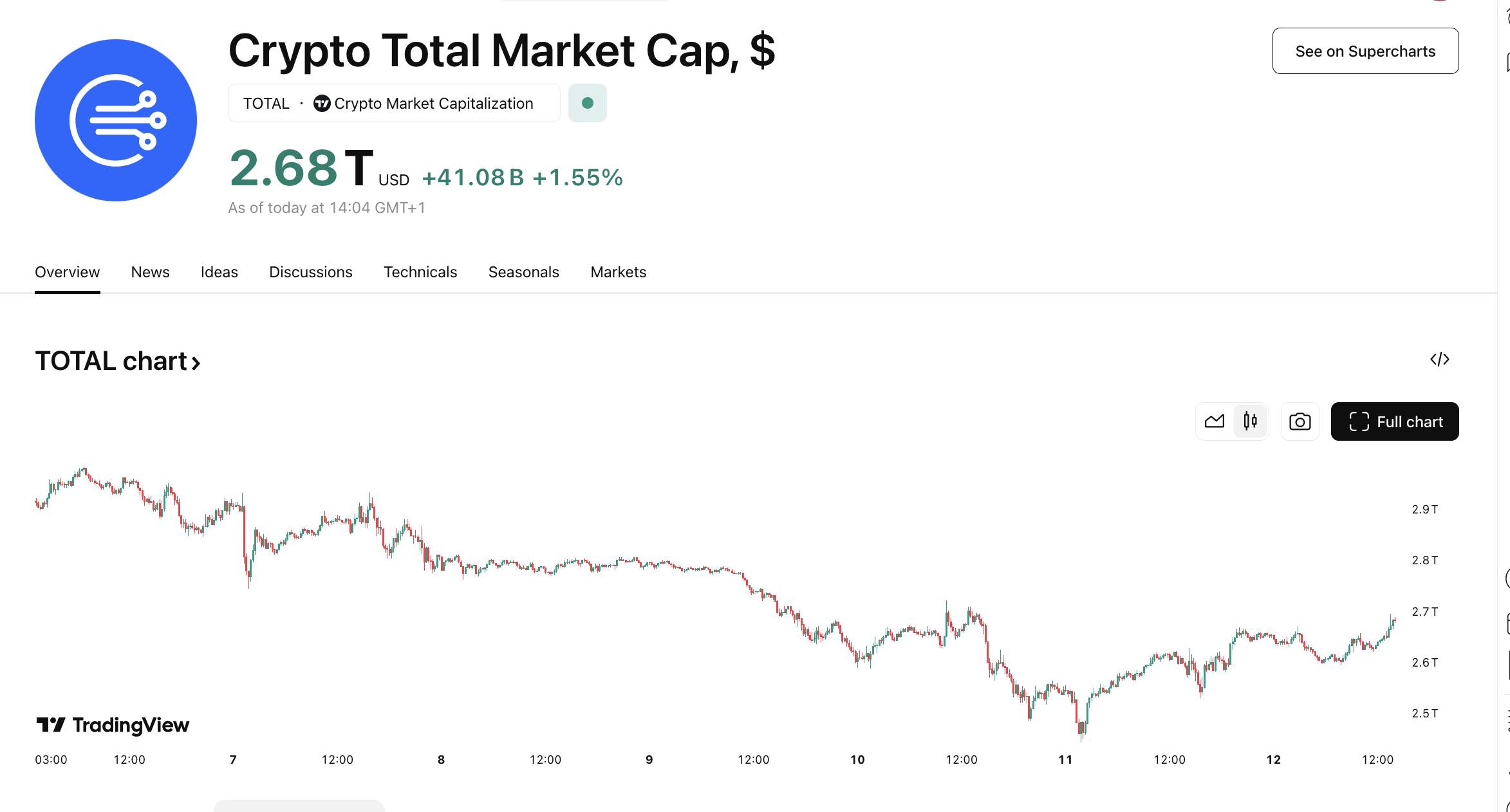

- The cryptocurrency market capitalization gained 1.6% on Wednesday, adding over $40 billion.

- PI Network, Hedera and Binance Coin led gains among the top 20 altcoins.

- TRX price sees a considerable pullback, signaling that traders are shifting from Tron-native stablecoins to altcoins as market sentiment recovers.

- Bitcoin's recovery remains curtailed below 5% as bulls struggle to breach the $85,000 resistance.

Bitcoin market updates:

- Bitcoin price rebounded as high as $83,500 on Wednesday, up 7% from the seven-month low of around $76,000 recorded on Monday.

- The BTC recovery is linked to cooler-than-expected inflation figures in the latest US CPI, which sparked demand across the global risk assets market.

Bitcoin ETF Flows | Source: SosoValue

Bitcoin ETF Flows | Source: SosoValue

In the Bitcoin ETFs, market investors pulled out another $371 million on Tuesday, bringing total outflows since the start of March above $1.5 billion

It remains to be seen if US CPI data could show that corporate investors will halt the BTC ETF outflows in the days ahead. If the sell-off continues, the Bitcoin price recovery could continue to lag behind altcoins in the weeks ahead.

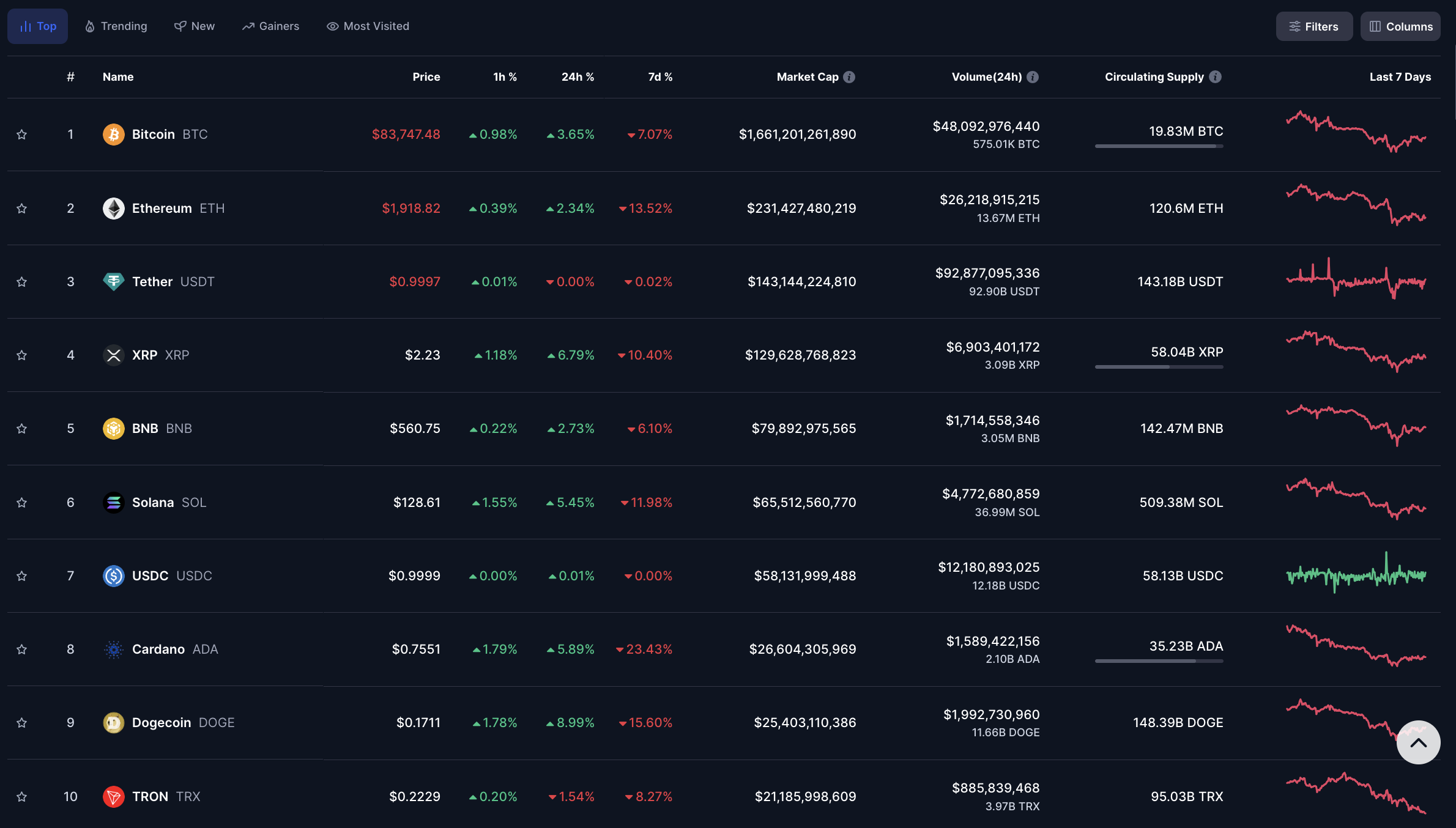

Altcoin market updates: Pi Network, Hedera and BNB lead early gains as US CPI fuels recovery

Cooler-than-expected US inflation data sparked renewed demand in the crypto markets on Wednesday, driving a 1.6% increase in global market capitalization, adding $40 billion.

Crypto Total Market Capitalization | March 12

Crypto Total Market Capitalization | March 12

A deeper analysis of market trends reveals that altcoins have captured most of these inflows, while Bitcoin's recovery remains subdued below the $85,000 mark.

Crypto Market Performance – March 12 | Source: CoinGecko

- Pi network leads with a 22% surge

Pi Network (PI) is the standout performer, rallying 22% at press time. The surge is primarily fueled by growing community engagement ahead of the network’s critical migration event scheduled for March 17. Additionally, increasing media attention surrounding PI’s potential listing on CoinMarketCap and CoinGecko has further bolstered bullish sentiment.

- Hedera (HBAR) breaks key resistance on ETF momentum

Hedera (HBAR) recorded a 6% gain, briefly breaching the $0.20 resistance level on the day. The rally was largely driven by the US Securities and Exchange Commission’s (SEC) recent acknowledgment of Nasdaq’s filing to list Grayscale’s Spot HBAR ETF. This development significantly boosted investor confidence within 24 hours of the announcement.

- BNB climbs 2% amid rising demand for exchange tokens

Binance Coin (BNB) gained 2%, settling near the $560 mark. The uptick in BNB price is attributed to heightened demand for exchange tokens, particularly as traders execute large-volume recovery trades in response to improving market conditions.

With altcoins leading the early recovery, all eyes remain on further macroeconomic developments and investor sentiment shifts that could dictate the next major market move.

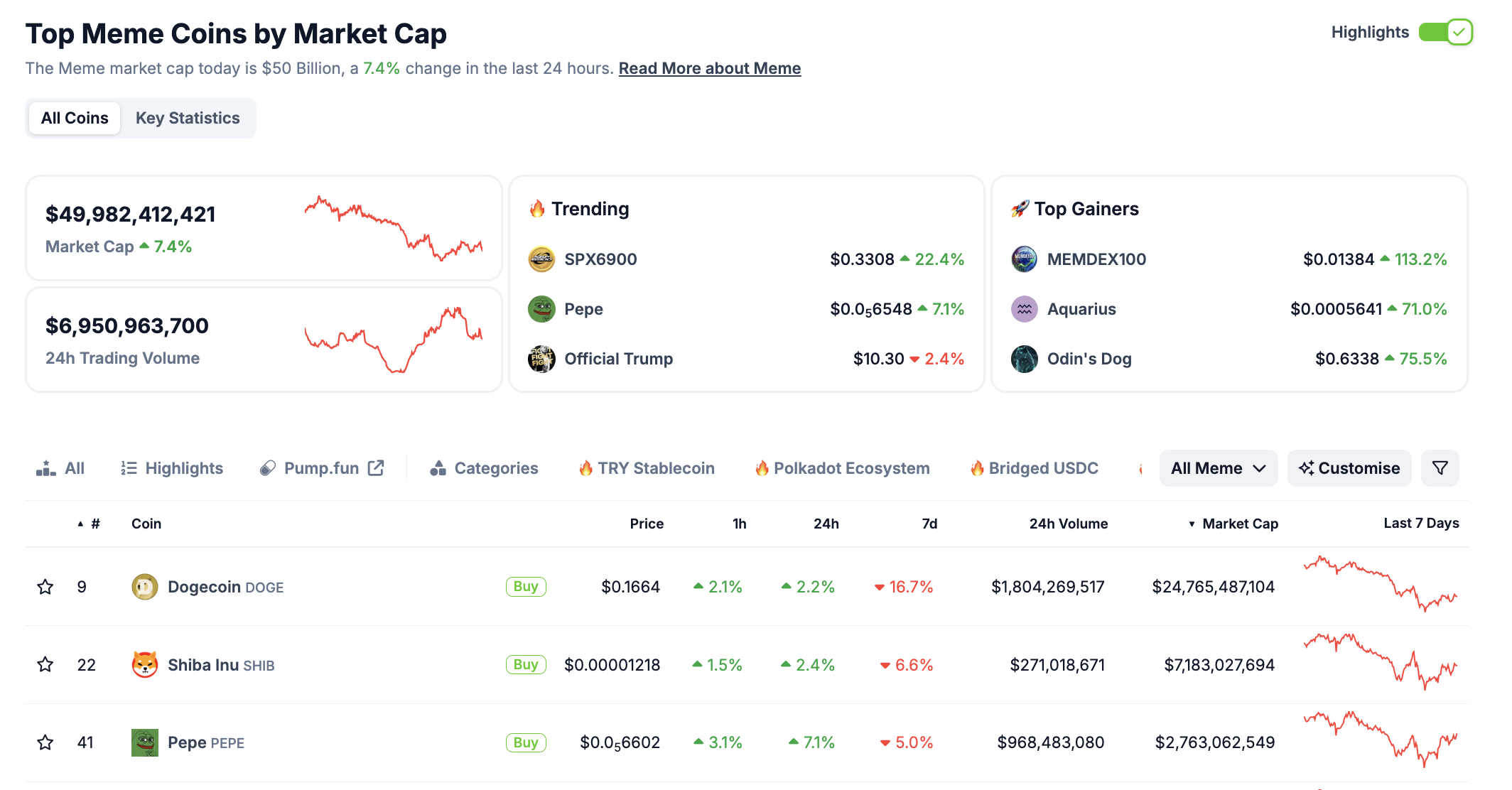

Chart of the day: Top 3 memecoins outperform as market signals prolonged recovery

While the broader crypto market remains anchored below a 5% recovery, key trading metrics on Wednesday suggest that the ongoing rebound is fueled by strong risk appetite and fresh capital inflows.

Notably, the stablecoin sector expanded by 0.6%, adding $117 million in the past 24 hours, according to data from CoinGecko. Stablecoin inflows during market reversals often signal that new funds are entering the ecosystem, providing a more sustainable foundation for the rally.

Top 3 Memecoins March 12 | Source: CoinGecko

Memecoins have also witnessed significant inflows, with their aggregate market capitalization surging 7.4% to approach the $50 billion mark.

A closer look reveals that all three top-ranked memecoins have outperformed Bitcoin over the past 24 hours. Dogecoin (DOGE) gained 1.4%, while Ethereum-based Pepe (PEPE) and Shiba Inu (SHIB) surged 6.3% and 1.7%, respectively.

Historically, when memecoins rally above the market average, it reflects a heightened risk appetite among traders.

Given that these assets have lower liquidity and are highly sensitive to sentiment shifts, their demand often serves as a key indicator of market conviction in risk-taking behavior.

The combination of $117 million in stablecoin inflows, $370 million pouring into memecoins amid a 7.4% sector-wide surge, and the latest US CPI data showing cooling inflation all point to a recovery phase that could be sustained in the near term.

Crypto news updates:

-

US reps vote to repeal IRS crypto tax rule, bill heads to Trump's desk

The US House of Representatives has passed a bill to repeal an IRS rule requiring decentralized finance (DeFi) brokers to report user transactions similar to traditional securities brokers.

The rule, implemented under the Biden administration, aimed to enhance tax compliance but faced opposition from lawmakers concerned about its impact on crypto innovation and the risk of companies relocating overseas.

The bipartisan effort, led by Rep. Mike Carey and Sen. Ted Cruz, secured approval in the House after earlier gaining traction in the Senate. Supporters argue that rolling back the reporting requirement will create a more favorable regulatory environment for the cryptocurrency sector. The bill now moves to President Donald Trump’s desk for final approval.

-

Cantor Fitzgerald partners with Anchorage Digital and Copper to expand Bitcoin financing

Cantor Fitzgerald has teamed up with Anchorage Digital and Copper to manage collateral and custody for its new global Bitcoin financing business.

The initiative is designed to provide leverage to institutional investors holding Bitcoin while ensuring high security through the expertise of its partners.

Anchorage Digital, the only federally chartered crypto bank in the US, will oversee custody and compliance, while Copper will handle digital asset services, including collateral management.

The partnership launches with an initial $2 billion in financing, with plans to scale further as institutional demand for Bitcoin-backed loans grows.

-

Russia’s central bank considers allowing crypto purchases for qualified investors

The Bank of Russia is exploring a new regulatory framework that would permit a select group of qualified investors to purchase cryptocurrencies under an experimental legal regime.

According to a press release published Wednesday, the initiative—developed under President Vladimir Putin’s guidance—aims to introduce controlled crypto investments while maintaining restrictions on its use as a means of payment between residents.

The proposed framework would run for three years, allowing authorities to assess risks and develop appropriate regulations.

Eligible participants would include individual investors with over 100 million rubles in securities and deposits or an annual income exceeding 50 million rubles, alongside corporate-qualified investors and financial institutions.

The central bank also plans to impose specific regulatory requirements for financial entities engaging in crypto investments to enhance market transparency and mitigate risks.